Having bad credit can make buying a home seem like an impossibility. Many lenders and banks will look at bad credit, and be hesitant to approve that individual for a mortgage.

Fortunately, there are programs in Missouri that can help those with bad credit acquire a mortgage. Today we’ll look at bad credit home loans in Missouri, and the different programs to achieve the dream of homeownership!

Bad Credit Home Loans Missouri

If you’re living in Missouri, you have several options when comes to applying for a mortgage with bad credit.

Get Help Pre Qualifying for a Missouri Bad Credit Home Loan – Click Here!

These programs range from federal initiatives like the FHA, down to state, local, and non-profit programs that can also assist in the home buying process.

Not everyone will be eligible for every single one though, so it’s important to do a bit of research beforehand to learn what options are available to you and in the area you’re looking to purchase a home.

FHA Loan

One of the most well known programs for low credit buyers is the FHA loan. This is available nationwide, and is a government backed loan that lessens the risk for the lender.

Due to the fact that the government guarantees a portion of the loan in the case of a default, the lender can be a little less strict about who is able to be accepted.

The loan itself generally requires a credit rating of 580 to get the best down payment options.

With a score at or above this number, you’ll be able to secure a loan for a down payment as little as 3.5%. This is significantly less than the standard 20% for conventional mortgages.

For those below 580 though, there are still options for you. FHA loans can be approved for individuals with a credit score as low as 500, but they will need to come to the table with a 10% down payment to compensate.

This opens the doors to a much larger range of buyers.

There are also some additional requirements on this loan such as a required property inspection, and these can sometimes slow down the process.

That said, this program is fantastic for low credit buyers as they can still be approved with the correct down payment. Also, being nationwide and not exclusive to a specific group makes it one of the most accessible options as well.

VA Loan

Next is the VA loan which is available exclusively to veterans. Much like the FHA loan, this one too is backed by the government, which in turn lessens the risk for lenders. This makes it accessible to a wide range of bad credit and no credit individuals.

For bad credit borrowers, it also doesn’t have a set credit score requirement. While having a better credit score is going to make finding a lender and getting good term easier, even poor credit borrowers will be able to utilize this program.

It also can be acquired for no down payment in some cases, making it excellent for many without the means to source a large savings easily.

The major drawback of course is that the loan program is only eligible to those who have served in the armed forces. This will automatically exclude a large number of individuals.

For those however that are eligible, this is an excellent program to take advantage of, and a great bad credit home loan in Missouri option.

USDA

For those looking for a rural home in Missouri USDA loans are a great option. USDA loans are other government backed program, and are part of a program that encourages people to move to rural parts of the country.

While these loans typically require a credit score of 640+, it’s still possible for a lower score individual to secure one.

Those with less than 640 will have to go through a manual underwriting process, a process that involves a real human being reviewing and making a decision on the loan.

While this can slow the process down, it can also work in your favor as human can take into account all the unique circumstances and make a fair decision.

State and Local Programs

In addition to the popular federal programs, there are also a number of local state, county, and city programs that are available too. These cover a wide range of situations, and there are a large number of them nationwide.

Not everyone will qualify for all of these, for example some are only for first time home buyers while others are only for teachers.

The idea is to do a bit of research to learn which programs are available in your area, as well as which programs you’re individual situation allows you to be eligible for.

Many of these programs provide support such as down payment assistance, which can really help a low credit borrower less risky for a lender. Here’s a couple examples that are available in various parts of Missouri.

Community Action Agency of St.Louis County

The CAASTLC is a program that cover the St.Louis county as well as a number of other nearby cities and counties that provides a number of services to low income and bad credit borrowers in missouri looking to purchase a home.

The program itself offers down payment assistance, as well as counseling that can help to rebuild low credit scores.

In order to qualify for assistance, all individuals must complete a home buyers education and one on counseling.

This not only provides useful information on the home buying process and saving, but also can help you improve your credit score.

During their “financial fitness” curriculum, MO residents will work on improving their financial standing. This benefit is two fold, both helping improve your credit score and providing financial assistance.

For those that qualify with low credit and income, and moving to a qualified Missouri county, this program is a great way to get on the right track. It’s an excellent option for to securing a mortgage with bad credit in Missouri.

Teacher Next Door

Another example of a great state program for getting a bad credit home loan in Missouri is the teacher next door program. This program provides down payment assistance, closing cost assistance, and grants to teachers moving to the state of Missouri.

In addition to the upfront financial assistance, the program also offers special rates as well as waiving many standard fees.

This makes loans much easier to get as they are able to work with you to not only find the right terms, but also may provide you with a monetary sum to help offset the risk.

While this particular program is available for teachers, there are also other programs available for first responders such as firefighters and police offers. These programs are similar in providing very financial and educational services for those that qualify.

These types of services are available all over Missouri, and can potentially save a buyer thousands while also making them more attractive to lenders.

Other Factors To Compensate

One thing all of the above options have in common is that they bring more to the table to compensate for a poor credit score. While a credit score is important, it’s not the only thing the bank looks for when approving a mortgage application.

By improving others aspects of your finances, you can potentially offset some of the problems a bad credit score brings with it. Here are some points to keep in mind when evaluating loan and program options, all of which can help secure a loan with poor credit.

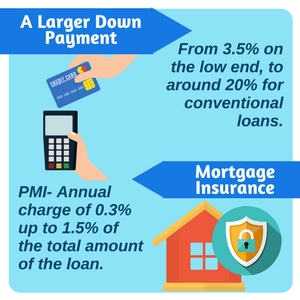

A Larger Down Payment

Lenders are always looking to reduce risk, and by coming with a larger down payment you do just that. A low credit score is risky, so coming with a larger down payment helps to lessen that risk. In the case of a default, the more money the bank takes upfront the better off they will be.

Down payments range from 3.5% on the low end, to around 20% for conventional loans. Depending on which type of loan you plan on applying for keep the minimum in mind as you’ll need to go above and beyond this.

Mortgage Insurance

Another important thing to keep in mind that many bad credit loans will come with is private mortgage insurance or PMI. PMI is an additional fee required by the bank to help offset the risk of a bad credit or low down payment mortgage.

PMI is typically an annual charge of 0.3% up to 1.5% of the total amount of the loan. While having PMI can help make the loan less risky for the lender, it’s very important to understand the cost from the buyers side. Even though it’s typically less than 2%, even that on a several hundred thousand dollar loan can mean several hundreds of dollars in extra payments per month.

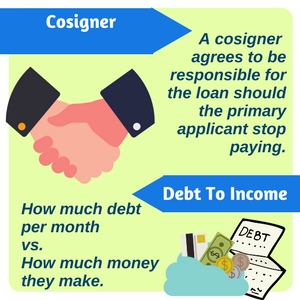

Cosigner

Another great option for securing a bad credit home loan in Missouri is to work with a cosigner. A cosigner is another party that agrees to be responsible for the loan should the primary applicant stop paying.

During the process, the lender will look at both the applicants and the cosigner’s credit and take both into account. If the cosigner has good credit, they can significantly offset a poorer score from the primary applicant.

As they are agreeing to be responsible for the loan, the lender considers their good score as less of a risk on their end.

It’s important to keep in mind that being a cosigner is a big responsibility. They’re basically on hook for the mortgage, and any missed or late payments will impact their credit as well. For these reasons, they are often family or close, long time friends.

Debt To Income

Another important factor lenders consider is the borrower’s debt to income ratio. This is a measure of how much debt an individual pays per month versus how much money they make. Obviously, the lower this is the better.

Lenders generally look for a debt to income ratio of less than 43%. Any higher than this and the loan starts to become too risky. If you have bad credit, work to lower your debt obligations and bring your debt to income ratio down. This can help to offset the bad credit as it will show the ability to make payments in event of emergencies and other unexpected expense.

What’s a Good Credit Score For Buying a Home In Missouri?

Your credit score is a measurement of your financial history presented in one number. Scores range from 350 on the low side up to 850 for excellent credit. There’s also three different agencies that report on credit, and each one may report their scores a bit different. Keep this in mind as even a few point difference can have an effect on the interest rate the bank will give you.

For conventional loans, most lenders are looking for credit scores of 620+. Borrowers above this range are generally of an acceptable risk level, and banks feel comfortable borrowing to them. If you’re below this though it’s not the end of the world. There are many programs for those with lower scores, and it’s always possible to rebuild your score.

Bad Credit Home Loans Missouri

Having bad credit can make getting approved for a mortgage more difficult, but certainly not impossible. There are a large number of programs that help Missouri residents become homeowners with bad or no credit. Don’t let a bad history with credit stop you from achieving your dream of home ownership!

FAQ

What’s Considered a Good Credit Score For Buying a Home?

Most lenders will look for a score of 620+ as a minimum. Higher is always better though, and being above this can mean better rates and less money spent. If you’re under this though there are still a lot of good options, there are lots of loan programs to help poor credit borrowers become homeowners.

Can I still buy a home with a bad credit score!

Yes! There are lots of programs that help bad credit borrowers become homeowners. For example, FHA loans only require a credit score of 500, a full 120 points lower than most conventional loans. This is just one example of a bad credit loan.

What Options Do I have For Bad Credit Home Loans In Missouri?

In addition to the many federal programs, Missouri also has some programs specific to the state. This includes CAASTLC which provides educational and down payment assistance as well as teacher next door which provides grants and financial assistance to teachers. These are just two examples of such programs; there are a ton more so make sure to see what’s available in your area.