by Mike Plambeck

When you sign up for a new mortgage under the Federal Housing Administration’s program, your loan will be subject to the FHA loan limits.

These limits dictate the maximum amount that a person can borrow while still receiving the backing of the federal government. While some lenders might consider allowing borrowers to seek financing above these FHA loan limits, it puts lenders at a significantly greater risk.

The FHA mortgage program is sponsored by the Federal Housing Administration to make homeownership more accessible to families who need a lower down payment.

The FHA mortgage program is sponsored by the Federal Housing Administration to make homeownership more accessible to families who need a lower down payment.

This agency works with private lenders to offer a sort of “insurance policy” in the event that a borrower defaults on their mortgage.

In order to help them keep these guarantees under control, the FHA sets a maximum amount that they are willing to insure for the lender.

Get Help Pre Qualifying for an FHA Home Loan – Click Here!

How Do FHA County Loan Limits Work?

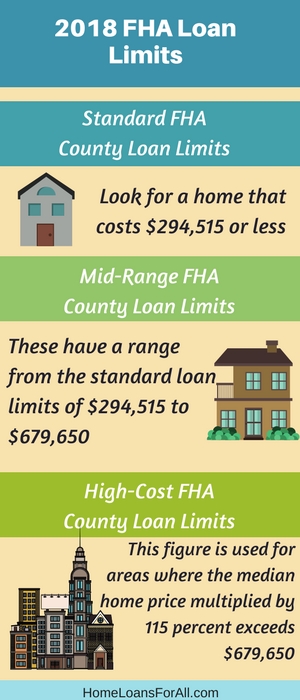

The FHA loan limits are based on the county you live in and the type of home you purchase. Many of the 2020 FHA loan limits also account for the median price of similar real estate in your specific area. The difference in FHA loan limits should be good news for families who want to purchase a home in a more expensive area. This means that the ceiling, or the maximum amount that the FHA will insure, is going to be higher than it will be for lower-income areas.

There are four distinct tiers that an area can fall into: the standard tier, the mid-range tier, the high-cost tier, and the special exception tier. Most properties and areas will be subject to the standard tier.

There are four distinct tiers that an area can fall into: the standard tier, the mid-range tier, the high-cost tier, and the special exception tier. Most properties and areas will be subject to the standard tier.

These FHA loan limits don’t describe the maximum loan to value ratio. The loan limits simply state how much the federal government is willing to insure on your loan, meaning the amount you will be financing. You could still purchase a home that exceeds these county loan limits if you make a down payment for the remainder.

Keep in mind that the county loan limits do not guarantee that you will receive lender approval for financing up to this amount. Your specific loan limit will be subject to borrower eligibility after the lender reviews key factors like your gross income, debt to income ratio, credit score, and more. The loan limits exist as a guideline for the maximum amount you could borrow, even though you might not be approved for this amount.

How are the 2020 FHA Loan Limits are Established?

The FHA county loan limits have increased for most of the country, effective in January 2020. As in most things, there is a specific formula used to determine what the loan limits will be in the various sections of the country. You can take a closer look at some of the math behind the 2020 FHA loan limits for each tier below.

Keep in mind that there will be different FHA loan limits for properties that have multiple units. Homeowners are welcome to use this type of financing to purchase a single unit, like a detached single-family home or a condominium. However, they can also purchase properties that will be used to generate a monthly income as long as the owner plans to live in one of the properties.

For example, you might be able to use the FHA mortgage to purchase a duplex or a triplex where at least one other unit would be rented out while you live in the other. You can use the FHA loan to purchase a maximum of four units on a single property, and they will be subject to additional guidelines and criteria before the financing can be approved.

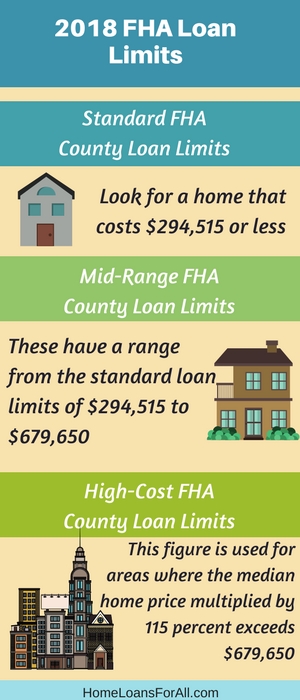

Standard FHA County Loan Limits

The standard limits apply to the majority of the nation, and they are perhaps the easiest standards to understand at a quick glance. The same loan limit will apply for every type of property from a 1-unit to a 4-unit home. Homeowners should expect to look for a home that costs $294,515 or less.

How did this number come to be?

The standard county loan limits are determined based on the “floor” calculation used by the government. They look at the conforming loan limit of $453,100 and take 65 percent of it for these FHA loans.

The standard FHA county loan limits apply in cities that have a lower median home price. Experts calculate which areas should have this standard limit instead of the significantly higher limits from in the other tiers by multiplying the median home price by 115 percent. When the product is less than $294,515, the county falls into the standard tier.

Mid-Range FHA County Loan Limits

The mid-range 2020 FHA loan limits are a little more complicated to determine than the standard tier. These have a range from the standard loan limits of $294,515 to $679,650 for a single unit property. The rest of the ranges are as follows:

- Two-unit property: $294,515 to $870,225

- Three-unit property: $294,515 to $1,051,875

- Four-unit property: $294,515 to $1,307,175

You will find that this limit also has its own mathematical calculation that is based on the floor found in the standard tier and the ceiling found in the high-cost tier. These limits apply to areas where 115 percent of the median home price exceeds $294,515 but still comes in lower than $679,650. Whatever the product of this calculation is, that is the loan limit for that particular county.

There are several of these areas around the nation, but they are not as common as the standard tier. However, you will notice that there are some variations due to the way this figure is calculated.

High-Cost FHA County Loan Limits

The high-cost FHA county loan limits are extremely rare to find. There are fewer than 100 of these across the entire country, with most of them being major cities such as the New York City metro area or Washington, D.C.

The high-cost tier sets the “ceiling” for the FHA loan limits. These are the maximum amounts that the FHA is willing to insure for any area, and they tend to be fairly generous for these more expensive cities. Take a look at what you can expect from the maximums for the different unit sizes:

- One-unit property: $679,650

- Two-unit property: $870,225

- Three-unit property: $1,051,875

- Four-unit property: $1,307,175

These areas are determined by a calculation similar to that for the floor. The ceiling is set by multiplying the conforming loan limit ($453,100) by 115 percent. This figure is used for areas where the median home price multiplied by 115 percent exceeds $679,650.

Special Exceptions

There is one final tier that is very rarely seen for FHA loans unless you live in Hawaii, Alaska, Guam, or the U.S. Virgin Islands. This last tier has significantly higher loan limits, as evidenced by the hard facts below:

- One-unit property: $1,019,475

- Two-unit property: $1,305,325

- Three-unit property: $1,577,800

- Four-unit property: $1,960,750

The construction expenses for these areas are estimated to be much higher than they are in other parts of the country. These higher loan limits are designed to give homeowners a chance to still purchase a home despite the increased cost to build it.

What are the FHA Streamline Refinance Loan Limits?

The FHA streamline refinance loans are not subject to the same loan limits as the purchase of a new property. However, you will have to bear in mind that these refinance loans are only available to homeowners who purchased a property using an FHA loan, to begin with. This means that your initial purchase of the property would have had to comply with the loan limits and standards in your area.

The FHA streamline refinance loans are not subject to the same loan limits as the purchase of a new property. However, you will have to bear in mind that these refinance loans are only available to homeowners who purchased a property using an FHA loan, to begin with. This means that your initial purchase of the property would have had to comply with the loan limits and standards in your area.

If the value of your home has increased, this could be a great way to still take advantage of lower interest rates or to reduce the MIP on your mortgage without being subject to the FHA county loan limits.

In order to refinance your current property, you need to:

- Be current on your payments

- Have no more than one late payment in the last year

- Make at least six payments on the mortgage

- Mortgage payment must reduce by a minimum of 5 percent

All of these requirements must be met in order for the 2020 FHA loan limits not to apply and for their property to exceed the ceiling.

Conclusion

Understanding the FHA loan limits for 2020 makes you more apt to find a property that is better suited to your family’s unique needs. Knowing where the FHA county loan limits come from and how they apply to your area will give you the tools you need to have a talk with your lender about a specific property. Make sure you know what the county loan limits are in your area by searching the FHA website here.

FHA Loan Limits Frequently Asked Questions

Do FHA loan limits include down payment?

No, the FHA loan limits dictate the maximum amount of financing they will insure for a private lender. Your down payment does not contribute toward this amount.

What is the FHA maximum loan to value ratio?

The maximum loan to value ratio (LTV) is 96.5 percent because it requires a minimum down payment of 3.5 percent.

What is the FHA maximum loan amount with MIP?

All FHA loans are subject to MIP. This means that the maximum loan amount with MIP will be the same as the 2020 FHA loan limits for your area.

Does borrower eligibility effect FHA loan limits?

Yes, borrower eligibility may determine the exact amount that your lender is willing to allow you to finance. The FHA loan limits are available to demonstrate the maximum amount you can borrow, but a lender may choose not to issue the full amount based on the borrower’s credit score, debt to income ratio, gross income, and other factors.

Why are the FHA loan limits so low in my county?

The FHA loan limits are based on the median home price in your area.

Are FHA streamline refinance loans subject to loan limits?

No, the streamline refinance loans are not subject to FHA loan limits.

Additional FHA Loan Limits Resources

FHA Mortgage Limits

FHA Loan Requirements in 2018

by Mike Plambeck

Mortgage insurance can be a necessary evil for home buyers who don’t have a substantial down payment for the new property. Even FHA loans require buyers to make these payments, but it can help to understand just where this money is going each month. FHA mortgage insurance is a necessary expenditure for those who want to use this program, so what exactly do these payments do?

Mortgage insurance can be a necessary evil for home buyers who don’t have a substantial down payment for the new property. Even FHA loans require buyers to make these payments, but it can help to understand just where this money is going each month. FHA mortgage insurance is a necessary expenditure for those who want to use this program, so what exactly do these payments do?

These monthly payments are a way to protect the lender in the event that you default on the loan. You pay a small fee each month which goes toward an insurance policy held by the lender or the investor in your loan. This provides them with some security if you ever stop making the payments on your home property. You might hear this referred to as PMI, which stands for private mortgage insurance. When it comes to FHA mortgage insurance, it’s referred to as MIP for your mortgage insurance premium.

Is Mortgage Insurance Required?

On a conventional loan, most home buyers have to pay for mortgage insurance until they build up twenty percent equity in their new home. A home buyer who put down a smaller down payment could request for their mortgage insurance to be removed once they met this standard benchmark. It was only required for homeowners who had very little equity in their new home purchase.

On a conventional loan, most home buyers have to pay for mortgage insurance until they build up twenty percent equity in their new home. A home buyer who put down a smaller down payment could request for their mortgage insurance to be removed once they met this standard benchmark. It was only required for homeowners who had very little equity in their new home purchase.

The FHA mortgage program is a little different, but it does still require mortgage insurance for a borrower who only places a small down payment on the property. One of the most advantageous features of the FHA loan is that it only requires a low down payment of 3.5 percent for most borrowers. This small down payment usually makes lenders a little wary of allowing you to forego mortgage insurance premiums though.

Yes, you must make your mortgage insurance premiums for a period of time but they can be removed later on.

How Does It Work?

When you make your initial purchase of the home, your lender will factor the mortgage insurance payments into your estimated monthly costs. You will make this payment monthly until you can lower your overall loan-to-value ratio, sometimes referred to as LTV. This payment will hold until you invest enough into the property to raise your equity to an acceptable level.

However, you will also have an upfront mortgage insurance premium that is due at the time of your closing. Borrowers do have the option to finance this amount into their overall loan if they choose not to pay it out of pocket.

Your upfront mortgage insurance premium is equal to 1.75 percent of your loan amount. Keep this figure in mind because it can definitely change the overall price of the home you are intending to purchase, particularly if you must combine it with your monthly insurance payments. The monthly payments are usually calculated on an annual basis but are only paid monthly.

How Much Does FHA Mortgage Insurance Cost?

The upfront FHA mortgage insurance cost is always the same. This number can be much easier to calculate because it is equal to 1.75 percent of the principal balance on your loan. This is a one-time fee that can easily be rolled into your remaining loan balance.

The second FHA mortgage insurance premium is a little more difficult to calculate. This will depend on your loan amount, your down payment amount (loan to value ratio), and the length of your loan. For loans that fall into the conventional category at $625,500 or less, you can expect your annual insurance premiums to fall into one of these categories:

The second FHA mortgage insurance premium is a little more difficult to calculate. This will depend on your loan amount, your down payment amount (loan to value ratio), and the length of your loan. For loans that fall into the conventional category at $625,500 or less, you can expect your annual insurance premiums to fall into one of these categories:

- 30-year loan with less than 5% equity: 0.85%

- 30-year loan with more than 5% equity: 0.80%

- 15-year loan with less than 10% equity: 0.70%

- 15-year loan with more than 10% equity: 0.45%

These percentages will be applied to the total balance of your loan to come up with your annual total for mortgage insurance premiums. This figure can then be divided by twelve to determine how much you will owe on a monthly basis.

As you can see, your mortgage insurance premiums will change as you build more equity in the home and decrease your principal balance. Make sure you are paying attention to the changes in your private mortgage insurance each year to prove that your rates are decreasing.

What is MIP?

The MIP stands for “mortgage insurance premium.” This is a specific type of insurance policy utilized with FHA loans to help protect the lenders in the event that you default on the loan. Your upfront mortgage insurance premium can be bundled into your loan amount, while you might also be responsible for a monthly payment to keep this service active.

The MIP stands for “mortgage insurance premium.” This is a specific type of insurance policy utilized with FHA loans to help protect the lenders in the event that you default on the loan. Your upfront mortgage insurance premium can be bundled into your loan amount, while you might also be responsible for a monthly payment to keep this service active.

The specific numbers will vary based on your loan amount, the duration of your loan, and the amount of equity you have built up in the property.

After you maintain the home for a period of time and build up enough equity in the home, you can qualify to have the MIP dropped from your monthly expenditures. You will have to know the details of your loan in order to determine if you qualify to cut out this unnecessary fee each month.

What is PMI?

PMI and MIP both have a very similar sound when you’re trying to have a logical talk with your lender. You should really know how these two acronyms differ from one another before you make a commitment to any one type of loan product. What is the primary difference between private mortgage insurance and monthly insurance premiums?

Private mortgage insurance is issued on conventional loans to help protect lenders in case you choose to stop making the monthly payments on your mortgage. They tend to require this amount whenever you have a down payment that is less than twenty percent of the home’s total value. PMI serves as an insurance policy to give them some peace of mind about taking a risk on your financing, even though you did not come up with a large down payment.

Private mortgage insurance is issued on conventional loans to help protect lenders in case you choose to stop making the monthly payments on your mortgage. They tend to require this amount whenever you have a down payment that is less than twenty percent of the home’s total value. PMI serves as an insurance policy to give them some peace of mind about taking a risk on your financing, even though you did not come up with a large down payment.

It is typically around 0.5 percent to 1.5 percent of the total loan value each year. This means that your PMI payments might change as you make more payments on your mortgage each year.

PMI can be removed from the property once you build up at least twenty percent interest with a good payment history. Alternatively, it might be terminated as soon as your loan balance is scheduled to reach 78 percent of the value on the home.

You might also be permitted to pay single premium PMI in one neat and tidy sum upon closing on your house. This lump sum payment could also be financed into the home’s loan value to avoid making monthly payments specifically for the PMI. This applies to the most common type of PMI, which is known as borrower-paid.

You might also encounter lender-paid PMI which is factored into the interest rate of the loan. This fee will never go away or decrease until you are finished paying off the mortgage.

On the other hand, the MIP is used specifically for FHA loans.

How to Avoid PMI with FHA Loan

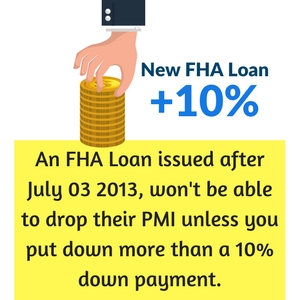

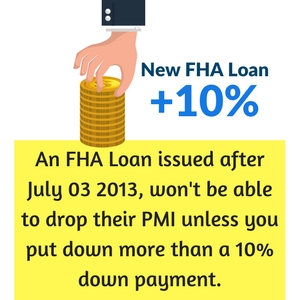

Understanding the ins and outs of how to get around making your MIP payments with FHA loans can be extremely tricky. Some of the details pertaining to your MIP are affected by the date of your closing. Homes that received financing prior to July 3, 2013, might already be able to remove their monthly insurance premiums.

Loans made prior to July 3, 2013, must be paid down to a loan to value ratio of 78 percent or less. If your total is lower than this number and you have been paying for at least 11 years, you should be able to request for this monthly expense to be removed from your billing cycle. Alternatively, some lenders only require that you make these MIP payments for five full years if your loan falls into this category.

Loans made prior to July 3, 2013, must be paid down to a loan to value ratio of 78 percent or less. If your total is lower than this number and you have been paying for at least 11 years, you should be able to request for this monthly expense to be removed from your billing cycle. Alternatively, some lenders only require that you make these MIP payments for five full years if your loan falls into this category.

An FHA loan that was issued after July 3, 2013, will not be able to drop their PMI unless you put down more than a ten percent down payment.

This is the trick to avoiding a PMI payment with a brand-new FHA loan. You should plan to put down a ten percent down payment so that you automatically have more equity built up in the property. When this is the case, you can drop your PMI after eleven years instead of paying it for the duration of the loan.

The ability to drop your mortgage insurance premiums can represent a huge savings for homeowners. They will be able to save thousands of dollars over the duration of their loan by selecting a much larger down payment right now. You will have to weigh whether this could be the best option for you, particularly if it requires you to wait a couple years to continue saving for the down payment on your property.

How Do I Cancel FHA Mortgage Insurance?

Getting rid of your mortgage insurance premium should be a major undertaking on every homeowner’s radar. Eliminating this monthly expense can save you a good bit of money each month, depending on your premium amount and the overall value of your home. It’s only natural to want more details on exactly how you can go about canceling your FHA mortgage insurance.

When Can I Cancel?

If you purchased your home prior to July 3, 2013, the MIP will simply be removed from your loan once the loan to value ratio reaches 78 percent. This can take roughly eleven years if you placed a 3.5 percent down payment on the property unless you make extra payments to remove the MIP sooner.

Homeowners who purchased their property after this magical date will have to take a slightly different approach to canceling their PMI, particularly if they only put down the minimum 3.5 percent down payment. You can choose to refinance your FHA mortgage into a different type of loan, such as a conventional loan product.

How does this work?

Well, the odds are that your home as gone up in value since the time you purchased it. Many homes have seen an increase as the real estate market started to rebound, even if they didn’t have any major updates in the last few years. The home you purchased for $150,000 years ago might now be worth closer to $200,000.

This shows as accrued equity in the property when you attempt to refinance. The home is worth substantially more than what you originally paid for it. When you refinance it, you will need to plan to change your loan into something other than the same FHA financing program. Even though this would allow you to tap into the equity of your home, you will still be required to keep the PMI on the FHA financing whereas a conventional loan might not require it.

The standards to refinance your home might be a little more stringent than those expected for a traditional FHA loan. You might need a much higher credit score in the average to good range (around 600) for a lender to feel comfortable refinancing your home. Consider where you might be at financially to determine if refinancing your FHA loan to remove PMI could be for you.

Conclusion

FHA mortgage insurance might be a necessary part of your loan structure, depending on when you purchased your property. Paying this fee every month can add up to thousands of dollars in wasted money for you as the homeowner. You can take a few creative routes to avoid making a PMI payment on the purchase of a new home. If you’ve owned your home for a while, you might need to talk to your lender about whether you can remove your mortgage insurance premiums.

Frequently Asked Questions

Will FHA mortgage insurance go down?

Yes, FHA mortgage insurance will decrease in the total amount due as you pay down your principal balance on the mortgage.

What does FHA mortgage insurance cover?

FHA mortgage insurance covers your lender in the event that you were to default on your mortgage and the property would move into foreclosure. It is an insurance policy to help the lender recoup any lost funds from their initial investment.

Why is FHA mortgage insurance required?

FHA mortgage insurance is required to offer more protection to lenders in case you do not make the expected payments on your loan. This is done to help protect lenders who are issuing financing with lower down payments to homeowners who do not have equity in their properties.

Does FHA mortgage insurance go away after a certain amount of time?

FHA mortgage insurance can go away on loans that were issued before July 3, 2013, once the loan to value ratio becomes 78 percent or less. On homes that were purchased after this date, you can only get rid of MIP if you put down a ten percent down payment. If you had a lower down payment, you will have to pay FHA mortgage insurance for the duration of your financing.

Why is my FHA mortgage insurance so high?

Your FHA mortgage insurance is based on your down payment amount and loan type. It is calculated based on the value of the home. Here are the annual MIP rates for FHA mortgages of $625,000 or less:

- 30-year fixed rate mortgage with less than 5% down payment: 0.85%

- 30-year fixed rate mortgage with more than 5% down payment: 0.80%

- 15-year fixed rate mortgage with less than 10% down payment: 0.70%

- 15-year fixed rate mortgage with more than 10% down payment: 0.45%

FHA Mortgage Insurance Resources

by Mike Plambeck

There are a lot of great reasons to own a home. It’s a long-term investment in your future. It’s an asset that can become more valuable over time. And you have the security and pride that can only come from owning your own property. But as we all know, owning a home is often a difficult and expensive process. It’s important to select the mortgage program that works best for you. So, for a lot of folks that means looking at an FHA loan in Illinois and the FHA loan requirements Illinois.

But as we all know, owning a home is often a difficult and expensive process. It’s important to select the mortgage program that works best for you. So, for a lot of folks that means looking at an FHA loan in Illinois and the FHA loan requirements Illinois.

We’ve compiled a list of some of the most common questions about Illinois FHA loans and answered them – and if you’re from Illinois yourself, maybe you’ll find that this type of mortgage is right for you. You don’t have to move to Illinois for that. It is a Federal program that wants you to have a house! So, FHA loan requirements Illinois work in all of the US!

We Can Help You Qualify For A FHA Loan in Illinois

Fill Out The Form Below To Get Help Today!

What is an FHA Loan in Illinois?

An FHA loan is a type of housing loan that is insured by the Federal Housing Administration, which is a department of the United States federal government.

The loan is still issued by a private moneylender or bank, but because the FHA promises the reimburse the lender if you can’t make your payments, lenders are willing to make much more substantial loans than they would otherwise.

In some cases, they will even grant mortgages to applicants who they would normally reject outright! This makes the FHA Loan a great choice for first-time homeowners, low-income families, and buyers who are interested primarily in making a low down payment.

Click here for more information on FHA Loans.

What are the different types of FHA loans in Illinois?

When most people talk about FHA mortgages, they’re thinking of fixed-rate FHA loans. But there are multiple alternatives in this option, and homeowners in Illinois should familiarize themselves with all the options available in their state so that they can pick the FHA loan that’s right for them:

- A 5-year adjustable-rate FHA loan in Illinois is an option that’s ideal for low-income and moderate-income families who are buying their first home. An adjustable-rate loan starts at an interest rate that’s lower than the fixed-rate, usually by about one percent. This interest rate holds for five years without changing, which gives the loan recipient time to save up for the larger payments to follow.

- A fixed-rate FHA loan in Illinois is an option that’s recommended for buyers who want a home but who haven’t been able to save up money for the purchase, often young first-time buyers who have just graduated college or who are recently married. A fixed-rate loan keeps the same interest rate for the entirety of the payback period, which is usually either 15 or 30 years. If your payment changes at all, it will only be slight adjustments arising from deviations in insurance or property taxes.

- A condominium unit FHA loan in Illinois is for loan applicants who want to buy a condominium unit instead of a traditional house. Condominium units usually – but not exclusively – appeal most to low-income and moderate-income singles.

Advantages of FHA loan in Illinois

FHA loans are the most popular in the country – in fact, roughly 30 percent of all home loans in Illinois are insured by the FHA. It’s not hard to see why when you look at the advantages:

- FHA loans Illinois has a much smaller down payment, charging only 3.5 percent of the total home’s value instead of the more typical 20 percent. This is the biggest advantage of an FHA loan and why this type of loan is most popular with buyers who haven’t been able to save up a lot of money for the purchase of a home.

- FHA loans in Illinois have much more flexible requirements. FHA-insured lenders will accept credit scores of only 580 and have no minimum income requirements. They also allow for a much higher debt-to-income ratio than traditional mortgages – sometimes approving D-I ratios as high as 50% in place of the usual 31%.

Because they’re backed by the US Treasury, FHA loans are seen as a much safer investment by moneylenders. As a result, they’re much cheaper upfront and much more accessible and traditional loans. However…

Disadvantages for an FHA loan

By now, the advantages of an FHA loan in Illinois should be obvious. But this type of loan can come with disadvantages as well, which is why it’s always best to find the mortgage that works for you. There is no “one size fits all.”

- FHA loan recipients have to pay an FHA funding fee which usually comes out to about 1.7 percent of the total mortgage. This fee goes to the Federal Housing Administration and is a way for them to protect their investment. Think of it as an insurance premium.

- FHA loan recipients can’t cancel their Private Mortgage Insurance until they’ve completely paid off the home. In Illinois, conventional mortgages typically let homeowners cancel their PMI after they have accrued equity equal to 20 percent of the total value of the property.

- FHA loans tend to have slightly higher interest rates, which is how the banks and moneylenders make back their money from the small upfront down payment. This means that FHA mortgages usually cost less upfront but can end up costing more than a conventional loan in the long run.

What properties qualify for an FHA home loan?

FHA loans often have lower loan limits than some conventional mortgages. You can see a per-country list that’s up-to-date for 2020 here, but for most counties in Illinois FHA loans can only pay off a property that costs $331,760 or less.

This is perfect for a low or moderate-income family but may hurt those who are looking at high-cost areas.

In addition, properties have to meet certain eligibility requirements. You can check them out in the 21-page checklist in Chapter 3 of the Department of Housing and Urban Development’s Handbook 4150.2.

The house will have to go through an inspection and appraisal. This can be a bit of a hassle – but it’s worth it. Most of these guidelines are safety standards; among other things, appraisers will look for:

- Faulty HVAC system

- Roof leakage

- Plumbing leakage

- A lack of hot water

- Low water pressure

As well as additional requirements for condominiums, which you can see at HUD.gov. Believe me, these are things you want if you’re committing to paying off a property for 30 years.

How important is credit when applying for an FHA loan in Illinois?

If you’re applying for a loan, you need a certain amount of credit, but FHA loans Illinois have much lower credit requirements than conventional loans. In Illinois, FHA Underwriters usually require a FICO credit score of 580 and will require three open tradelines on your credit report. Each report needs to have been there for a minimum of 12 months.

However, having a credit score under 580 won’t necessarily keep you from qualifying. Some banks will accept credit scores as low as 500 – but be aware, they will need to make up for that elsewhere.

Lower credit scores usually mean higher down payments – sometimes as high as 10 percent. That’s about 3 times the down payment on a typical FHA mortgage, though it’s still lower than most conventional home loans.

In addition, you may not have to have a traditional FICO credit score to meet FHA loan requirements Illinois. Some lenders will now allow alternative forms of credit. A good example is a long-standing account with your phone or cable company, in place of a credit score.

What are the FHA loan requirements in Illinois?

In 2020, the minimum requirements for an FHA mortgage in Illinois are:

- A minimum credit score of 500 or two forms of alternative credit.

- A property that is worth less than $331,760 (this varies by county) and meets the minimum property standards

- A debt-to-income ratio of 50 percent or less

These are the minimum requirements set by the state and federal government, though lenders will often set their own standards. For example, almost all FHA Underwriters require a credit score of 580. They also seek a debt-to-income ratio of around 30-40 percent. This gets the lowest possible down payment.

However, it’s always worthwhile to “shop around” for a lender that can meet your needs.

How do you receive an FHA loan in Illinois?

Despite a common misconception, the Federal Housing Administration doesn’t originate FHA mortgages. You will need to find a bank, mortgage company, or another moneylender who works with the government to give out these kinds of loans.

Because these loans are so popular, most lenders will probably have some kind of FHA program in place.

Once you’ve shopped around and found an FHA-partnered Illinois lender with terms that work for you, you will have to apply for the loan. A representative will ask for proof of your job history, credit score, and income documentation. They will check all this to make sure you fit the federal requirements listed above as well as the requirements of the moneylender.

This process works just like it does for any other loan.

What are the FHA loan rates for Illinois?

That depends. The real estate market is in a constant state of flux and loan rates often change on a daily basis depending on current economic indicators.

Besides, Illinois is a big state – the rates in Chicago will be different than the rates in, say, Galena. Do research to see which vender in your area is offering the lowest rates. So, your payments won’t become too much to handle down the road.

Do you have to be a first-time homebuyer for an FHA loan in Illinois?

No – there is no truth to this common misconception. FHA loans are often recommended for first-time homebuyers because their advantages appeal most to that income bracket. Anyone who meets the minimum requirements printed above can apply for this type of loan.

What is the maximum income limit for FHA loans?

The idea of a “maximum income limit” is another common misconception with no truth to it.

FHA loans are usually best for those in low or moderate-income brackets. It has steep loan limits and somewhat higher interest rates. The best is that there is no maximum income limit for FHA loan applicants in the state of Illinois. So, you got this. You can become a homeowner now!

Additional Resources

by Mike Plambeck

If you want to qualify for one of the best loan programs around, you should really know what the FHA loan requirements are.

This set of standards makes it easier for people to become homeowners with lower credit scores and lower down payments.

This set of standards makes it easier for people to become homeowners with lower credit scores and lower down payments.

Understanding what the requirements are can help you to navigate your own path toward homeownership. This can help you even if you still have a little bit of work to do before you meet the minimum standards.

Many of the FHA loan requirements have been around for a while, but they did come up with new loan limits in 2020.

For a single-family residence, the new maximum limit for a low-cost area comes to $331,760 and a high-cost area comes to $765,600.

These were increased just this year to make homeownership more likely for buyers in these areas.

We Help You Qualify For A FHA Loan Fast

Fill Out The Form Below To Get Help Today!

If you’re wondering what the rest of the FHA loan requirements are, it’s time to take an in-depth look at what you should prepare for.

These requirements will give you an idea of what you might need to make yourself more appealing to lenders.

FHA Credit Requirements 2020

In the past, most lenders wanted prospective borrowers to maintain a credit score that came in around 620.

Borrowers who want a conventional mortgage can still expect to come up with a credit score like this for the most favorable interest rates and loan terms.

Fortunately, the FHA credit requirements are substantially lower than this.

Fortunately, the FHA credit requirements are substantially lower than this.

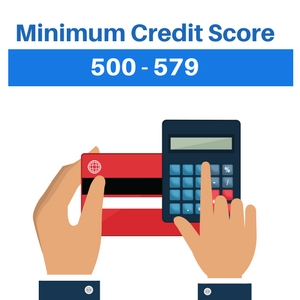

Most borrowers who want to take full advantage of the FHA mortgage program will need to have a credit score of 580 or higher.

This allows them to put down a much lower down payment of just 3.5 percent of the purchase price on the property.

If you are relatively close to reaching this FHA loan credit score, you should really attempt to polish your score before you apply.

What is the minimum credit score for an FHA loan?

You can still meet the FHA credit requirements with a lower credit score between 500 and 579.

You can still meet the FHA credit requirements with a lower credit score between 500 and 579.

These lower credit scores place eligibility under the FHA underwriting guidelines in the realm of possibility for many borrowers who have been struggling to improve their financial standing.

However, it does come with a cost difference compared to the higher tier.

Plan to come up with a ten percent down payment when your credit score falls into this bare minimum range.

While this might make homeownership more difficult for you, it does still lend you plenty of possibilities.

Can you get an FHA loan with no credit score?

Many lenders are still willing to issue loans to borrowers who do not have credit.

You might be able to submit alternative lines of credit such as a phone bill or your utility bills. Your accounts for multiple years with paid bills on time is a good enough proof.

This makes the FHA mortgage program ideal for first-time homebuyers. They usually haven’t had enough time to build up their own credit score yet.

Much like with a lower credit score, you might have to come up with a larger down payment if you have no credit at all.

FHA Loan Debt to Income Requirements

Lenders have always considered how much debt you have as an important factor on whether they can safely issue you a loan.

When your debt reaches a dangerously high percentage of your income, it can be difficult to make your mortgage payment each month.

When your debt reaches a dangerously high percentage of your income, it can be difficult to make your mortgage payment each month.

This is why lenders want to get a clear picture of your finances before they approve you for any type of loan.

In order to calculate this number, a lender will first tally up all of your accumulated debt that you make payments on.

These figures include any auto loans, student loans, or credit card payments that you might have on a monthly basis.

Lenders are only interested in money you have borrowed from other sources. So, it will not include monthly expenditures such as your estimated grocery costs, utility bills, and other items similar to these.

From here, they will divide your total debt amount by your income and multiply it by 100.

Let’s say that you have $500 in debt each month due to a car payment and an old student loan. If your gross monthly income is $2,500, that means that your debt to income ratio is 25 percent.

What is the allowable debt to income ratios for FHA loans?

Now that you know how to calculate your own debt to income ratio, you should know how lenders use these numbers to decide on your approval for a mortgage.

They will use two different debt to income ratios to determine your ability to repay the loan.

They will use two different debt to income ratios to determine your ability to repay the loan.

The first number is your front-end debt to income ratio. Lenders will be looking solely at the approximate cost of the monthly mortgage payment with interest compared to your overall income.

For this calculation, they leave out all of your other debt to see what percentage of your income will go toward housing each month.

According to the FHA underwriting guidelines, the maximum front-end DTI is 31 percent.

The second is known as your back-end debt to income ratio. This adds up your mortgage payment and any other debts you might have to see how much you will really owe on a monthly basis.

The FHA allows debt-to-income ratios of 41 percent when looking at the back-end numbers.

What do I do if my debt to income ratio is too high?

Fixing a high debt to income ratio doesn’t have to be extremely difficult, but it might require a little bit of time.

The only way you can adjust your debt to income ratio is to either increase your income or to decrease your debt.

The latter tends to be the easier method for lowering the debt to income ratio.

Paying down some of your old loans can make a huge difference in your debt to income ratio. This is a quick way to make yourself more appealing to lenders.

FHA Loan Employment Requirements 2020

The employment requirements for obtaining an FHA loan tend to be a hang-up for many individuals who think they should qualify.

Lenders really want to see a stable income and a long employment history because those two make you far more likely to repay your mortgage. You should know the specific details regarding these employment requirements.

How long must you be employed to receive an FHA loan?

Determining the minimum length of time you must be employed to receive an FHA loan is a little tricky because it can be circumstantial.

Most lenders want to see a two-year employment history to demonstrate some job stability. This doesn’t have to be all at the same job or even at the same type of job.

However, it does give them some glimpse into whether you are capable of obtaining and keeping a job.

Under the FHA loan employment requirements, you’re allowed to change positions and jobs during these two years. Try to keep your employment changes to less than three to avoid taking additional steps.

Under the FHA loan employment requirements, you’re allowed to change positions and jobs during these two years. Try to keep your employment changes to less than three to avoid taking additional steps.

Once you’ve had three job changes in a year, you must show more documentation about your positions and the income you received with each of them.

The bank might request proof of your qualifications or training to prove that you can handle this position. However, they are more likely to be interested in how your income and benefits improved as a result of each career change.

Perhaps you had to take a break from working for a while due to unexpected unemployment, a medical issue, or the need to take care of a family member full-time.

You can still meet the FHA loan employment requirements, even with a gap of more than six months. In order to qualify upon your return to the workforce, you will need:

- Six months of employment at your current position

- Two-year history before the employment gap

- Proof of why you had an extended break

Ultimately, these are the minimum requirements for employment based on FHA standards. Your lender might have additional requirements they need borrowers to meet before they are willing to issue financing.

Some research into the specific requirements of every lender will give you a good idea of which lender might be willing to work with your employment history.

FHA Loan Inspection Requirements

After it is determined that you personally meet all the necessary criteria for a loan, the lender will turn their attention to your property.

Every home that receives financing through this program must meet certain guidelines to ensure that it is safe and sanitary for the new home buyer.

Is an inspection required?

Yes, a home inspection and appraisal are required to meet the FHA loan inspection requirements. A lender will need to see the full report from a HUD-approved inspector who checked the house for soundness, safety, and general sanitation. They will ensure that the home has things like:

- Safe electrical systems

- A strong roof

- No major damage to the infrastructure

- Adequate heating

- Running water and working septic system

They are not concerned with the cosmetic items that might need to be touched-up on the property.

These don’t affect the overall safety of the home, so they do not make it into the inspection report that is required by FHA underwriting guidelines. You will paint the walls the color you want anyway when you buy the house.

Only major issues that could signal significant repairs in the future can be in this report.

This is to keep you from purchasing a home that seems likely to cause you significant financial hardship in the future.

Any major safety issues will need to be corrected prior to receiving financing for the property.

Keep in mind that this inspection is only concerned with general safety and major issues.

You might still want to hire your own third-party inspector to take a more thorough look at every aspect of the home prior to closing.

This gives you a better idea of what you might be able to expect in the years ahead with this property.

Does the FHA require a home inspection?

Most times, your inspector and appraiser will be the same person. Their primary job is to ensure that you are paying a fair price for the home based on its condition, the price of surrounding real estate, and the area in which it is located.

They will come up with the market value of the home based on their own research.

Lenders compare the appraiser’s estimated value to the sale price of the home. An appraisal that comes in too low means they are financing the house for more than it is really worth.

This could be bad news for a lender in the future if you should default on the payments. It would be much harder for them to recoup the money they invested if the house is overpriced.

If the appraisal comes back much lower than the sale price of the home, it could potentially derail your financing unless you take further action.

You might need to renegotiate the sale price with the home’s current owner so that it is more in line with what the appraisal would have estimated.

Conclusion

Compared to a conventional mortgage, it should be much simpler for you to meet the FHA loan requirements. They take borrowers with a minimum credit score of 500, provided you can come up with a ten percent down payment.

Even the debt to income ratios and employment history requirements are slightly more generous than those for conventional mortgages. Once you personally qualify, the only thing you need to figure out is whether the property will pass the FHA’s minimum property standards.

If you have any questions about whether you meet the FHA loan requirements, be sure to contact your lender today. They should be able to help you determine your own eligibility and offer suggestions if you’re a little short of qualifying.

Frequently Asked Questions about FHA Loan Requirements

There is no such thing as a stupid question!

Are there any 580 credit score mortgage lenders available for FHA loans?

Yes, there are 580 credit score mortgage lenders available. You can find out if you pre-qualify for one of these loans using our online application here!

What are the credit requirements for FHA Title I Loans?

There are no minimum credit scores for the FHA Title I loans. This type of financing makes remodeling a property much more accessible to homeowners, even if they have no equity built up in the property yet.

Does an FHA loan require a termite inspection?

The FHA mortgage program does not necessarily require a termite inspection unless there is evidence of a current or previous termite infestation. Some areas and lenders may still require a termite inspection before financing the home.

Does FHA require PMI?

Yes, FHA loans do require private mortgage insurance.

Additional FHA Loan Requirement Resources

FHA Home Loans: Loan Requirements and Eligibility

Many lenders are loosening requirements for prospective home buyers

Mortgage Information for a FHA Loan in North Carolina

by Mike Plambeck

Owning a home gives you a sense of security and stability you just can’t get from renting an apartment or a duplex.

Owning a home gives you a sense of security and stability you just can’t get from renting an apartment or a duplex.

You’re not beholden to anyone – you can keep pets, paint the walls pink, play your music as loud as you want.

It’s the best place to raise a family – and it’s no wonder that for many, home ownership is seen as the ultimate goal of the American dream.

There are practical considerations too – a home is a long-term asset whose value can appreciate over time, making home ownership a solid investment.

Get Pre Qualified for a New Jersey FHA Loan – Click Here.

But as we all know, home ownership is also expensive and complicated, which is why it’s important to find the mortgage loan program that’s right for you.

Many New Jerseyans are looking at Federal Housing Administration Loans, or FHA Loans.

We’ve compiled a handy FAQ about this common type of loan so that you can decide if it’s the right choice for your family.

What is an FHA Loan in New Jersey?

An FHA loan is a housing loan that is insured by the United States Federal Housing Administration, from which it takes its name.

An FHA loan is a housing loan that is insured by the United States Federal Housing Administration, from which it takes its name.

These loans are still issued by a private bank or lender, but they’re protected by a promise from the government that if you can’t pay back your loan they will reimburse the moneylender for you.

Lenders who are partnered with the FHA in this way are willing to give a better deal on a loan than they would otherwise because the money is protected by the promise of the government and the power of the US Treasury.

However, they can be more expensive than a conventional loan with a large down payment, which is why they mostly appeal to applicants in New Jersey with low credit scores or low income.

What are the different types of FHA loans in NJ?

When you hear someone talk about “FHA loans,” they’re usually talking about a fixed rate mortgage. But this is only one type of loan that’s ensured by the Federal Housing Administration.

In New Jersey, there are three types of FHA loans:

A 5-year adjustable rate FHA loan in New Jersey. This type of loan starts at a lower interest rate than the more common fixed-rate option and remains at that same low rate for five years, giving the homeowner a chance to settle in and set money aside before making larger payments.

The starting interest rate for a 5-year adjustable rate mortgage in New Jersey is usually 1 percent lower than the fixed rate.

This option appeals most to low or moderate income families who have never bought a home before.

A fixed rate FHA loan in New Jersey. This type of loan has a fixed interest rate that remains steady for the duration of the mortgage – a period of usually either 15 or 30 years.

A fixed rate FHA loan in New Jersey. This type of loan has a fixed interest rate that remains steady for the duration of the mortgage – a period of usually either 15 or 30 years.

The only change in your payments during this time will be from slight deviations in insurance or property taxes.

This option appeals most to buyers who want a home but haven’t been able to save up money for payments – usually recent college graduates or newlyweds.

An FHA condominium loan in New Jersey. This type of loan is pretty straightforward – it’s an option for buyers who are purchasing a condominium unit instead of a traditional house.

What advantages do homeowners have with an FHA loan in New Jersey?

The US Federal Housing Administration is the largest mortgage insurer in the world and approximately 30 percent of all home loans in the country are FHA loans.

This is because these types of mortgages come with several advantages:

FHA loans in New Jersey require a greatly reduced down payment. This is the biggest advantage to choosing an FHA loan over other types of mortgages.

The usual down payment on a home is twenty percent of the total price, but in New Jersey an FHA mortgage can start with a down payment as low as 3.5 percent.

This makes this type of loan the best choice for people who have steady work and can make regular payments but who haven’t saved up enough for a large up-front deposit.

The requirements for FHA loan approval are much more flexible.

In New Jersey, applicants for an FHA loan need to have worked for the same employer for at least two years, be able to make their down payment, and have a credit score of at least 620.

That’s it – there’s no minimum income requirement, and 620 is much lower than the 700 credit score the state requires for conventional mortgage applications.

In many cases, applicants that would normally be turned down will get accepted for an FHA loan because the lender knows they’ll make their money back from the government even if the homeowner defaults.

FHA loans also benefit the national economy by stimulating the real estate market, expanding the tax base, and creating jobs.

But for most of us the main benefit of an FHA loan in New Jersey is that it’s cheaper upfront and more accessible than traditional mortgages.

What are the disadvantages for an FHA loan?

FHA loans offer many attractive advantages, but they come with disadvantages as well, which is why it’s important to see if you are the type of person best suited to benefitting from this type of mortgage:

Buyers have to pay an FHA funding fee up front. Though this is still lower than a typical down payment on a home, the Federal Housing Administration charges a fee that’s approximately 1.7 percent of the total mortgage.

This is how the government protects its investment – it’s basically an insurance premium.

FHA loan recipients cannot cancel their insurance until they’ve paid off the whole mortgage.

Conventional home loans usually let recipients cancel private mortgage insurance payments after they’ve accrued a certain amount of equity.

In practice, this means that the FHA loan payments will probably be higher than those of conventional mortgages especially as you get to the end of the loan term.

Interest rates are often slightly higher for an FHA loan in New Jersey. This is how the lender makes up for the small up front payment.

In short, think of an FHA loan as having slightly larger monthly payments in exchange for a much smaller down payment.

What type of properties qualify for FHA Loans in NJ?

In New Jersey, many types of properties qualify for FHA home loans:

In New Jersey, many types of properties qualify for FHA home loans:

Townhomes

Multi-unit properties

Manufactured homes

Single-family homes

Condominium units

These properties must be at least 400 square feet and have been constructed after June 15, 1976.

They also have to meet rigorous safety standards – a government employee will appraise the house beforehand to make sure these standards are met.

The complete 21-page checklist these appraisers go through is detailed in Chapter 3 of the Department of Housing and Urban Development’s Handbook 4150.2, which can be found here.

In brief, they will disqualify a home with:

- Foundation cracks

- Loose handrails

- Structural concerns

- Holes or leaks in the roof

- Low water pressure

- No hot water

- Insufficient space

- Faulty HVAC system

Among other concerns.

The property must also cost less than the maximum lending limit for an FHA loan in New Jersey, as described on a county-by-county basis here.

How important is credit when applying for an FHA loan in New Jersey?

Credit is a major concern whenever you’re applying for a loan, but one of the major benefits of FHA mortgages is that they have much lower credit requirements.

In New Jersey, most FHA Underwriters require a middle credit score of 620, as well as three open trade lines on your credit report that have been there for a minimum of 12 months.

However, this credit limit is not actually set by the federal government. If you “shop around” you may find FHA-partnered moneylenders that will accept credit scores as low as 580. However, these lower credit requirements usually mean a higher down payment.

Also, some FHA lenders in NJ may consider “additional forms of credit” like long-standing accounts with your phone company or utility services in place of a FICO credit score.

What are the requirements for an FHA loan in New Jersey?

As of 2018, these are the typical requirements for an FHA loan in New Jersey:

As of 2018, these are the typical requirements for an FHA loan in New Jersey:

- A middle credit score of 620 or two forms of alternative credit.

- A property that has been appraised and meets the requirements of HUD Handbook 4150.2

- A property that is worth less than the maximum loan limits described here.

- A debt-to-income ratio of 50 percent or less

- Two years of steady employment history

- Ability to make a down payment of at least 3.5 percent

FHA Lenders in NJ

FHA Lenders in NJ can set their own standards for an FHA mortgage in New Jersey, but this is what you’re most likely to see.

It will often be worthwhile to spend time looking around for a lender that can work with your specific needs.

How do you receive an FHA loan in New Jersey?

FHA loans are insured by the American government but are originated by private moneylenders.

Most likely your local bank or mortgage company in New Jersey will have some kind of FHA loan program in place.

It’s often recommended to shop around several different lenders to find the one that has the best rate and the requirements that work best for you – the lowest possible down payment, for example, or maybe the most flexible credit scores.

Once you decide on a FHA lender in NJ, you will apply for the FHA mortgage just as you would for any other loan.

Your representative will then check your credit score, income, debt, and more to make sure you fit the lender’s requirements and the federal requirements for this type of loan.

What are the FHA loan rates for New Jersey?

The real estate market is in a constant state of flux, and as a result, loan rates will change frequently – sometimes even on a daily basis! What’s more, different lenders offer different rates for FHA loans in New Jersey.

As a result, we can’t give you an exact number for what the loan rate will be where you live. This is why it’s best to do some research before applying to a specific moneylender.

Do you have to be a first-time home buyer for an FHA loan in New Jersey?

FHA loans often appeal more to first-time home buyers than to other customers for the reasons we’ve listed above.

However, despite the common misconception, you do not have to be a first time buyer to be eligible for an FHA loan in New Jersey. That is not one of the federal requirements.

What is the maximum income limit for FHA loans NJ?

This is another popular myth with no basis in reality – there is no maximum income limit for FHA loan applicants in New Jersey.

However, FHA loans are usually a better investment for low-income families who are willing to accept greater ongoing payments in exchange for a lower down payment.

Get Pre Qualified for a New Jersey FHA Loan – Click Here.

The FHA mortgage program is sponsored by the Federal Housing Administration to make homeownership more accessible to families who need a lower down payment.

The FHA mortgage program is sponsored by the Federal Housing Administration to make homeownership more accessible to families who need a lower down payment. There are four distinct tiers that an area can fall into: the standard tier, the mid-range tier, the high-cost tier, and the special exception tier. Most properties and areas will be subject to the standard tier.

There are four distinct tiers that an area can fall into: the standard tier, the mid-range tier, the high-cost tier, and the special exception tier. Most properties and areas will be subject to the standard tier.

The FHA streamline refinance loans are not subject to the same loan limits as the purchase of a new property. However, you will have to bear in mind that these refinance loans are only available to homeowners who purchased a property using an FHA loan, to begin with. This means that your initial purchase of the property would have had to comply with the loan limits and standards in your area.

The FHA streamline refinance loans are not subject to the same loan limits as the purchase of a new property. However, you will have to bear in mind that these refinance loans are only available to homeowners who purchased a property using an FHA loan, to begin with. This means that your initial purchase of the property would have had to comply with the loan limits and standards in your area.

Mortgage insurance can be a necessary evil for home buyers who don’t have a substantial down payment for the new property. Even FHA loans require buyers to make these payments, but it can help to understand just where this money is going each month. FHA mortgage insurance is a necessary expenditure for those who want to use this program, so what exactly do these payments do?

Mortgage insurance can be a necessary evil for home buyers who don’t have a substantial down payment for the new property. Even FHA loans require buyers to make these payments, but it can help to understand just where this money is going each month. FHA mortgage insurance is a necessary expenditure for those who want to use this program, so what exactly do these payments do?  On a conventional loan, most home buyers have to pay for mortgage insurance until they build up twenty percent equity in their new home. A home buyer who put down a smaller down payment could request for their mortgage insurance to be removed once they met this standard benchmark. It was only required for homeowners who had very little equity in their new home purchase.

On a conventional loan, most home buyers have to pay for mortgage insurance until they build up twenty percent equity in their new home. A home buyer who put down a smaller down payment could request for their mortgage insurance to be removed once they met this standard benchmark. It was only required for homeowners who had very little equity in their new home purchase.  The second FHA mortgage insurance premium is a little more difficult to calculate. This will depend on your loan amount, your down payment amount (loan to value ratio), and the length of your loan. For loans that fall into the conventional category at $625,500 or less, you can expect your annual insurance premiums to fall into one of these categories:

The second FHA mortgage insurance premium is a little more difficult to calculate. This will depend on your loan amount, your down payment amount (loan to value ratio), and the length of your loan. For loans that fall into the conventional category at $625,500 or less, you can expect your annual insurance premiums to fall into one of these categories: The MIP stands for “mortgage insurance premium.” This is a specific type of insurance policy utilized with FHA loans to help protect the lenders in the event that you default on the loan. Your upfront mortgage insurance premium can be bundled into your loan amount, while you might also be responsible for a monthly payment to keep this service active.

The MIP stands for “mortgage insurance premium.” This is a specific type of insurance policy utilized with FHA loans to help protect the lenders in the event that you default on the loan. Your upfront mortgage insurance premium can be bundled into your loan amount, while you might also be responsible for a monthly payment to keep this service active. Private mortgage insurance is issued on conventional loans to help protect lenders in case you choose to stop making the monthly payments on your mortgage. They tend to require this amount whenever you have a down payment that is less than twenty percent of the home’s total value. PMI serves as an insurance policy to give them some peace of mind about taking a risk on your financing, even though you did not come up with a large down payment.

Private mortgage insurance is issued on conventional loans to help protect lenders in case you choose to stop making the monthly payments on your mortgage. They tend to require this amount whenever you have a down payment that is less than twenty percent of the home’s total value. PMI serves as an insurance policy to give them some peace of mind about taking a risk on your financing, even though you did not come up with a large down payment.  Loans made prior to July 3, 2013, must be paid down to a loan to value ratio of 78 percent or less. If your total is lower than this number and you have been paying for at least 11 years, you should be able to request for this monthly expense to be removed from your billing cycle. Alternatively, some lenders only require that you make these MIP payments for five full years if your loan falls into this category.

Loans made prior to July 3, 2013, must be paid down to a loan to value ratio of 78 percent or less. If your total is lower than this number and you have been paying for at least 11 years, you should be able to request for this monthly expense to be removed from your billing cycle. Alternatively, some lenders only require that you make these MIP payments for five full years if your loan falls into this category.

But as we all know, owning a home is often a difficult and expensive process. It’s important to select the mortgage program that works best for you. So, for a lot of folks that means looking at an FHA loan in Illinois and the FHA loan requirements Illinois.

But as we all know, owning a home is often a difficult and expensive process. It’s important to select the mortgage program that works best for you. So, for a lot of folks that means looking at an FHA loan in Illinois and the FHA loan requirements Illinois.

This set of standards makes it easier for people to become homeowners with lower credit scores and lower down payments.

This set of standards makes it easier for people to become homeowners with lower credit scores and lower down payments. Fortunately, the FHA credit requirements are substantially lower than this.

Fortunately, the FHA credit requirements are substantially lower than this. You can still meet the FHA credit requirements with a lower credit score between 500 and 579.

You can still meet the FHA credit requirements with a lower credit score between 500 and 579.

When your debt reaches a dangerously high percentage of your income, it can be difficult to make your mortgage payment each month.

When your debt reaches a dangerously high percentage of your income, it can be difficult to make your mortgage payment each month. They will use two different debt to income ratios to determine your ability to repay the loan.

They will use two different debt to income ratios to determine your ability to repay the loan. Under the FHA loan employment requirements, you’re allowed to change positions and jobs during these two years. Try to keep your employment changes to less than three to avoid taking additional steps.

Under the FHA loan employment requirements, you’re allowed to change positions and jobs during these two years. Try to keep your employment changes to less than three to avoid taking additional steps.

Owning a home gives you a sense of security and stability you just can’t get from renting an apartment or a duplex.

Owning a home gives you a sense of security and stability you just can’t get from renting an apartment or a duplex.  An FHA loan is a housing loan that is insured by the United States Federal Housing Administration, from which it takes its name.

An FHA loan is a housing loan that is insured by the United States Federal Housing Administration, from which it takes its name.  A fixed rate FHA loan in New Jersey. This type of loan has a fixed interest rate that remains steady for the duration of the mortgage – a period of usually either 15 or 30 years.

A fixed rate FHA loan in New Jersey. This type of loan has a fixed interest rate that remains steady for the duration of the mortgage – a period of usually either 15 or 30 years.  In New Jersey, many types of properties qualify for FHA home loans:

In New Jersey, many types of properties qualify for FHA home loans:

As of 2018, these are the typical requirements for an FHA loan in New Jersey:

As of 2018, these are the typical requirements for an FHA loan in New Jersey: