Teaching is a hard job, one that definitely doesn’t get the respect it deserves in this country. Long hours, time after work grading papers, dealing with troublesome students. And all for an insultingly low pay grade.

With the job’s high stress and low income, we’re seeing more and more teachers giving up on buying a home and turning to apartments or rental properties instead. But it doesn’t have to be that way, and today we’re going to show you how to find Indiana home loans for teachers.

Get Help Pre Qualifying for an STATE Low Credit Home Loan – Click Here!

We’ll start by covering some of the best Indiana home loans for teachers – mortgages that you can apply to and get accepted for no matter what your income, credit, or work-life balance looks like.

Then we’ll go over some of the other assistance that Indiana teachers can receive from their state, local, and federal governments.

Using these resources, finding Indiana home loans for teachers should be a snap!

Indiana Home Loans For Teachers

The most common Indiana home loan for teachers available is what’s most commonly known as a “conventional mortgage.” Per the usual guidelines on this kind of home loan, a conventional mortgage usually requires you to pay 20 percent of the total value of the home as an up front down payment.

Moreover, your application for a conventional mortgage is usually only accepted if you have a credit score of 660-700 or higher and a 40 percent debt-to-income ratio.

Even if you’re an Indiana ana teacher with good credit and few debts, it’s often difficult for those living on a teacher’s salary to save up the thousands of dollars required for the down payment.

And if you’re reading articles like this one, we assume that you’ve already considered the conventional mortgage option and are looking for something that’s more affordable, more accessible, or which simply offers a better interest rate.

With that in mind, here are a few Indiana home loans for teachers that might better suit your needs:

No down payment home loans in Indiana for teachers

Sadly, the only no down payment home loans in Indiana for teachers are those insured by the Department of Veterans’ Affairs.

VA loans offer great terms and are extremely affordable, but they’re only available to current or former members of the armed services who have served long enough to earn their Certificate of Eligibility.

This means that they are not available for many Indiana teachers.

However, if you are a teacher who previously served in the military, you should definitely apply for this excellent program.

VA loans are easier to apply for than conventional mortgages because they have expanded income eligibility and no minimum credit requirements (though many lenders may require a minimum credit score of 500-580 depending on a number of factors.)

They’re a lot cheaper, too, because they have low interest rates, no private mortgage insurance payments, limited closing costs, and (as you can probably guess from their inclusion in this section) no required down payment.

If you’re not a veteran and you’re concerned about making the down payment, you might consider the FHA and USDA programs that offer Indiana home loans for teachers, or you may need to apply for down payment assistance.

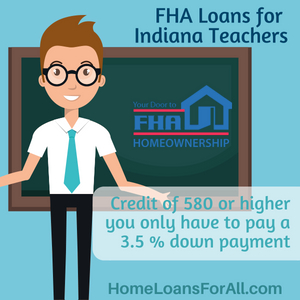

FHA home loans in IN for teachers

FHA loans operate in a similar manner to VA Indiana home loans for teachers. In both cases, a portion of the mortgage is insured by the federal government, which reduces the risk for lenders, which in turn means that lenders are willing to lower their requirements for these sorts of loans.

The difference is that FHA home loans are insured by the Federal Housing Administration, not the Department of Veterans’ Affairs, so they’re available to anyone who applies for them! FHA loans only require a debt-to-income ratio and a credit score of 500 or higher.

In some cases, you might even be able to get away with credit that’s lower than 500 if you can provide alternative forms of credit. Be sure to consult with your local lender to see what loans they’re offering.

FHA loans are also great for Indiana teachers who know they’ll have no problem making weekly payments but who are worried about paying thousands of dollars all at once as part of the initial down payment.

If you have credit of 580 or higher, your down payment on an FHA loan will only be 3.5 percent of the home’s total value! And if your credit score is in the 500 to 579 range, you may still get accepted if you’re willing to make a down payment of up to 10 percent, which is still much cheaper than the closing costs on a conventional home loan for Indiana teachers.

USDA home loans in IN for teachers

USDA home loans are a government insured mortgage offered by the United States Department of Agriculture.

These Indiana home loans for teachers are designed to encourage home buyers to move to rural areas and are also known as “Rural Development Loans.”

In many cases, USDA loans require no down payment at all. Of course, this means that you have to finance 100% of the home and pay it back as monthly payments, but for many Indiana teachers this is more achievable than paying thousands of dollars up front.

USDA loans also have interest rates that are up to 0.40 percent lower than the interest rates on a conventional home loan. They may even be cheaper than FHA mortgages!

The downside of USDA loans is that they’re not particularly accessible, especially to Indiana teachers with bad credit, because they have eligibility requirements that are nearly the same as conventional mortgages. Still, if you’re eligible for this type of loan, you should give it serious consideration!

Down Payment Assistance For Indiana Teachers

If you can’t secure a no down payment home loan in Indiana for teachers, never fear! Down payment assistance programs offered by state and city governments in Indiana can help you make that initial down payment without having to save up thousands of dollars beforehand.

These programs are especially useful for Indiana teachers with bad credit, because bad credit home loans almost always require high down payments to offset the risk of taking on a bad credit buyer.

The best place to start if you’re looking for Indiana down payment assistance for teachers is the Indiana Housing and Community Development Authority. The IHCDA offers a program called “Next Home” that will pay for 3% of the down payment on a conventional mortgage and 4% of the down payment on an FHA mortgage.

Despite what the name sounds like, this program is offered to first time home buyers AND returning home owners alike.

The city of Indianapolis has its own down payment program: the Indianapolis Neighborhood Housing Partnership, or INHP. If you apply for a loan through this organization, they will cover up to $5,000 of the down payment.

Conclusion

With the resources listed in this article, we’re sure that you’ll be able to secure one of these great Indiana home loans for teachers for yourself. We know that the home loan process can be stressful and expensive, and that if you have bad credit or low income it can feel like an impossible dream.

But don’t give up! Everyone deserves to own a permanent place of their own and anyone can make that dream come true in time.