by Mike Plambeck

Veterans and service members who are looking to purchase a home in 2018 will be excited to learn about all of the great VA loan benefits.

Veterans and service members who are looking to purchase a home in 2018 will be excited to learn about all of the great VA loan benefits.

This government program offers a wide array of advantageous features that could make home ownership a more likely possibility for your military family.

Before you even start the process of searching for a home, you should know all of the VA loan benefits that you can expect.

The largest benefit of applying for a VA loan is that buyers no longer need to scrape together their savings to cover the down payment. This payment, along with your private mortgage insurance (PMI), is waived altogether.

Saving money on these two perks is significant, but those aren’t the only advantages of a VA loan. You’ll find out some of the other inherent benefits of this loan program in the sections below.

We Are VA Loan Specialists, Pre Qualify for a VA Home Loan Today, Click Here.

VA Loan Benefits = Saving More Money

When it comes to deciding on a mortgage program, you want to ensure that you select something that offers many perks for you as a homeowner.

These benefits can help eligible veterans save thousands of dollars over the duration of your loan. With the advantages of a VA loan, you can keep more money in your pocket with some of these key perks.

Did you know that the VA also offers Small Business Loans for veterans? Learn more about programs available to veterans for small business loans here.

There’s No Better VA Loan Benefits Than No Down Payment

This perk is one of the most heavily advertised features of a VA loan program. Lenders are able to waive the typical down payment on a home due to the backing of the federal government.

This perk is one of the most heavily advertised features of a VA loan program. Lenders are able to waive the typical down payment on a home due to the backing of the federal government.

In a conventional mortgage, home buyers are required to put down a twenty percent down payment to give the lender some security for the loan in the event that you would default on the payments.

The security of the down payment is unnecessary because the Department of Veterans Affairs is willing to cover a portion of the loan. This is mutually beneficial for both you as the buyer and for the lender.

The lender can have peace of mind and financial security for issuing the financing, while you can avoid the need to save up for years in order to make the necessary down payment.

Consider that the cost of the average home for sale in the United States is approximately $200,000.

This means that a down payment on this home would typically come to $40,000.

Most homeowners don’t have that kind of money tucked away in a savings account which ultimately delays their ability to purchase a home. With the VA loan benefits, you won’t have to worry about scraping out your savings account for this upfront sum.

VA Loan Advantage of No Monthly Mortgage Insurance

On a conventional mortgage, homeowners who put down less than the requisite twenty percent down payment are usually forced to pay private mortgage insurance (also abbreviated as PMI).

The security granted by the federal government’s backing allows lenders to drop this unnecessary fee as well.

Homeowners may not truly understand how much money this can save them at a quick glance. However, you should be aware of how quickly these payments can add up over the years.

The average PMI payment ranges from 0.3 percent to 1.5 percent of the principal balance on the mortgage. On the home from our previous example, this means you could be paying up to $3,000 annually on this insurance policy.

Unlike other federal programs, such as the FHA mortgage, one of the main advantages of the VA loan is the ability to skip over this cost and lower your monthly expenditures.

Lower Interest Rates

Finding the exact interest rates for a VA loan can be difficult. It should be noted that the government doesn’t actually set specific interest rates for this program.

Finding the exact interest rates for a VA loan can be difficult. It should be noted that the government doesn’t actually set specific interest rates for this program.

They leave up to the private lenders who ultimately issue the financing to set specific interest rates. In this situation, you may find that your interest rate is heavily influenced by your credit score, down payment amount, economic indicators, debt-to-income ratio, and more.

The good news is that the interest rates are typically much lower on a VA loan than they would be on conventional products. Lenders often use high interest rates as a way to gain some security for themselves in the event that a homeowner misses payments.

This is why applicants with low credit scores tend to receive higher interest rates. It’s the lender’s way of justifying the risk they will be taking on your credit profile.

However, a VA loan allows the lender to rest in the security of the government’s backing and offer lower interest rates to all customers.

You’ll have to check around with several lenders to ensure that you receive the best possible rate, but they are almost all guaranteed to be lower than conventional mortgage rates.

Lower Credit Requirements

Have you struggled with making payments on time in the past? Poor credit can be the result of several missed payments, high credit utilization, or a short credit history.

A lower score may mean that you won’t qualify for conventional mortgages or even some of the other government programs.

For example, an FHA loan requires a credit score of 580 or higher in order to pass on the most benefit.

In comparison, one of the major VA loan benefits is the lower credit requirements. Because the lenders know the loan is secure due to the federal backing, they are more willing to consider buyers who have a spotty credit history.

There are no minimum credit score requirements in order to be eligible for this loan program.

Lenders are encouraged to take a detailed look at the entire profile before making a decision on who is eligible for a loan.

Closing Cost Concessions

Sometimes, a veteran may be financially prepared for the purchase of a home but the closing costs can really add up. Most experts will estimate that the closing costs for any home add up to equal roughly three to five percent of the home’s cost.

Depending on the market value of your home, this could mean thousands of dollars are due at the time of closing.

There could be another solution for homebuyers who know all of the VA loan benefits though. Because of the closing cost concessions possible with this loan program, you may be eligible to have the seller pay all closing costs.

This will have to be worked into the sales contract on the property, but it could save you a ton of money.

These closing cost concessions shouldn’t be confused with seller concessions. A seller can pay the full closing costs, but other seller concessions (such as covering the VA funding fee) are capped at four percent of the home’s value.

Lifetime Benefit

There aren’t enough veterans who are currently taking advantage of the VA loan benefits, but it is something that can last a lifetime. You can actually purchase more than one home with this program, allowing you to use it over and over again.

Every veteran receives a certain amount of entitlement, the money that the government is willing to guarantee on the loan. The basic entitlement is $36,000 and they will guarantee up to one-fourth of your mortgage.

Depending on the cost of your home, you may still have entitlement money left over that could be used on another property.

Alternatively, you may sell the home and pay off the mortgage. The entitlement could be restored, allowing you to purchase another home using the same entitlement funds all over again.

This is particularly useful for allowing you to continue taking advantage of all the VA loan benefits time and time again.

No Prepayment Penalties

Some lenders hate the idea of homeowners paying off their mortgage early. By reducing their loan term even slightly, a homeowner cuts into the profit that the lender would make on the interest of the loan.

Many lenders will help to minimize the impact of early payoff by instituting prepayment fees and penalties for homeowners who decide to take this financially savvy move.

With a VA loan, there are no prepayment penalties allowed regardless of when you pay off the home. You can finish paying off your mortgage in one year, twenty-five years, or thirty years without paying anything additional.

Basic Allowance for Housing

In some situations, service members may qualify for a basic allowance for housing (BAH). This is available whenever government housing isn’t available to help offset the cost of living in a particular area.

Lenders are allowed to include this allowance in your income when considering what you would qualify for with a new mortgage.

The specific BAH levels will be determined based on your rank, length of service, dependent statuses, and the area you live in. You may choose what portion of the BAH you spend on your living expenses and cover the difference if you choose a more expensive place to live.

This can work out in your favor, allowing you to purchase a much nicer home than you otherwise could afford.

Do All Veterans Qualify for a VA Loan?

The specific criteria that allow veterans to qualify for a VA loan are relatively easy to meet. You must serve in some branch of the armed forces for a minimum period of time and receive other than dishonorable discharge.

In general, the service time requirements for the various branches are listed below:

Armed Forces during peacetime: 180 days of continuous active duty status unless discharged for a service-related disability

Armed Forces during wartime: 90 days of continuous active duty status unless discharged for a service-related disability

National Guard or Selected Reserve: Six creditable years unless discharged for a service-related disability

There are more specific requirements regarding the time periods during which you may have served as well. To check to see if you qualify, you can take a look at the specific requirements from the VA here.

Can Spouses Qualify for a VA Loan?

Under some circumstances, the spouse of a service member may be eligible to receive financing through the VA loan program as well. This allows them to take advantage of all the many benefits of a VA loan, even if they did not serve in the armed forces themselves. The specific criteria for a spouse hoping to qualify for a VA loan require that you be:

The widow or widower of a service member who died while in service or from a service-connected disability

The spouse of a service member who is missing in action or a prisoner of war

The recipient of the Dependency and Indemnity Compensation benefits if your spouse’s death was not service-related

You must not be remarried unless you are over the age of 57 and got married after December 16, 2003.

How Do I Qualify?

If you want to qualify for all of the advantages of a VA loan, you need to meet the service requirements listed above. These will help you to obtain your Certificate of Eligibility (COE) that allows you to receive some of the entitlement funds from the federal government.

Applying for your Certificate of Eligibility can take just minutes if you fill out the required information online or weeks if you prefer to send it in by mail.

From here, you will also need to select a property that meets the guidelines and minimum property standards for a VA loan.

You can purchase many different types of properties with a VA loan, including single-family homes, manufactured homes, and condos in a VA-approved project.

You may even be able to build a new home or purchase and upgrade a new home.

No matter what property you select, they must all meet the minimum standards during the appraisal process.

These regulations are put in place to ensure that a potential home is both safe and sanitary for a veteran to live in. An appraiser must inspect the property to determine if any major issues exist, such as issues with heating, electrical, sewage, or running water.

You must also have a good income and a low debt-to-income ratio that demonstrates affordability for the property. The specific requirements for these items will be determined by your unique lender.

Frequently Asked Questions About VA Loan Benefits

Can you add closing costs to a VA loan?

Closing costs may not be added to the principal balance of a VA home loan, but the funding fee could be. Homebuyers who intend to use the VA home loan to fund their purchase may be able to request that the seller cover the closing costs or receive credits from their lender toward these fees. They typically average between three and five percent of the home’s value (not including the funding fee) and must be paid upfront.

There are some fees related to closing that are “non-allowable,” meaning that veterans cannot be charged for them. These include:

- Attorney fees charged by the lender

- Broker commissions or fees

- Real estate agent commissions

- Appraisal requested by the lender or seller (anyone other than the buyer)

- Fees for flood zone determination by the lender or appraiser

For more information on closing costs, you can see the expected costs on this VA brochure here.

What is the interest rate on a VA home loan today?

There are no set interest rates for a VA home loan. Instead, these rates are determined based on individual factors such as your credit score, income, overall debt, and other economic indicators. Each lender will set their own rates that may fluctuate on a daily basis.

Be sure to check with your lender to see what rates you may qualify for when it comes to your VA home loan today.

Can I reuse my VA home loan?

Yes, you can reuse your VA home loan. You will need to pay back the entitlement you borrowed from the government before you can move forward with another VA loan. This can be done when the mortgage is finished or is paid off through the sale of the house.

Some veterans may have money left over on the eligibility that would allow them to qualify to use the VA home loan again sooner.

VA Loan Benefits Conclusion

Prospective home buyers should really be aware of all the benefits that come along with the VA loan program. You could easily qualify to waive your down payment, avoid unnecessary monthly fees, and even rid yourself of your mortgage ahead of schedule with no penalty.

All of the inherent benefits of this program combine to put you in a financially stable status that allows you to receive the best possible deal on a home.

Keep in mind that you can use this benefit multiple times over the years. Even if you receive a PCS or just desire a change of scenery, you don’t have to sacrifice the benefits of this loan program.

Be sure to talk with your lender today about whether you meet the qualifications for this program and can receive all of the benefits associated with it.

by Mike Plambeck

In order to officially secure financing on your next home purchase with the VA financing, you will need to obtain a VA Appraisal. This tool is used to determine the fair market value of the home you intend to buy. In turn, this helps both the buyer and the lender to protect their interests.

In order to officially secure financing on your next home purchase with the VA financing, you will need to obtain a VA Appraisal. This tool is used to determine the fair market value of the home you intend to buy. In turn, this helps both the buyer and the lender to protect their interests.

The VA home appraisal is a significant hurdle that must be crossed before you can move forward with purchasing your home.

How does this tool help to protect both you and the lender? Some homes are priced above what would be considered fair or reasonable based on their condition and the prices of the comparable surrounding homes.

We Specialize in VA Home Loans

Fill Out The Form Below To Get Help Today!

If you were to default on your loan, the bank would take ownership of your property. They want to ensure that they can resell the home to recoup their initial investment in your financing.

Similarly, not all homeowners intend to stay in one home for the rest of their lives. You may decide to move on or receive orders to be stationed elsewhere across the country.

The home you purchase should be able to be resold for at least the amount you originally paid in order to cancel out the mortgage debt you incurred.

The lender is the preferred party who will initiate the appraisal process and formally submit the request shortly after the home moves under contract. However, any party to the mortgage purchase may submit the request for a VA loans appraisal as long as it is a VA-certified inspector who completes the job.

Is a VA Appraisal the Same as a Home Inspection?

On the surface, you may notice that the VA loans appraisal is meant to financially protect the lender.

The VA appraisal is also designed to help protect veterans from purchasing a home in need of significant repairs. This must be completed prior to the closing of the loan in order to guarantee financing from the lender and the Department of Veterans Affairs.

The timing of the VA appraisal prevents the sale from going too far without the property meeting minimum property requirements or being reasonably priced.

While the primary goal of the VA loans appraisal may first appear to be protecting your financial interests, it also ensures that the house meets the minimum property requirements. These are the basic rules established that make the house safe and sanitary.

Appraisers are looking for major hazards, including those with electrical issues, termites, or running water. It’s a cursory glance over many of the most important components of a home, but it’s not an exhaustive list.

A VA home inspection provides a more thorough examination of the property. This additional step is optional but highly recommended. A home inspection may uncover far more issues with the property than you could expect with an appraisal.

Inspectors are trained differently than appraisers, with an eye more for the finer details of your home. They will thoroughly inspect the roof, electrical, plumbing, and more.

Once you have a detailed look at any issues that present themselves, you may opt not to purchase the home (if you have an inspection contingency). The repairs could be too costly or more extensive than you’re willing to commit to.

However, a VA home inspection is a great idea to make sure that you know what to expect before you take out a thirty-year mortgage.

VA Loan Inspection Requirements

This federal program wants to ensure that every property purchased by veterans and active-duty service members meets a few minimum standards.

This federal program wants to ensure that every property purchased by veterans and active-duty service members meets a few minimum standards.

These are known as the minimum property requirements (MPRs). They help to establish a baseline that determines whether a property is going to be safe, sound, and sanitary for your residence.

It may seem like another hoop to jump through or a delay in obtaining your financing, but these property requirements are designed to protect you as the home buyer. As we mentioned earlier, this is not an exhaustive list of issues that could be wrong with the home.

You would need an inspection for that. However, this is to make sure that it meets the VA loan inspection requirements in regards to basic health and safety.

For example, they will start by making sure that this is designed for residential purposes only and provides adequate living space.

There isn’t necessarily a magic formula to determine the amount of living space necessary, but it should be large enough to allow you to do all of the basic daily activities like eating and sleeping.

Beyond that, here are a few other items that are included in the VA home inspection requirements:

- Electrical and plumbing systems are safe. The property must be able to demonstrate that all of these systems work appropriately and will continue to do so. It should be noted if it becomes apparent that a significant repair is looming on the horizon.

- Heating is adequate. The home must have heat in order to make a safe living environment. This will be tested as part of the minimum property requirements.

- Water is available. Clean drinking water is a must-have feature for any home.A VA loans appraisal will make sure that there is running water available and provide testing of well water to determine whether it is safe to drink. Public or county water can usually forego this additional testing step.

- Roofing is in good shape. Your roof protects the entire home from the elements. It should be in good shape now and for the foreseeable future. Read more about VA Roof requirements here.

- Property is accessible from a street. You should be able to enter and exit your home without illegally trespassing on someone else’s property. This requires a permanent driveway or a permanent easement with a neighboring property.While you may be allowed to share a driveway with someone else, additional documents might need to be drawn up to outline the responsibilities of each party when it comes to maintenance and upkeep.

- No defective construction. This category includes a wide variety of issues relating to the structural integrity of your home. It may start at the foundation, checking for cracks or rotted wood in the crawl space. The foundation should be stable and not in need of current (or future) repair.Water damage is also taken into consideration when looking at the lower levels of the home. From there, you can move all the way into the attic. Here, ventilation is going to be key in order to prevent future issues with mold.

- Termite inspection. Would you really want to purchase a home that was infested with termites and other pests? A basic termite inspection provides answers to some of these extremely pressing issues.The VA appraisal should also take a look at whether there is any damage done by a previous infestation, such as rotted wood or significant repairs needed.

- No safety or health hazards. It seems like this should go without saying, but your VA loans appraisal is concerned with identifying any potential health or safety risks that this property poses. This could include exposed wires, leaking sinks, or a dry rotted roof. Anything that poses a concern for safety is noted and needs to be repaired.

- No lead-based paint. Older homes may have been decorated using lead-based paints prior to the year 1978. The dust created by this paint can lead to lead poisoning. Your inspector should check to make sure that the paint on the walls does not fall into this category.

The basic premise of a VA appraisal is to make sure that your potential home can live up to all of these minimum property requirements.

The basic premise of a VA appraisal is to make sure that your potential home can live up to all of these minimum property requirements.

Sometimes, that turns out not to be the case. Before you despair over potentially losing your dream home, you may still be able to work out a way to secure financing for this specific property.

Depending on the issues and the agreeability of the sellers, the current homeowners may be willing to make the necessary repairs.

You may even be able to cover the cost of the repairs yourself in order to move forward with the financing. Either way, these minimum property standards should be met on any home you will live in.

These standards aren’t set out by the federal government simply because they are guaranteeing a portion of your financing. These are standards that all properties should meet to make your living spaces safe and sound.

If the property doesn’t meet these minimum standards, you may really want to consider whether it’s going to be the best house for you. You should always have the option to walk away from the purchase and continue on with a new search for the perfect home.

VA Appraisal Timeline

How long can you expect this stage of your financing approval to take? Many new home buyers are anxious to get themselves into their new home and resent the idea of waiting for an additional step. Understanding the VA loan appraisal timeline can help you to prepare yourself for the anticipated time required to complete this essential step.

It begins when the lender (or another member of your loan team) sends the official request to the VA.

This notifies them that you are ready to move forward with the VA home inspection for minimum property requirements. An appraiser will be assigned to your file and schedule a time to complete the walkthrough.

The VA will send out an independent inspector to take care of this step. A third-party who works for neither the Department of Veterans Affairs nor your lender ensures that you are getting an objective look at the home.

They do not have to protect anyone else’s interests in financing the property except for yours.

Overall, it should take ten business days or less to compile the full report. Homeowners may experience a delay in some areas where there could be a shortage of available independent inspectors. It’s always best to plan for a few extra days just in case something else arises that you weren’t expecting.

Fortunately, the appraisal process is relatively short. This gives you plenty of time to move forward with a home inspection as well if you choose to do so.

VA Home Appraisal Fees

As you may have already guessed, a VA appraisal isn’t completely free. The prospective home buyer is required to pay for the appraisal upfront whenever the task is completed. Many home buyers choose to have a thorough home inspection completed first in order to spare them from paying the VA appraisal fee on a property they won’t purchase. This is one way to save money on a house that could be a potential money pit.

However, they are both essential aspects of making a wise investment and the appraisal is non-negotiable.

Your VA appraisal should cost anywhere from $300 to $500, depending on the state and the type of home you purchase. For example, a VA appraisal on a single-family home is typically more expensive than a similar appraisal on a manufactured home. You will be responsible for this fee at the time services are rendered.

The initial cost could be reimbursed during your closing costs based on your negotiations with the seller. It isn’t a guarantee that you will be able to recoup these costs though.

Read more about VA Appraisal Fees here.

VA Appraisal Challenges

Sometimes, a property does not appraise for the list price when your appraiser determines the fair market value of the property. Lenders may hesitate to offer financing on a property that isn’t worth as much as you are currently projected to pay. If you were to default on the loan, they would not be able to recoup their costs based on what the property could potentially sell for.

Sometimes, a property does not appraise for the list price when your appraiser determines the fair market value of the property. Lenders may hesitate to offer financing on a property that isn’t worth as much as you are currently projected to pay. If you were to default on the loan, they would not be able to recoup their costs based on what the property could potentially sell for.

When this happens, homebuyers are presented with a few different choices. The simplest option is to walk away from the property and find another house that would suit your needs. Unfortunately, most buyers are very committed to a specific property by the time the appraisal returns. You may not want to start the house hunting all over again.

The second option is to request that the seller lower the price to meet the fair market value determined by the appraiser. You may have some success with this method and still be able to secure full financing for the property. The seller could opt to meet you in the middle of the appraised value and the list price, which still leaves you in a bit of a bind.

You may be required to bring cash to closing if you still want to proceed with a home that costs more than it’s worth.

For many prospective buyers, this isn’t going to be a possibility. One of the largest advantages of opting for a VA loan is that no down payment is required. Buyers may not have thousands of dollars saved up to cover the additional expense of putting down money at closing.

It’s even possible that you don’t believe the appraisal was completed fairly or accurately. Perhaps you found comparable properties in the area that appraised for much higher than what your desired property did. You can always call the appraisal itself into question with a Reconsideration of Value appeal.

Reconsideration of Value

A home buyer, lender, or real estate agent can request that the appraisal be reconsidered by submitting what is known as a Reconsideration of Value (ROV).

You will need to notify your lender of the request and give them an opportunity to review both the appraisal and the reasons why you believe it should be reconsidered.

If you have any substantial claim to request a revised appraisal, the lender will then forward the information over to the appraiser who was initially assigned to your property.

It will require a lot more work on your part than simply signing a letter requesting this ROV. Research other properties in the area of your pending sale to be used as comps, explain why remodeling changes boosted the home’s market value, and any other details you find pertinent that weren’t accurately included in the initial appraisal report.

Furthermore, you should even take the time to thoroughly check and recheck the numbers in the first appraisal.

It’s possible that there were errors in addition or other math sections that led to a lower appraisal value. These are relatively easy to fix, but they can take quite some time to spot.

The Reconsideration of Value is still not a guarantee that the home will appraise for the asking price.

If this doesn’t yield any results, you will have to come to grips with one of the three main options you have left: renegotiate with the seller, bring money to the closing, or walk away from the property altogether.

Conclusion

A VA home appraisal is a necessary part of the home buying process when you make use of this advantageous federal program. It can help to ensure that the home meets some very basic minimum property standards and allows you to make sure you receive a good deal on the property. Be certain not to confuse it with a VA home inspection though.

Take the time to carefully read over any appraisal reports generated on a potential property. You should know everything there is to know about a home you plan to purchase. Allow this stage to help you make an informed decision about the purchase of a particular property.

VA Appraisal FAQs

What is the difference between a VA appraisal and a VA home inspection?

A VA appraisal is designed to assess the fair market value of a property and ensure it meets the minimum property standards. It provides a cursory look at some of the most important features related to safety and health in the property. A VA home inspection is a separate process that takes a much more in-depth look at any potential issues with the property.

Only the VA home appraisal is typically required, but it’s highly recommended that you have both.

What does a VA loans appraisal cost?

The cost for a VA loan appraisal varies based on the type of property you are attempting to purchase and the state in which it is located. For detailed specifications regarding the appraisal price, you can select your state from this list.

Are there new appraisal requirements in 2018?

No, there are no new appraisal requirements for 2018.

Who orders the VA appraisal?

Anyone who has an interest in the sale of the property may order the VA appraisal, but it is preferred that the lender initiate the request.

I got an appraisal. Do I have to get a home inspection too?

Only the VA appraisal is absolutely required for the purchase of the home. However, a VA appraisal takes only a cursory glance at some of the main areas of the house to determine if it meets the minimum property standards. A home inspection, while optional, is highly recommended because it takes a more thorough look at the state of the home.

What are the VA minimum property requirements?

- Residential property with adequate living space

- Safe electrical and plumbing systems

- Adequate heating

- Clean drinking water availability

- Sturdy roofing

- Street-accessible

- No defective construction

- Current termite inspection

- No safety or health hazards

- No lead-based paint

Why did my home fail the VA Home appraisal?

Your potential property could fail the VA Home Appraisal for an inability to meet any of the minimum property requirements. This often means that the home doesn’t have adequate heating or electrical systems, has a roof in disrepair, or is infested with pests (including termites). However, this list is by no means exhaustive of all the possible ways a property could fail the VA appraisal.

Resources

How-to Challenge a VA Loan Appraisal

Appraisers/Staff Appraisal Reviewer

by Mike Plambeck

What is a Missouri VA loan?

Applying for a VA loan in Missouri often has the most favorable terms and conditions. In fact, this program has the potential to save Missouri homeowners thousands of dollars.

Navigating through all of the financing options available for prospective home buyers can be overwhelming.

You should understand all of the benefits associated with a VA loan in Missouri to ensure that you receive the best possible financing.

We Specialize in Helping Veterans find Home Loans – Pre Qualify Today Click Here.

The VA loan program allows veterans and service members to receive better terms from their lenders. A private lender issues the financing with a small guarantee from the Department of Veterans Affairs on the overall loan value.

This makes lenders more likely to give out favorable terms and to approve individuals who may not qualify for traditional mortgage programs.

VA Loan in Missouri Benefits

The benefits of receiving a VA loan in Missouri can save potential home buyers thousands of dollars in unnecessary fees. Find out the most advantageous parts of this loan program below.

The benefits of receiving a VA loan in Missouri can save potential home buyers thousands of dollars in unnecessary fees. Find out the most advantageous parts of this loan program below.

No Down Payment

The largest upfront cost associated with purchasing a new home is your down payment. Traditional financing often requires a twenty percent down payment.

This could mean waiting a few years to purchase a home while you scrape together a large enough savings account.

With a VA loan in Missouri, home buyers are not necessarily required to come up with a down payment. This savings alone is what makes the program so appealing to potential buyers.

No Private Mortgage Insurance

When you purchase a home with little to no down payment, most lenders will require you to carry private mortgage insurance. This monthly fee usually equals 0.3 percent to 1.5 percent of the loan value each year.

It represents a significant cost to homeowners each month and may limit what sort of housing they can afford. A VA loan in Missouri does not require private mortgage insurance, which represents yet another source of savings.

No Penalty for Early Payoff

Some families dream of being debt-free and are willing to work hard to make that dream a reality. Paying off a mortgage early eliminates some of the cost associated with interest rates, but the fine print dictates what sort of penalties you will face for this. With a VA loan in Missouri, you won’t face any penalties or fees for choosing to pay off your loan early.

Loan Assistance Programs

The ultimate goal for VA loans is to make homeownership affordable for all individuals and families. If you are struggling with financial hardship and may be facing foreclosure, there are trained loan experts available to assist you through the Department of Veterans Affairs.

They can help to connect you with resources to prevent you from losing your home.

Eligibility

How can you qualify for a VA loan in Missouri? You must obtain a Certificate of Eligibility for meeting the service requirements set out by the government. The service requirements will vary based on your dates of service, the branch you served in, and your enlistment dates.

Surviving spouses may also qualify for a VA loan in Missouri if they meet the eligibility requirements.

You can find more information regarding the criteria for a Certificate of Eligibility here.

From there, you will need to find a property that qualifies for financing with a military mortgage. Single-family homes, condominiums in a VA-approved project, and manufactured homes with lots will all qualify. New construction homes are also allowed, and you can use a VA loan in Missouri to build your own home.

Some people may be interested in using VA loans to purchase and remodel a new property at the same time. The financing could also be used to install energy efficient upgrades or improvements to an existing property.

VA loans can be used to refinance your current home. This allows you to take advantage of lower VA loan rates in Missouri without selling your current property. Over the duration of your loan, this savvy move could save you thousands of dollars in interest.

Loan Limits by County in Missouri

The amount of financing you receive in a VA loan is subject to approval by your lender. The final decision will be made based on your credit score, income level, debt-to-income ratio, and other factors. However, there are also VA loan limits in Missouri.

These loan limits are the maximum amount that can be borrowed for a home without making a down payment. Technically, there are no maximum loan amounts for this program but you will be required to come up with a down payment for homes in excess of the VA loan limits in Missouri.

The specific loan limit often varies by county with higher limits in areas that see significant increases in the cost of living. However, the VA loan limits in Missouri are all equal at $453,100 in every county.

Regional Loan Centers

There are eight regional loan centers available to offer assistance to veterans who want additional information about the VA loan program. You can connect with trained representatives who can answer questions regarding your eligibility, the application process, and how to get started with receiving a VA loan in Missouri.

This is also an ideal contact for homeowners who feel they may be facing foreclosure. A regional loan center can often connect you with available resources that could prevent this from occurring.

In Missouri, you would need to contact the regional loan center located in St. Paul.

Missouri Home Prices

Making sure you can pay the monthly mortgage payments on your new home is essential before you sign on the dotted line.

Take the time to research the real estate market in your state, as well as the specific prices of homes in your desired area. This can help you to make the decision about whether homeownership is truly affordable for you right now.

The median list price of homes in Missouri is currently at $165,900 with a square foot price of $106.

To compare it with two major cities, you can see the median list price for both Kansas City and St. Louis below:

Kansas City: $184,450 with square foot price of $119

St. Louis: $144,900 with square foot price of $117

Regional Benefit Offices

Contact the regional benefit office in your area if you have any questions about the VA loan program in Missouri. They may also have information regarding additional resources available in your area.

St. Louis Regional Benefit Office

9700 Page Avenue

St. Louis, MO 63132

FAQs

I have bad credit. Can I get a VA loan in Missouri?

Yes, you can still qualify for a VA loan in Missouri with a low credit score. You will need to do additional research to find a lender who is willing to issue loans to individuals with bad credit. There are no minimum credit score requirements for this loan program though. If you can find a lender to issue the loan, the federal government will still guarantee your financing.

You may face higher VA loan rates in Missouri if you have bad credit.

Can a surviving spouse receive a VA loan in Missouri?

Yes, a surviving spouse who meets the eligibility requirements can receive a VA loan in Missouri. You must be either un-remarried or remarried past the age of 57 and after December 6, 2003. You must also meet the following criteria:

Must be the spouse of a veteran who died while in service or from a service-connected disability

Must be the spouse of a service member who is missing in action or a prisoner of war

Must be the spouse of a totally disabled veteran whose disability may not have been the cause of death

What is the VA loan rate in Missouri?

The government does not set a specific VA loan rate in Missouri. Instead, each individual will receive an interest rate based on their personal financial history, economic factors, and the private lender. These rates will fluctuate over time, so be sure to check with your lender to see what today’s VA loan rates in Missouri happen to be.

by Leslie Rowberry

What are VA Loans in Pennsylvania?

When you’re attempting to purchase a new home in Pennsylvania, you want to ensure that you’re getting the best possible deal. For many individuals and families, Pennsylvania VA loans quickly appear to offer the most favorable terms and benefits. It’s important to fully understand the advantages and the eligibility requirements for applicants interested in VA loans in Pennsylvania.

When you’re attempting to purchase a new home in Pennsylvania, you want to ensure that you’re getting the best possible deal. For many individuals and families, Pennsylvania VA loans quickly appear to offer the most favorable terms and benefits. It’s important to fully understand the advantages and the eligibility requirements for applicants interested in VA loans in Pennsylvania.

These loans are offered through private lenders but are guaranteed in part by the Department of Veterans Affairs. As a result, lenders are more likely to issue loans with better terms to borrowers who may not qualify for conventional mortgage products.

We Specialize in VA Home Loans – Pre Qualify in Pennsylvania Today, click here.

VA Loan Benefits in Pennsylvania

What kind of benefits are truly available with this loan program? For a closer look at the benefits associated with a military mortgage in Pennsylvania, you can see more detailed information below.

No Down Payment

This is perhaps the single largest advantage when it comes to applying for VA loans in Pennsylvania. Traditional mortgage products typically require a twenty percent down payment, which can equate to years’ worth of savings. In comparison, you may be able to purchase a home without any down payment at all.

No Private Mortgage Insurance Premium

When it comes to traditional mortgage products, lenders often require private mortgage insurance when you have a down payment under twenty percent. This insurance premium costs between 0.3 and 1.5 percent of the loan amount annually. These military mortgages in Pennsylvania don’t require private mortgage insurance, which can add up to huge savings on a monthly basis.

No Penalty for Paying Off the Loan Early

Do you want to keep more money in your pocket over the course of your loan? Making extra payments is a great way to reduce the overall cost of your interest rates. A VA loan will allow you to pay off your home early and save on interest costs without any penalty from the lender.

Loan Assistance Available from the VA

If you find yourself struggling to make ends meet, the Department of Veterans Affairs offers help from qualified experts familiar with loan assistance programs to help you avoid foreclosure. Don’t hesitate to reach out if you need help making the monthly payments on your mortgage.

VA Home Loan Eligibility in PA

In order to qualify for a VA loan in Pennsylvania, you will need to determine whether you meet the criteria for a Certificate of Eligibility. Prospective home buyers will need to meet minimum service requirements for active duty in a branch of the armed forces, either during a war or during peacetime. Spouses may also qualify under certain circumstances. You can see the detailed service requirements for a VA loan in Pennsylvania here.

In order to qualify for a VA loan in Pennsylvania, you will need to determine whether you meet the criteria for a Certificate of Eligibility. Prospective home buyers will need to meet minimum service requirements for active duty in a branch of the armed forces, either during a war or during peacetime. Spouses may also qualify under certain circumstances. You can see the detailed service requirements for a VA loan in Pennsylvania here.

Once you can obtain your Certificate of Eligibility, you must select a property that meets the VA loan requirements. There are specific property types that are eligible for these mortgages, including single family homes, condominiums in VA-approved projects, and manufactured homes or lots.

You may be surprised to learn that you can do a number of things with a military mortgage beyond just purchasing a single-family home. Here are some other ways that a military mortgage in

Pennsylvania may be able to help you make homeownership a reality:

Building a new home

Renovating a newly purchased home

Installing energy efficient features or improvements

Refinancing a direct loan to receive a lower interest rate

Refinancing an existing mortgage loan or other indebtedness secured by a lien of record on a home owned and occupied by a veteran as a primary residence

VA Loan Limits by County in Pennsylvania

There is no real maximum dollar amount that a VA loan can have, but most lenders will adhere to specific loan limits set for their county. These are the limits at which prospective buyers can still purchase a home with no down payment. While you can definitely exceed this amount, your lender will likely require you to come up with some type of down payment to cover the difference.

In Pennsylvania, most of the counties will all have the same loan limit. The limit is typically $435,100 based on the average cost of living and the maximums prescribed by Ginnie Mae.

The exception to this loan limit is in Pike County, where the limit is raised to $679,650.

VA Home Loan Pennsylvania Regional Loan Centers

Regional loan centers are a great place to receive additional information regarding a potential military mortgage. You may find yourself filled with tons of questions regarding your eligibility, how the process works, or how to take the first steps. There are eight of these regional loan centers dedicated to helping veterans navigate the waters of homeownership with this mortgage program.

If you are at risk of having your home move into foreclosure, this is also an excellent resource to connect you with loan servicers who may be able to help.

The closest regional loan center to Pennsylvania is actually located in Cleveland.

They are responsible for assisting more than five million individuals in a jurisdiction that includes many of the states in the northeast.

Pennsylvania Home Prices

Do you wonder if you could afford to purchase your own home? It can help to take a look at the median prices of home sales in your area to determine if you can afford it. Real-world numbers can give you a clear glimpse at the current state of the real estate market in your area.

Do you wonder if you could afford to purchase your own home? It can help to take a look at the median prices of home sales in your area to determine if you can afford it. Real-world numbers can give you a clear glimpse at the current state of the real estate market in your area.

The median home price in Pennsylvania is currently on the rise, according to housing market experts.

Over the past few years, it has increased by more than four percent and the trend is likely to continue. Consider the below statistics to determine what you may be able to afford in this state:

Median list price: $189,900

Median sale price: $170,375

Median list price per square foot: $118

Of course, these median prices can change drastically based on the specific area where you may be shopping for a new home. More expensive areas include Philadelphia and Pittsburgh, where you may not get as much house for your money. Both of these cities have seen tremendous growth over the past couple of years.

Currently, the median list price of a home in Philadelphia is almost $195,000 but the median home value is closer to $142,000. Compared to the state as a whole, the square footage price is substantially higher at $143 per square foot.

Pittsburgh is slightly less expensive than Philadelphia, with a median list price coming in right around $190,000. However, the value of homes as a whole is lower than Philadelphia at approximately $129,000. Square foot value is roughly the same as it is across the state at $123 per square foot.

Pennsylvania Regional Benefit Offices for VA Home Loans

For more information regarding the programs available in your area, you can contact one of the local regional benefit offices in Pennsylvania. They can help to answer any questions you may have regarding eligibility for a particular program. These offices may also offer other services that could be beneficial to veterans.

Philadelphia Regional Benefit Office

5000 Wissahickon Avenue

Philadelphia, PA 19144

Pittsburgh Regional Benefit Office

1000 Liberty Avenue

Pittsburgh, PA 15222

Pennsylvania VA Home Loan FAQs

I have bad credit. Can I get a VA loan in Pennsylvania?

Yes, you may still qualify for a VA loan in Pennsylvania even if you have poor credit. There are no minimum credit scores required to be eligible for this loan program. Instead, the federal government is willing to guarantee the loan as long as you can find a lender that will agree to issue a mortgage.

You will need to find a lender that is open to working with individuals who have low credit scores.

Find out how to raise your credit score here.

Can a surviving spouse receive a VA loan in Pennsylvania?

Yes, a surviving spouse can receive a VA loan Pennsylvania when they meet certain requirements. Surviving spouses must remain unmarried until the age of 57 and have been remarried after December 6, 2003. They must also meet the following criteria:

- Must be the spouse of a veteran who died while in service or from a service-connected disability

- Must be the spouse of a service member who is missing in action or a prisoner of war

- Must be the spouse of a totally disabled veteran whose disability may not have been the cause of death

What is the VA loan rate in Pennsylvania?

Unfortunately, there isn’t one standard VA loan rate for all lenders in Pennsylvania. Each lender will set their own unique interest rates based on the state of the economy, competition in the market, credit scores, debt-to-income ratios, and other key factors. Check with your local mortgage company to see what their current rates are for a VA loan Pennsylvania.

Additional Resources for Pennsylvania VA Loans

by Leslie Rowberry

For veterans looking to purchase a home the loan program offered by the VA can be an excellent option to secure a mortgage. The VA loan program offers qualified veterans the ability to secure a home loan at a low interest rate, and for little to no down payment. This makes the program extremely attractive to many veterans. There’s a lot that goes into a VA loan, but one of the lesser understood aspects is the VA loan closing costs.

For veterans looking to purchase a home the loan program offered by the VA can be an excellent option to secure a mortgage. The VA loan program offers qualified veterans the ability to secure a home loan at a low interest rate, and for little to no down payment. This makes the program extremely attractive to many veterans. There’s a lot that goes into a VA loan, but one of the lesser understood aspects is the VA loan closing costs.

Closing costs is sort of a catch all term that describes the variety of expenses due at the final phase of a home purchase. This includes things like an origination fee, attorney fees, and monies due to real estate ages. All mortgages will have fees like this, but the difference with VA loan closing costs is that certain costs cannot be paid for by the buyer. It’s important to understand which costs fall into this category as they will then likely need to be paid for by the lender, seller, or the agent.

We Can Help With Your VA Home Loan Qualification

Fill Out The Form Below To Get Help Today!

Closing costs will typically range anywhere from 1-5%. This varies depending on the location and home. Talk to your lender or agent to get an idea of where they might be for your purchase. It’s important to understand the variety of closing costs as even a few percent of the loan can end up being thousands of dollars.

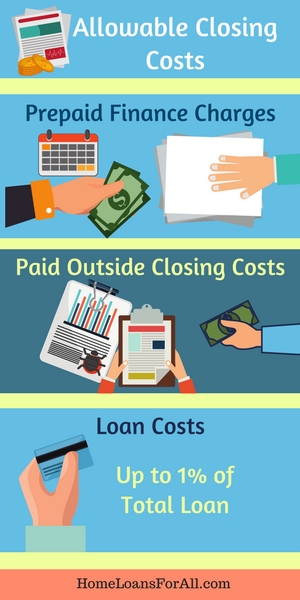

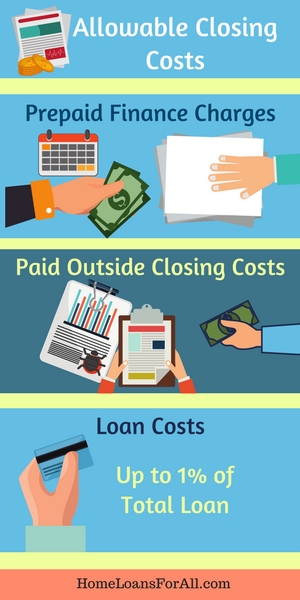

Allowable Closing Costs

Closing costs are costs associated with the actual cost of creating and processing a loan. These costs are typically into a couple of different types

Prepaid Finance Charges: PFCs are costs directly associated with the loan, and can increase your APR. These include:

Prepaid Finance Charges: PFCs are costs directly associated with the loan, and can increase your APR. These include:

1.Escrow payments for interest, property taxes, or homeowners insurance.

2.Points used to buy down interest rates.

3.The VA funding fee.

4.Any sort of applicable homeowners association fees.

Paid Outside Closing Costs: POCs on the other hand are items that aren’t factored into the overall cost of the loan. They won’t affect the overall APR, but still need to be paid at closing. These costs include:

1. Credit Reports

2. Pest inspection fees (some are non-allowable depending on location).

3. Mandatory VA appraisal and additional home inspections (read about VA Appraisal Fees)

Loan Costs: Lastly, there are a series of costs that are associated with the loan itself. The biggest is typically the origination fee, which is a fee that the lender charges for processing the loan. This can be up to 1% of the total loan.

For VA backed loans, you’re also required to pay what is known as the funding fee. This is a fee paid directly to the VA to offset the cost of running the program. It’s typically a couple of percent, but can be rolled into the loan itself.

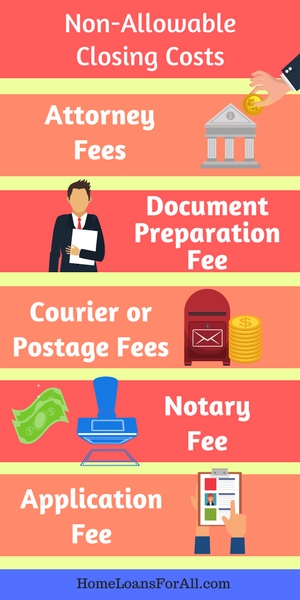

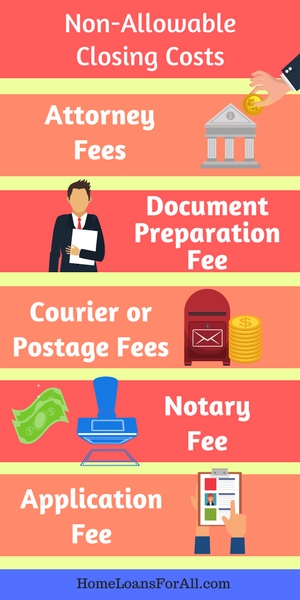

Non-Allowable Closing Costs

Outside of the above, there are a number of VA loan closing costs that cannot be paid by the buyer. These are specific costs the VA has said the buyer cannot pay, and therefore must be picked up by one of the other parties.

Attorney Fees: Attorney fees for either the seller or lender cannot be paid for by the buyer.

Attorney Fees: Attorney fees for either the seller or lender cannot be paid for by the buyer.

Escrow Fee: The VA does not allow the buyer to pay an escrow fee. An escrow company takes care of accepting and distributing the monies for the transaction, as well as ensuring all parties have signed the appropriate documents. This fee can get quite expensive, and not having to pay it is a great benefit for VA loan users

Document Preparation Fee: Any sort of fee charged by the escrow company for preparing the documents cannot be paid by the buyer.

Courier or Postage Fees: In some cases, specific documents might need to have special shipping conditions met such as being overnighted. Any sort of fees related to this cannot be paid by the buyer and need to be covered by the lender.

Notary Fee: Any sort of fee required, typically by the escrow company, to send a notary to the borrower when signing the mortgage documents is also non-allowable.

Application Fee: Some lenders sometime charge a fee upfront before a potential borrower is able to apply for a loan. This is not allowed on VA loans. No VA approved lender should be charging any sort of up-front or application fee for VA backed loans.

For each of these, allowable and non-allowable, the list is non-inclusive. There may be additional fees that fall into either category depending on where you live or the specific lender you’re dealing with.

For example, some high-risk areas require a termite inspection as part of the appraisal process. In the majority of states, this inspections cost is not allowed to be paid by the buyer.

Situations like this make it a good idea to work with a lender and agent that have experience with VA loans in the area where the home is being purchased. They’ll be able to provide more details on the fees, and any sort of special situations you might find yourself in.

Seller Concession Limits

In the case where the seller pays for the closing costs of a loan it is called a seller concession. Concessions for the seller are negotiable, and they can choose to pay some not at all depending on the specifics of the deal and how motivated of a seller they are.

In the case where the seller pays for the closing costs of a loan it is called a seller concession. Concessions for the seller are negotiable, and they can choose to pay some not at all depending on the specifics of the deal and how motivated of a seller they are.

On VA backed loans, seller concessions are limited to 4% of the total price of the loan. This means that a seller can only cover that much in closing costs for the buyer, after that the VA deems this to be excessive concessions.

This limit is imposed to prevent a large concessions from hiding an above market selling price. This helps the VA and the lender reduce their risk in the transaction.

Closing Cost Assistance for Veterans

For those veterans looking to come up with the necessary monies to pay for allowable closing costs, there are a couple of options available.

For those veterans looking to come up with the necessary monies to pay for allowable closing costs, there are a couple of options available.

The first, and most obvious, is to simply to talk to the lender and seller and see what sort of deal might be worked out. Many sellers understand there’s a certain amount of give require to push a deal through, and may be able to pick up some of the closing costs. If under the concession limit, there’s nothing wrong with going back to seller and asking for them to pay some or even all of the closing costs.

VA Loan Grants

In addition to getting help from the seller, there are also a number of grants offered through the VA and private organizations aimed at helping veterans acquire housing. For example, the Pentagon Federal Credit Union offers the dream makers grant which provide assistance for down payments and closing costs to veterans.

Specially Adapted Housing Grant

For veterans that require special accommodations due to disabilities, the specially adapted housing grant can provide up to half of the purchase price or a new home or renovating an existing property. The grant does have some strict requirements, and does have a cap on monies, but is a great option that can be used to help cover closing costs for those that qualify.

State & Local Grants

There are also a wide range of state and local grants available to a wide range of home buyers that can also help cover parts of the loan. Searching for grants in your area is a great way to help cover closing costs.

There are also a wide range of state and local grants available to a wide range of home buyers that can also help cover parts of the loan. Searching for grants in your area is a great way to help cover closing costs.

For example, in Texas first time veteran home buyers may be eligible for the Mortgage credit certificate program. This gives a tax credit of up to $2,000 on interest paid on the mortgage. You can also speak to your lender or agent, as they can likely point you in the right direction to determining if you’re eligible for any local grants.

VA Loan Closing Costs

The VA loan is an excellent option for veterans, and limiting the closing costs that buyers are required to pay makes them even more attractive. Having knowledge of which closing costs are non-allowable can help make the entire process smoother. It’s also smart to work with an agent who understands the VA process, as they can help you understand the various closing costs and how they will affect the overall price of the loan.

VA Loan Closing Costs – FAQ

What Does Cash To Close Mean?

Cash to close refers to the amount of money needed to be brought to closing. This includes all of the closing costs, as well as any down payment for the loan.

Can the VA Loan Closing Costs be Rolled into the Loan?

Other than the funding fee, all closing costs must be paid at closing and cannot be rolled into the cost of the loan.

How Much Are CLosing Costs on a VA Loan?

As closing costs are typically a percentage of the total loan it’s impossible to give a specific dollar amount. That said, VA loan closing costs will usually run around 1-5% of the total loan amount, with borrowers instructed to plan for 3-5% to prevent surprises.

Veterans and service members who are looking to purchase a home in 2018 will be excited to learn about all of the great VA loan benefits.

Veterans and service members who are looking to purchase a home in 2018 will be excited to learn about all of the great VA loan benefits.  This perk is one of the most heavily advertised features of a VA loan program. Lenders are able to waive the typical down payment on a home due to the backing of the federal government.

This perk is one of the most heavily advertised features of a VA loan program. Lenders are able to waive the typical down payment on a home due to the backing of the federal government.  Finding the exact interest rates for a VA loan can be difficult. It should be noted that the government doesn’t actually set specific interest rates for this program.

Finding the exact interest rates for a VA loan can be difficult. It should be noted that the government doesn’t actually set specific interest rates for this program.

In order to officially secure financing on your next home purchase with the

In order to officially secure financing on your next home purchase with the  This federal program wants to ensure that every property purchased by veterans and active-duty service members meets a few minimum standards.

This federal program wants to ensure that every property purchased by veterans and active-duty service members meets a few minimum standards. The basic premise of a VA appraisal is to make sure that your potential home can live up to all of these minimum property requirements.

The basic premise of a VA appraisal is to make sure that your potential home can live up to all of these minimum property requirements. Sometimes, a property does not appraise for the list price when your appraiser determines the fair market value of the property. Lenders may hesitate to offer financing on a property that isn’t worth as much as you are currently projected to pay. If you were to default on the loan, they would not be able to recoup their costs based on what the property could potentially sell for.

Sometimes, a property does not appraise for the list price when your appraiser determines the fair market value of the property. Lenders may hesitate to offer financing on a property that isn’t worth as much as you are currently projected to pay. If you were to default on the loan, they would not be able to recoup their costs based on what the property could potentially sell for.

The benefits of receiving a VA loan in Missouri can save potential home buyers thousands of dollars in unnecessary fees. Find out the most advantageous parts of this loan program below.

The benefits of receiving a VA loan in Missouri can save potential home buyers thousands of dollars in unnecessary fees. Find out the most advantageous parts of this loan program below.

When you’re attempting to purchase a new home in Pennsylvania, you want to ensure that you’re getting the best possible deal. For many individuals and families, Pennsylvania VA loans quickly appear to offer the most favorable terms and benefits. It’s important to fully understand the advantages and the eligibility requirements for applicants interested in VA loans in Pennsylvania.

When you’re attempting to purchase a new home in Pennsylvania, you want to ensure that you’re getting the best possible deal. For many individuals and families, Pennsylvania VA loans quickly appear to offer the most favorable terms and benefits. It’s important to fully understand the advantages and the eligibility requirements for applicants interested in VA loans in Pennsylvania.  In order to qualify for a

In order to qualify for a  Do you wonder if you could afford to purchase your own home? It can help to take a look at the median prices of home sales in your area to determine if you can afford it. Real-world numbers can give you a clear glimpse at the current state of the real estate market in your area.

Do you wonder if you could afford to purchase your own home? It can help to take a look at the median prices of home sales in your area to determine if you can afford it. Real-world numbers can give you a clear glimpse at the current state of the real estate market in your area. For veterans looking to purchase a home the loan program offered by the VA can be an excellent option to secure a mortgage. The VA loan program offers qualified veterans the ability to secure a home loan at a low interest rate, and for little to no down payment. This makes the program extremely attractive to many veterans. There’s a lot that goes into a VA loan, but one of the lesser understood aspects is the VA loan closing costs.

For veterans looking to purchase a home the loan program offered by the VA can be an excellent option to secure a mortgage. The VA loan program offers qualified veterans the ability to secure a home loan at a low interest rate, and for little to no down payment. This makes the program extremely attractive to many veterans. There’s a lot that goes into a VA loan, but one of the lesser understood aspects is the VA loan closing costs.  Prepaid Finance Charges: PFCs are costs directly associated with the loan, and can increase your APR. These include:

Prepaid Finance Charges: PFCs are costs directly associated with the loan, and can increase your APR. These include: Attorney Fees: Attorney fees for either the seller or lender cannot be paid for by the buyer.

Attorney Fees: Attorney fees for either the seller or lender cannot be paid for by the buyer.  In the case where the seller pays for the closing costs of a loan it is called a seller concession. Concessions for the seller are negotiable, and they can choose to pay some not at all depending on the specifics of the deal and how motivated of a seller they are.

In the case where the seller pays for the closing costs of a loan it is called a seller concession. Concessions for the seller are negotiable, and they can choose to pay some not at all depending on the specifics of the deal and how motivated of a seller they are.  For those veterans looking to come up with the necessary monies to pay for allowable closing costs, there are a couple of options available.

For those veterans looking to come up with the necessary monies to pay for allowable closing costs, there are a couple of options available.  There are also a wide range of state and local grants available to a wide range of home buyers that can also help cover parts of the loan. Searching for grants in your area is a great way to help cover closing costs.

There are also a wide range of state and local grants available to a wide range of home buyers that can also help cover parts of the loan. Searching for grants in your area is a great way to help cover closing costs.