Being Self Employed while seeking to borrow through the Fannie Mae lending system is an incredibly complicated process!

This article will help you understand and navigate through the guidelines surrounding being self-employed and applying for Fannie Mae. We will also cover recent important changes.

You’ll learn:

-

- What’s Changed with Fannie Mae and the Self Employed

- How You Can Get Help from Homeloansforall.com With Your Self Employed Fannie Mae Application

- Guidelines for Getting Approval with Fannie Mae while being Self Employed

- What to do if your business distributions are irregular

- What can you do if you don’t have 2 years tax returns

- What if You are employed while also running your own business.

Home loans for self-employed borrowers are becoming more accessible by the day.

‘Why?’, you ask?

Because of recent changes to Fannie Mae self-employment guidelines in regards to income.

In this article, we’ll discuss in detail what’s changed, explain why these changes specifically benefit self-employed homeowners. We will help you through the process of securing a Fannie Mae self-employed loan for yourself.

We Can Get Your Self Employed Fannie Mae Loan Approved

Fill Out The Form Below To Get Help Today!

Fannie Mae Self Employed Guidelines: What’s Changed?

“Fannie Mae” is the colloquial name for the Federal National Mortgage Association, a publicly-traded company sponsored by the US government.

For years, their borrowing process has been quite tedious, especially for Fannie Mae self-employed borrowers. Largely, it has been so due to the burdensome documentation requirements and the Fannie Mae verification of employment guidelines.

For example, on top of the usual requests for credit reports and bank statements, self-employed borrowers have had to show their federal income tax returns. The more other related documentation, the better.

New changes have made these loans much more accessible and have simplified the process for everyone. Self-employed and salaried persons with secondary sources of income from non-salaried businesses find new ways convenient for them.

One of the biggest changes is that only one year of federal income tax is required instead of two. Though, this only applies to certain cases. Also, the body has unveiled a new income calculation that caters to business owners with a little-to-no history of distributions.

-

-

- Fannie Mae Self-employed borrowers whose business distributions are irregular or non-existent will now have show access to their business income. This can be shown easily by producing a letter of incorporation or the K-1 filing. Additionally, your business should show adequate liquidity that can support income withdrawals.

- Self-employed borrowers whose businesses do not have the previously required two years of federal tax returns now only have to show one year of federal tax returns. However, your business’s cash flow needs to appear realistic and credible. It also should cover at least 12 months.

- Borrowers with a self-employment income from a second, non-salaried business will no longer be required to show proof of income from their self-employment sources. If the income from the “salaried” job qualifies them for a mortgage, there is no need for that. If you’re a borrower living off pension payments, retirement income, social security income as well as dividends, this is definitely good news. However, you will have to produce your federal income or corporate tax returns as it relates to your non-salaried source of income.

-

It is worth noting that these new rules only apply to conventional home loans, and thus guidelines for other mortgage products such as FHA loans and VA loans may differ.

How To Get Approved For A Fannie Mae Self-Employed Mortgage

These changes to the Fannie Mae self-employed guidelines and current mortgage rates under 4% are a sign for you to become a homeowner. There’s never been a better time to shop for a mortgage. Here’s a quick guide to getting approved for a mortgage if you’re self-employed.

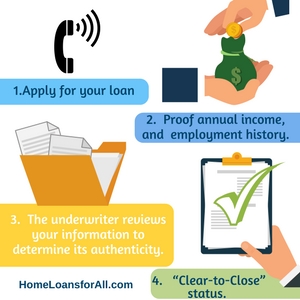

Firstly, you should apply for your loan in-person, by telephone or online. Applying for a loan usually includes showing proof of your annual income, savings, debts, your locality, and your employment history.

The last section laid out some of the more specific Fannie Mae self-employment guidelines. Your lender will tell you exactly what you need to send them.

Once you’ve applied, your application will be forwarded to a bank employee, underwriter. The underwriter reviews your information to determine its authenticity. This includes making requests for supporting documentation and clarifications where needed.

Your underwriter is at liberty to seek as much information from you as they deem right. It’s their job to make sure your loan application is feasible, based on the minimum qualification standards of a respective bank.

For example, you may have to explain and even show proof of the source of an unusually large deposit (60 days or so).

If your loan meets the bank’s qualification guidelines, including the Fannie mae verification of employment guidelines, the underwriter will assign your loan a “Clear-to-Close” status. Then you’re all ready to start financing your house!

Also, the underwriting process doesn’t follow any specified pattern and will vary for different types of loans, lenders, and applicants. So, if the underwriter asks you weird questions, it only seems to you. During the underwriting process, the underwriter is your best friend.

This means all Fannie Mae self-employed borrowers will be required to present specific documentation depending on what the underwriter considers right.

So, What Has Changed With the New Rules?

This borrowing process has for a long time been quite tedious. Self-employed borrowers felt this even harsher than everyone.

For example, on top of the usual requests for credit reports and bank statements, self-employment borrowers have had to show their federal income tax returns. Imagine, someone loves seeing those papers! They would also ask for additional documents that might be proof of business stability. Whatever these docs might be, you’d better provide them or you lose any chance of Fanny Mae loan whatsoever.

However, with the new mortgage guidelines in place, the amount of documentation is smaller now.

This move waives a fair share of the paperwork especially for the self-employed as well as the salaried persons with secondary sources of income from non-salaried businesses.

Fannie Mae Guidelines for Self-Employed Mortgage Borrowers

As mentioned earlier, the Fannie Mae guidelines are keen to make access to home loans easier for the self-employed mortgage borrowers. The policy updates that have been in effect since late-August 2015 covers three main areas;

-

-

- Self-employed borrowers whose business distributions are irregular or non-existent

-

In this case, you (borrower) will only be required to have access to your business income which you can easily prove by producing a letter of incorporation or the K-1 filing. Additionally, your business should show adequate liquidity that can support income withdrawals.

-

-

- Self-employed borrowers whose businesses do not have two years of federal tax returns.

-

The new rules offer looser guidelines for this category. All that you need is proof of one year of federal tax returns. However, your business’s cash flow needs to appear realistic and credible and covering 12 months and over. No cheating! You learned this in school, right?

-

-

- Salaried borrowers who also have a second self-employment job

-

You do not have to provide income from your self-employment job/business as proof to qualify for a mortgage. This will particularly be necessary if you’re a borrower living off pension payments, retirement income, social security income, or dividends.

This means you no longer have to produce your federal income or corporate tax returns as it relates to your non-salaried source of income. However, this only applies if your application for a mortgage indicates adequate household income. It should be less than your salaried job.

It is worth noting that these new rules only apply to conventional home loans, and thus guidelines for other mortgage products such as FHA loans and VA loans may differ.

That’s it! Our comprehensive guide to the new Fannie Mae guidelines for self-employed borrowers has come to its end. So, what does this mean to you? Well, it’s your perfect opportunity to consider taking that mortgage you’ve only dreamed about before. The hitherto stringent mortgage rules are gone. It’s your time to celebrate the newly found opening and own a home.

Related Articles:

How To Successfully Apply For A Mortgage While Self-Employed