When you sit down to sign the paperwork on your new home, most people are ecstatic to begin their journey as homeowners. The excitement is almost palpable regardless of whether it’s your first house or your fiftieth. Unforbanktunately, life circumstances can sometimes enter the picture and cloud your once clear image of the future. Maybe you’ve faced unexpected health issues or the company you worked for went bankrupt. Perhaps your spouse passed away. No matter what your specific circumstances may be, you aren’t alone if you find yourself in a situation where you can’t pay your mortgage.

When you sit down to sign the paperwork on your new home, most people are ecstatic to begin their journey as homeowners. The excitement is almost palpable regardless of whether it’s your first house or your fiftieth. Unforbanktunately, life circumstances can sometimes enter the picture and cloud your once clear image of the future. Maybe you’ve faced unexpected health issues or the company you worked for went bankrupt. Perhaps your spouse passed away. No matter what your specific circumstances may be, you aren’t alone if you find yourself in a situation where you can’t pay your mortgage.

People all over the country can find themselves facing financial hardship and unable to make their mortgage payments. We will walk you through the steps you need to take to be able to come to terms with this problem in the best possible way. Following these steps, you can help to minimize the havoc that can be wreaked on your finances and home life by missed mortgage payments.

Looking for a new mortgage with low interest and affordable payments? Click Here!

If you find yourself in this unfortunate predicament, the most important thing you can do is call your lender and talk with them right away. It’s important to open the lines of communication between you and your lender before things move too far along.

Steps to Take When You Can’t Make Your Mortgage Payment

Chances are that you know you will have a difficult time making your mortgage payment in advance of the time it is due. By taking charge of the situation before it moves too far along, you will experience a greater sense of control over the following events. Many homeowners struggle to identify which steps they should take first when they know they are going to miss a mortgage payment.

These guidelines should help to simplify the situation and give you a clearly-defined path for how to proceed.

Make Some Phone Calls

In order to move forward productively, you’re going to need to open the lines of communication with several important people. First and foremost, you are going to need to set aside a few hours to make some phone calls to the most pressing agencies. This can help you to make a more solid plan moving forward and possibly help you to find a solution to your missed payment.

Call Your Mortgage Provider

The first person you need to call is the company who is expecting your mortgage payment at the beginning of the month – your mortgage provider. Some people have a difficult time tracing the appropriate phone number and contact information when they’re already overwhelmed by this situation and having trouble paying their mortgage. However, it should be fairly easy to find listed on your monthly loan statement.

Before you call, you should have a plan of what you need to say and do once you reach a representative.

Outline a plan for explaining why you can’t make the mortgage payment in the first place. Structure your explanation in a way that is clear and makes sense to explain to an outside person. If you need to, it may be helpful to make some notes to keep in front of you during your conversation. For many people, this is an extremely emotional subject, and it can be difficult for them to think clearly when discussing it.

Be sure to tell your lender whether this is a temporary or permanent problem. You may need to figure out the answer to this question yourself. Is this an issue that will be resolved in a few months or is it unlikely to ever reach a conclusion and you will continue to have trouble paying the mortgage?

You should also have details about your income, expenses, and other assets available when you call. This can help your mortgage representative to gain a clearer picture of why you are unable to make your mortgage payment, as well as to potentially make recommendations that would enable you to come up with the necessary funds for the monthly payment.

If you’re in the military, you should also mention any permanent change of station (PCS) orders you may have received. These orders are issued when you will be permanently moving to another station with no intention or timeline on returning to your current location. This could factor into the best decision you can make regarding the mortgage right now.

The first phone call you have to make regarding your inability to pay is likely to be the most difficult one you will face. It is extremely important to make this as soon as possible before you do anything else. Once you’ve made this phone call, it’s time to make a second call.

Contact a HUD-Approved Housing Counselor for Help

You can receive free or low-cost advice from a HUD-approved housing counselor in almost every area in the country. These professionals are available to help with a wide range of issues, including purchasing or renting a home, defaulting on a loan, foreclosure avoidance, credit issues, and more. However, they can definitely help you to come up with a plan regarding your current situation.

You can receive free or low-cost advice from a HUD-approved housing counselor in almost every area in the country. These professionals are available to help with a wide range of issues, including purchasing or renting a home, defaulting on a loan, foreclosure avoidance, credit issues, and more. However, they can definitely help you to come up with a plan regarding your current situation.

Their foreclosure prevention and homeless counseling services are always free through the program. You should never expect to pay a dime for these services.

You can find a list of all available foreclosure avoidance counselors here or call their 24-hour helpline at 1 (888) 995-HOPE for free.

In addition to offering you some sound advice on ways you could perhaps manage your finances to make room for the mortgage payments, they can also help you to connect with important programs. For example, the United States Treasury Department and the Department of Housing and Urban Development both offer a number of programs to help homeowners who may be facing foreclosure.

Because of the Homeowner Affordability and Stability Plan (HASP), you may be eligible for one of their Making Home Affordable programs. This detailed program allows for loan modifications, refinancing, and other tools that can reduce monthly payments and allow you to remain in your home.

If you have not yet reached the point of facing foreclosure, it could still be beneficial to reach out to the HUD-approved counselors to see their recommendations. A considerable financial strain on a monthly basis may be an indicator that foreclosure is on the horizon in months or years to come.

These programs could help you to avoid foreclosure if you feel like this problem may be imminent. The right counselor may be able to offer you a solution that would help your family to reach firmer financial footing.

Trouble Paying Your Mortgage? Know Your Options

If you can’t make your mortgage payments, there could be several different methods for you to reach a conclusion with your lender. Each of these has advantages and disadvantages that you will want to weigh extremely carefully before you select one specific plan. Educating yourself in the present gives you the best opportunity to make wise long-term decisions in the immediate moment.

Refinance

Refinancing your home is a way to start a new mortgage on the property with the end goal being lower monthly payments or a reduced interest rate. This is not always an option for individuals who may be facing foreclosure, particularly if your credit score is already leaning toward abysmal. However, you may qualify for a special type of refinancing through the HASP program.

Pros

The new loan you would obtain for the property can be used to cover the cost of the home as well as any missed payments. This is a quick and easy way to repair the damage done by missed mortgage payments without moving into the extremes of relinquishing your property. Perhaps the biggest advantage of refinancing the loan would be that you can remain in the home for years to come.

When you refinance your loan, you may even find that you’re getting a great deal. A lower interest rate on the current market could make for lower payments in addition to any other modifications made to the new financing. Hopefully, these modifications would allow you to meet the monthly payments with greater ease.

Cons

If you’re already behind on your mortgage payments, refinancing may not be a real option for you. Lenders tend to hold prospective applicants up to the same standards for a refinance as they would for a new mortgage. This typically entails a good to excellent credit score unless your lender is skilled at working with individuals who have poor credit. Your credit score may limit your approval for this process.

Loan Modification

In some circumstances, your lender may be able to change some of the terms of your mortgage agreement to grant you a more affordable monthly payment. These modifications are permanent and will make alterations to the original terms of the loan such as your payment amount, the length of your loan, your interest rate, and other essential details.

Pros

A loan modification gives you a new opportunity on your current home. Instead of facing foreclosure, you can resolve your outstanding debt to the lender and lower your monthly payments in one fell swoop. This is less damaging to your credit score as well.

The other major benefit to loan modification is that the arrangement is permanent. This should allow you to make your mortgage payments more easily well into the foreseeable future. With this security under your belt, you may be able to make smarter financial decisions that will have a positive impact on the rest of your budget.

Cons

As you may imagine, a loan modification does require some amount of paperwork and processing. These items come with a cost as you move toward what could essentially be a “new” mortgage. These fees may be due to the lender upfront or they may be added to the principal balance of the loan.

Repayment Plan

A repayment plan is pretty much exactly what it sounds like it is – a plan to pay back your lender over a specified period of time for the missed mortgage payments, late fees, and any other costs incurred during your time of financial hardship. The repayment amount will be added to your current mortgage payment instead of being due all at one time. This keeps homeowners from feeling quite so overwhelmed by the debts they racked up over the past several months.

This is an option for homeowners who faced only a temporary financial hardship that rendered them unable to pay their mortgage. If your hardship hasn’t resolved itself or you don’t think that will be possible, a repayment plan is not for you.

Pros

Like loan modification and refinancing, a repayment plan is less damaging your credit score than a foreclosure. There will still be blemishes from where you missed payments that can cause significant damage to your credit score, but it won’t be as substantial as losing the home altogether would be.

A repayment plan allows you to remain in your home and to catch up on your debt over a reasonable period of time. It’s a great way to divide up one large bill into manageable pieces without losing your home.

Cons

This will not work if your financial challenges are the result of a permanent change. For example, major medical conditions may still affect your monthly income with no end in sight. By the time you are able to regain control of your money each month, the home may have already moved into the foreclosure process.

You may have also accumulated too much debt to reasonably increase your mortgage payment to cover the costs. It may land you back on shaky ground while trying to make the newly exaggerated monthly payments.

Mortgage Forbearance

If you can’t pay your mortgage on a temporary basis, you may be able to enter into what is known as forbearance. This means that you and lender are coming to a mutual agreement to either halt your current mortgage payments or to reduce the monthly amount for a specific period of time. Mortgage forbearance could be an extremely beneficial option if you and your lender are able to come to terms with an agreement.

The details regarding mortgage forbearance are completely unique to each situation, lender, and homeowner. The length of time the forbearance will last can vary drastically, as can the specific terms regarding reduced or suspended payments. Homeowners will be responsible for making the suspended payments when the mortgage is reinstated.

It could be due all in one sum at reinstatement or spread out via a repayment plan. Alternatively, these suspended payments could be added onto the principal of the loan for a loan modification.

Pros

By temporarily taking a break from your mortgage payments, you’ll have the opportunity to get back on your feet financially. The extra money each month could help you to resolve the immediate financial crisis before your home moves into foreclosure. This option is relatively simple and allows you to keep your home without doing significant damage to your credit score.

Cons

Much like loan modification, mortgage forbearance isn’t going to be an option if your issue is permanent. It can only be offered to homeowners who need assistance on a temporary basis. Eventually, the lender is going to want the money that they loaned you for the property. You may still have a challenge ahead of you when the payments are reinstated.

Following mortgage forbearance, many homeowners have a difficult time readjusting to the new mortgage payments or making the one lump sum payment required for reinstatement. Either option can put you in a major financial bind that will require sacrifice in other areas of your life.

Short-Sell Your Home

A short sale is the stage directly before a foreclosure where you may sell your property for a sum less than the remaining balance of the mortgage. The lender must agree to this type of sale to pay off all or a major portion of your principal balance. When considering a short sale, you should be positive that there are no better options available to help you with your current financial hardship.

A short sale is the stage directly before a foreclosure where you may sell your property for a sum less than the remaining balance of the mortgage. The lender must agree to this type of sale to pay off all or a major portion of your principal balance. When considering a short sale, you should be positive that there are no better options available to help you with your current financial hardship.

During the short sale process, you will work closely with a real estate agent to market and sell your home. However, your lender will also be actively involved in the pending transaction by helping to set the sales price, reviewing offers, and working with the new mortgage company during the closing process.

This is a scenario best reserved for those facing an extremely long-term financial difficulty that would make it nearly impossible to make payments at any point in the near future. You should be prepared and ready to move on from this home as soon as possible if you are considering a short sale.

Pros

A short sale is still easier on your credit than a foreclosure would be and may be the best option if you weren’t eligible for loan modification or refinancing. Credit scores are not quite as negatively affected by a short sale which means you will have an easier time qualifying to purchase a new home in the future.

Some individuals and families may even qualify for $3,000 in relocation assistance to help you get started in a new residence. This money could be used to cover the costs of a security deposit, first month’s rent, a moving truck, boxes, and any other miscellaneous fees associated with changing residence.

Cons

While it is better for your credit than a foreclosure, a short sale will still have a negative effect on your credit score. You will not be eligible to purchase a new home for at least two years.

Some homeowners are also required to make some sort of financial contribution to the short sale. This may be particularly true if you will be selling the home for less than what is owed on the current mortgage.

In a constantly fluctuating real estate market, housing prices have left some homeowners underwater on their current loan (meaning they owe more than the house is worth according to current fair market values). Talk with your lender about the specific parameters surrounding any unresolved debt that may result from a short sale.

Deed-in-Lieu of Foreclosure

A deed-in-lieu of foreclosure (sometimes abbreviated as DIL or referred to as a mortgage release) gives you the opportunity to voluntarily surrender your rights to the property back to your lender. The exchange helps to absolve you of the current mortgage on the property, potentially releasing you from the debt and outstanding payments. The release from mortgage payments and outstanding debt isn’t necessarily a guarantee.

A deed-in-lieu of foreclosure (sometimes abbreviated as DIL or referred to as a mortgage release) gives you the opportunity to voluntarily surrender your rights to the property back to your lender. The exchange helps to absolve you of the current mortgage on the property, potentially releasing you from the debt and outstanding payments. The release from mortgage payments and outstanding debt isn’t necessarily a guarantee.

In some cases, you may be asked to leave immediately while others may be able to work out an arrangement to stay in the home for up to a year while leasing it.

If you aren’t able to sell your home in a short sale or receive any of the other accommodations from your lender, a deed-in-lieu of foreclosure may be your next best option.

Pros

The benefits of handing ownership back to the mortgage company are relatively few, apart from the obvious advantages of not allowing the home to move into complete foreclosure. Your credit will not be as damaged by a deed-in-lieu of foreclosure, and you can begin work to repair it immediately. Similar to a short sale, you could purchase a new home in as few as two years from the time the DIL is finished.

The other major benefit is the flexibility afforded to homeowners or tenants in terms of their departure. You may be able to or want to leave the property immediately after handing your rights back over. However, other families need three months or so to prepare for a major move. Depending on the agreement worked out with your lender, you may be able to live in the space rent free for a few months while attempting to make new arrangements.

Some homeowners may be eligible for relocation assistance to ease the financial burden of moving. This could range up to $10,000 in some states.

Cons

Opting for a deed-in-lieu of foreclosure is a more extreme option than many of the choices listed here. This does force you to move on from the property and start to make a new home elsewhere. It should also be noted that a DIL will have a detrimental effect on your monthly payments.

Bankruptcy

Filing for bankruptcy is a last resort for any individual or family. This status legally means that you are claiming to be unable to pay your current debts. The process begins by measuring your assets and income to determine the best way to proceed with paying your outstanding debts. Bankruptcy could ensue after a short sale fails to produce any meaningful results, particularly if the homeowner has more debt than simply their mortgage.

There are two primary types of bankruptcy, referred to as Chapter 7 Bankruptcy and Chapter 13 Bankruptcy. A Chapter 7 Bankruptcy will allow you to pay off your debts by leveraging all of your assets, including the home. When you finish selling assets that are non-exempt (such as homes, vehicles, stocks, valuable collections, etc.), the remaining unsecured debt is erased and you may start anew.

In a Chapter 13 Bankruptcy, individuals have an opportunity to repay their debts under longer-term repayment plans and may be able to keep the home. You should be prepared to propose a realistic repayment plan that can be spread out over a number of years (typically around five).

A Chapter 7 Bankruptcy may force your home into foreclosure.

Take a look at our What You Should Know About Mortgages After Bankruptcy here.

Pros

There aren’t many advantages to filing for bankruptcy other than the possibility of being released from an often overwhelming burden of debt. If you’ve been feeling crushed by the weight of what you owe to creditors, it may be a relief to finally be out from under their thumb and start to rebuild your financial status once more.

A Chapter 13 Bankruptcy does at least grant you the opportunity to keep your home if that’s what you desire to do. Unfortunately, most individuals find that this isn’t possible by the time they reach this stage. In order to make up for the missed payments, the monthly amount tends to be in excess of what they are able to pay. After all, you would now be responsible for paying your original mortgage payment and any repayment amounts scheduled by the lender.

When bankruptcy is filed, you may receive a court order for an automatic stay that provides some immediate relief. This could allow you to stay in the home for three to four months while the legal processes take place. Meanwhile, you can rest in peace without the harassing phone calls, visits, and bills in the mail from your creditors. For you, this may be a welcome respite from the chaos of creditors.

Cons

Bankruptcy has a serious effect on the state of your credit, causing it to drastically nosedive in a no time at all. Your credit score may already be abysmal after missing so many payments and incurring other debts apart from your mortgage. However, a good credit score will take a serious hit before all is said and done.

Not only does it have an immediate impact on your credit, but the effects are long-lasting. Credit reports will keep a history of your bankruptcy information for seven to ten years.

The other major disadvantage to filing for bankruptcy is that your home is likely to move into foreclosure. Unlike a short sale or a deed-in-lieu of foreclosure that would allow you to purchase a new home in just two years, buyers will have to wait seven years to achieve the status of being eligible for another purchase again.

Be Wary of Scams!

Is someone promising that they can help you to save your home but it just sounds too good to be true? There’s truth in the old adage that if something sounds too good to be true, it probably isn’t true at all. Consumers who are in such a vulnerable position need to take care to make sure that they don’t fall prey to scams.

Many companies will make big promises about what they can offer desperate homeowners who can’t pay their mortgage. At first glance, they sound like excellent offers to help you out of this sticky situation and put you back in the black. They may make promises to speed up your process, stop foreclosures, and more. How can you spot one of these scams and tell it apart from a legitimate offer for help when you can’t pay your mortgage?

The first thing you need to aware of is that no company can charge fees to a homeowner in this predicament until they have received a relief offer them from their lender that they choose to accept. This is a rule put in place by the Federal Trade Commission to help protect consumers, and it is known as the Mortgage Assistance Relief Services Rule. Under this rule, you don’t even have to pay the financing company if you choose not to accept the offer from the lender.

If you’re asked to pay anything upfront, be aware that it is a scam immediately.

Another prominent scam comes from companies or individuals who offer to purchase your home. They may propose an elaborate scheme where you can sell them the home at a significantly lower price but continue to live there in a rent-to-own scenario. As time passes, they may stop making payments on the mortgage or raise the rent to astronomical rates that are no longer affordable.

In both scenarios, you end up evicted from the home in an even worse financial bind than you were prior to the “help” they offered.

Anytime you are asked to sign paperwork in relation to your mortgage or assistance with your mortgage, be sure to read each and every detail thoroughly. Scam artists are notorious for placing hidden documents and key line items in this pile of paperwork that may force you into surrendering the title to your home.

Real companies who are focused on helping you instead of scamming you in an already precarious financial situation are required to disclose certain information to you upfront. Be wary of any company that offers assistance to homeowners potentially facing foreclosure without telling you these things:

They are not associated with a government program and are not approved by the government or your lender.

The lender reserves the right not to change your loan.

If they advise you to forego making mortgage payments, they must also tell you that this could result in foreclosure (losing your home) and severely damage your credit.

They may not tell you not to contact your lender.

Hiring an Attorney

The exception to all of these rules is when you hire an attorney to help you with the loan. There are some circumstances where lawyers are uniquely trained to serve homeowners who can’t pay their mortgage. You must be careful who you accept help from in this case and be sure to do your homework.

Attorneys are allowed to ask for money upfront if they are licensed in your state, are providing legal services, and are complying with ethics requirements. However, they must place the funds in a client trust account, only taking money out when real legal services have been rendered. As the client, you must be notified each time a draw is made from the trust.

Because you may have to pay some type of fee to an attorney upfront, you need to be cautious about the services they provide. The best thing to do first is to check on their license status to ensure that they are a legitimate attorney and to see if they have faced trouble for their actions in the past. All you need to do is obtain their license number and check with the state bar for more information.

If you suspect that a company or attorney offering you help is fraudulent, you need to report it to protect other homeowners who may be unaware. You may report it to the Federal Trade Commission, the state Attorney General’s office, or the Better Business Bureau.

What Happens When I Cannot Make My Payment?

Eventually, there will be long-term and serious consequences for missing your monthly mortgage payments. Contacting your lender upfront when you know that a missed payment is imminent can help them to consider offering advantageous programs that allow you to keep your home, maintain your credit, and offer relief from your financial hardship. However, it isn’t necessarily a guarantee that you will qualify for any of these programs.

If you miss too many mortgage payments, the home will eventually move into foreclosure. The specifics regarding when and how the lender can proceed with the foreclosure process will vary by state and individual circumstances. You should be aware that lenders have the right begin the paperwork for a foreclosure as soon as sixty days following the missed payment.

Before the foreclosure takes place, you should receive a notice of default. This short letter may put you on notice that you are behind in your monthly payments and need to repay the lender. You will have a set period of time in which the reparations can be made, along with any outstanding late fees, interest charges, and other costs.

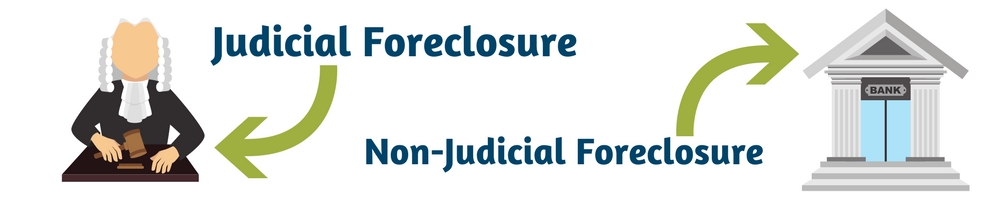

Once these items have been addressed with the property owner, the lender will wait until the appropriate amount of time passes per the notice of default. Then the lender can begin to pursue one of two options based on state laws: judicial or non-judicial foreclosure.

A judicial foreclosure is a supervised court hearing with formal legal proceedings. In essence, this means that you will be facing a civil lawsuit. On the other hand, a non-judicial foreclosure means that the process will not be overseen by the court.

From here, the bank will attempt to regain its initial investment by selling the property to recoup those costs. You will receive a legal notice of the foreclosure and typically find it published in the local newspaper as well. The home itself will be sold at a public auction to the highest bidder. Alternatively, the bank may purchase the property for resale at a later date.

If the lender pursues a judicial foreclosure, you will receive notice of the foreclosure and the judge will set the date of the sale.

You will have very little control over when you have to leave the home and are no longer eligible for the relocation assistance found with short sales and deed-in-lieu of foreclosures. There is no flexibility when it comes to the opportunity to remain in the home for months following the notice of foreclosure. You will have to have an immediate plan of where you and your family will relocate to.

If you want to purchase a home again in the future, you may have a much more difficult time doing so with a foreclosure on your record. There could be a waiting period of up to seven years before you can receive traditional mortgage financing once more.

Do you still owe anything on the house if they take it from you?

A foreclosure is never in your best interest. You are still responsible for all of the outstanding debt from this first mortgage, whereas you could have eliminated some of it with a short sale or a deed-in-lieu of foreclosure. When might this come into play?

Many homeowners are considered to be underwater on their current mortgage, which means they owe more than the house is worth. As a result, the lender may not receive the full value of the outstanding debt when the house sells at the public auction. Any balance remaining on the first mortgages from these “underwater” properties will be the responsibility of the owner to repay.

The court could enter a deficiency judgment against the property owner so that the lender can pursue any other valuable assets that could offset the remaining balance.

The exception to this is if the homeowner had insurance that would protect them in the event of a foreclosure. This insurance, known as private mortgage insurance, can help to cover the cost of any outstanding debts remaining on the first mortgage.

If you file for bankruptcy either before or directly following the foreclosure, you may be relieved from the outstanding debt on the first mortgage.

Trouble Paying the Mortgage Conclusion

Your best option when you can’t pay your mortgage is to take action early in the process. This gives you the most choices and the least consequences when you compare all of the potential outcomes. By prolonging the inevitable or attempting to ignore the problem, you will only make your current situation worse.

Take action today by contacting your lender or a HUD-approved housing counselor to see what options are available to you. All you have to do is pick up the phone and know what options your options are.

By preparing yourself for what the possibilities are, you can take the steps you need to take in order to be in complete control over the next stages of this process. Whether your financial hardship is temporary or permanent, there can be a reasonable solution that gives you the best possible advantage when moving forward.

FAQs

What is forbearance?

Forbearance is a mutual agreement entered into between the homeowner and the lender to either reduce or suspend mortgage payments for a set period of time. Upon their reinstatement, homeowners will still be responsible for those missed payments. The extra money may be added to the monthly mortgage payment over the coming months in a repayment plan or paid upfront for a reinstatement.

How does mortgage forbearance affect your credit?

A mortgage forbearance will have a negative impact on your overall credit score. It demonstrates that you were unable to make the loan payments and will show missed payments on your credit report. As a result, it will lower your score.

How does short-selling your home work?

A short sale is much like any other type of real estate transaction. You will partner closely with a real estate sales professional to market your home, show it to potential buyers, and sell the property. In a short sale, the mortgage company will also be actively involved in this process by setting the sales price, reviewing any submitted offers, agreeing to the terms of a sale, and working with the buyer to finalize things.

Eligible homeowners may receive relocation assistance following a short sale to help minimize the impact of moving their primary residence.

What is a deed-in-lieu of foreclosure?

A deed-in-lieu of foreclosure is when the homeowner hands the lender ownership of the property. The homeowner is then absolved of their debt and released from the monthly payments. You may be eligible to receive a relocation incentive, remain in the home rent-free for three months, or lease the property from the lender for up to one year.

How do I get a loan modification?

In order to get a modification to your current mortgage, you will need to talk to your lender. Be sure to share all of the pertinent details regarding why you believe a loan modification would be in your best interest and theirs. You may need to share your current mortgage information, debts, assets, income, and explain your current situation that is making mortgage payments difficult for you.

Can you skip a mortgage payment?

No, you cannot skip a mortgage payment. While you may forego paying your mortgage one month, you will ultimately still be responsible for paying off that bill. You will receive a notice of default and an expected timeframe in which the payment and late fees must be received to prevent foreclosure.

How many missed mortgage payments can I have before foreclosure?

The specific requirements for foreclosure vary by state, but some lenders can begin the foreclosure process in as few as sixty days.

I lost my job and can’t pay my mortgage. What can I do?

The best thing you can if you need short-term assistance with paying your mortgage is to reach out to your lender. They may be able to offer a repayment plan, temporary loan modification, or mortgage forbearance until you reach a stronger financial state once again.

I can’t pay my mortgage. What are my options?

You have a few basic options other than foreclosure when you realize that you can no longer pay your mortgage. These options include:

- Refinancing

- Loan modification

- Repayment plan

- Forbearance

- Short sale

- Deed-in-lieu of foreclosure

- Bankruptcy

Do you get to skip a payment when you refinance?

No, you do not get to skip a payment when you refinance. You may go one month without paying your mortgage during the transition between your first mortgage and the new refinance. However, that month’s payment is added to the end of your loan, effectively extending the new mortgage by one additional month.

Can I lower my mortgage payment without refinancing?

Yes, there are other ways to lower your monthly mortgage payments without moving through the refinancing process. For example, you may be able to eliminate your private mortgage insurance or extend the loan term for several more years. Talk with your lender about what options may be available to lower your monthly payments without refinancing.

Resources

If I Can’t Pay My Mortgage, What Are My Options?

Talking to a Housing Counselor

Six Things You Can Do to Avoid a Maltortgage Mis-Modification

Federal and State Agencies Stop Paying Phony Mortgage Relief Schemes

Mortgage Relief Scams