by Mike Plambeck

One thing everyone wants to do is own a home. It’s a symbol of security and status, something that makes us feel like we’ve “made it.” And in a more practical sense, a home is a long-term investment – an asset whose value can appreciate over time and pay big dividends in the future.

But whether you’re buying your first home or your fifth, finding the right mortgage program can be difficult. And realizing the dream of home ownership can be especially difficult for those with a lower income. That’s why many homeowners are looking at FHA loans in New York.

Pre Qualify for a New York FHA Loan today – Click Here.

If you’re interested in securing such a loan for yourself, we’ve compiled this easy guide that will tell you everything you need to know about FHA loans and the New York requirements for getting one.

What is an FHA Loan?

As the name implies, an FHA loan is insured by the Federal Housing Administration, a branch of the United States federal government.

These loans are still issued by a private bank or lender, but because the government is backing the mortgage with the full taxing power of the US treasury, lenders who are partnered with the FHA are willing to make more substantial loans than they would otherwise.

In many cases, they will even issue loans to applicants who would normally be rejected outright.

FHA loans mostly appeal to buyers who have low credit scores, who want to make a low down payment, or who are purchasing a house for the first time.

What are the different types of FHA loans in New York?

It’s very important to educate yourself on the different kinds of home loans available in New York. Usually when people hear “FHA loan” they think of fixed-rate loans, but that’s only one of three different types of FHA mortgages available in NY:

What advantages do homeowners have with an FHA loan in New York?

FHA loans are the most popular form of loan in the country and it’s not hard to see why when you look at the advantages.

Firstly, FHA loans require a much smaller down payment than conventional loans (3.5 percent of the mortgage instead of 20 percent.)

Secondly, the requirements for securing an FHA mortgage are much more lenient than the requirements for a conventional home loan, requiring lower credit scores, no minimum income, and a much higher debt-to-income ratio than traditional mortgages (usually your payment needs to be no more than 31% of your income, but in some cases an applicant can get approved with a D-I ratio as high as 50%.)

For these reasons, applicants who would normally be rejected outright for a conventional mortgage are often able to secure an FHA loan in New York.

In short, loans insured by the FHA are much less expensive upfront and much more accessible than most other forms of mortgages in New York. This is why these types of loans are often preferred by first-time homeowners, low income families, and younger prospective buyers.

What are the disadvantages for an FHA loan?

The advantages of FHA loans are certainly attractive, but it’s important to be aware of the three major disadvantages these types of mortgages come with as well.

Firstly, FHA loans require you to pay an upfront premium called a “funding fee” to protect the government’s investment. This fee is usually 1.7 percent of the total cost of the mortgage.

Secondly, FHA loans require you to pay for Private Mortgage Insurance (PMI) for the duration of the payback period, when conventional loans let you cancel said insurance after acquiring a certain amount of equity.

Thirdly, FHA loans usually have slightly higher interest rates than conventional New York mortgages, so that the banks can make their money back from the greatly reduced down payment.

What type of properties qualify for an FHA home loan?

Before you can take out an FHA mortgage on a property, it will have to be appraised. The full guidelines for what type of property qualifies are listed in a 21-page checklist in Chapter 3 of the Department of Housing and Urban Development’s Handbook 4150.2.

They will disqualify a home with cracks in the foundation or other structural concerns, loose handrails, holes or leaks in the roof or plumbing, low water pressure, no hot water, insufficient space, or a faulty HVAC system, among other concerns. This is actually a good thing, because you certainly don’t want to buy a house without those things!

To qualify for an FHA home loan, properties must also cost less than the maximum FHA lending limit for New York in 2018, which you can see described on a county-by-county basis here.

How important is credit when applying for an FHA loan in New York?

One of the biggest benefits of choosing an FHA mortgage over a conventional loan is the lower credit requirements. While traditional loans usually ask for a credit score of at least 700, FHA loans can be secured with credit as low as 620 in most cases (and technically the federal requirements are only 500!)

The FHA also allows up to two thirty-day late entries on your credit report and makes allowances for applicants with no credit report at all! In these cases, lenders will usually require a higher down payment (sometimes as high as 10 percent) but will allow you to submit “alternative forms of credit” like recent utility or phone bills as proof that you will pay off your mortgage.

What are the requirements for an FHA loan in New York?

Securing an FHA loan in New York typically requires:

– A minimum credit score of 620 or two forms of alternative credit.

– A property that has been appraised and meets the requirements of HUD Handbook 4150.2

– A property that is worth less than the lending limit (which varies greatly by county in New York)

– A debt-to-income ratio of 50 percent or less

However, private lenders are allowed to set their own requirements and may ask for higher or lower credit scores and debt-to-income ratios. You can use this tool to look for FHA loan lenders in your area and do your own research to find someone who works for you.

How do you receive an FHA loan in New York?

Though many buyers think that FHA loans are originated by the government, they actually come from private banks and moneylenders like any other home loan. Since FHA loans are the most popular type of loan in the country, your local lenders will most likely have a partnership in place.

From there, you’ll provide evidence that you meet the requirements to the bank’s underwriter, who will check your credit score, income, debt, and more just as they would for any other type of loan.

What are the FHA loan rates for New York?

Loan rates change on a daily basis because they’re based on economic indicators and the ever-fluctuating real estate market. Furthermore, different lenders across the state will offer different rates. So while we can’t give you an exact number for current FHA loan rates in New York, you should do your own research and “shop around” different lenders in your area to see who’s offering the best deal.

Do you have to be a first-time home buyer for an FHA loan in New York?

No. Any applicant who meets the minimum requirements for an FHA loan in New York (as described three sections above) can secure a mortgage regardless of how many homes they’ve owned before.

What is the maximum income limit for FHA loans?

There is no maximum income limit for FHA loans in New York or any other state. However, high income applicants who can afford a larger down payment will probably benefit more from the lower interest rates of a conventional loan.

Additional Resources

by Mike Plambeck

Owning a home gives you a sense of security and stability you just can’t get from renting an apartment or a duplex.

Owning a home gives you a sense of security and stability you just can’t get from renting an apartment or a duplex.

You’re not beholden to anyone – you can keep pets, paint the walls pink, play your music as loud as you want.

It’s the best place to raise a family – and it’s no wonder that for many, home ownership is seen as the ultimate goal of the American dream.

There are practical considerations too – a home is a long-term asset whose value can appreciate over time, making home ownership a solid investment.

Get Pre Qualified for a New Jersey FHA Loan – Click Here.

But as we all know, home ownership is also expensive and complicated, which is why it’s important to find the mortgage loan program that’s right for you.

Many New Jerseyans are looking at Federal Housing Administration Loans, or FHA Loans.

We’ve compiled a handy FAQ about this common type of loan so that you can decide if it’s the right choice for your family.

What is an FHA Loan in New Jersey?

An FHA loan is a housing loan that is insured by the United States Federal Housing Administration, from which it takes its name.

An FHA loan is a housing loan that is insured by the United States Federal Housing Administration, from which it takes its name.

These loans are still issued by a private bank or lender, but they’re protected by a promise from the government that if you can’t pay back your loan they will reimburse the moneylender for you.

Lenders who are partnered with the FHA in this way are willing to give a better deal on a loan than they would otherwise because the money is protected by the promise of the government and the power of the US Treasury.

However, they can be more expensive than a conventional loan with a large down payment, which is why they mostly appeal to applicants in New Jersey with low credit scores or low income.

What are the different types of FHA loans in NJ?

When you hear someone talk about “FHA loans,” they’re usually talking about a fixed rate mortgage. But this is only one type of loan that’s ensured by the Federal Housing Administration.

In New Jersey, there are three types of FHA loans:

A 5-year adjustable rate FHA loan in New Jersey. This type of loan starts at a lower interest rate than the more common fixed-rate option and remains at that same low rate for five years, giving the homeowner a chance to settle in and set money aside before making larger payments.

The starting interest rate for a 5-year adjustable rate mortgage in New Jersey is usually 1 percent lower than the fixed rate.

This option appeals most to low or moderate income families who have never bought a home before.

A fixed rate FHA loan in New Jersey. This type of loan has a fixed interest rate that remains steady for the duration of the mortgage – a period of usually either 15 or 30 years.

A fixed rate FHA loan in New Jersey. This type of loan has a fixed interest rate that remains steady for the duration of the mortgage – a period of usually either 15 or 30 years.

The only change in your payments during this time will be from slight deviations in insurance or property taxes.

This option appeals most to buyers who want a home but haven’t been able to save up money for payments – usually recent college graduates or newlyweds.

An FHA condominium loan in New Jersey. This type of loan is pretty straightforward – it’s an option for buyers who are purchasing a condominium unit instead of a traditional house.

What advantages do homeowners have with an FHA loan in New Jersey?

The US Federal Housing Administration is the largest mortgage insurer in the world and approximately 30 percent of all home loans in the country are FHA loans.

This is because these types of mortgages come with several advantages:

FHA loans in New Jersey require a greatly reduced down payment. This is the biggest advantage to choosing an FHA loan over other types of mortgages.

The usual down payment on a home is twenty percent of the total price, but in New Jersey an FHA mortgage can start with a down payment as low as 3.5 percent.

This makes this type of loan the best choice for people who have steady work and can make regular payments but who haven’t saved up enough for a large up-front deposit.

The requirements for FHA loan approval are much more flexible.

In New Jersey, applicants for an FHA loan need to have worked for the same employer for at least two years, be able to make their down payment, and have a credit score of at least 620.

That’s it – there’s no minimum income requirement, and 620 is much lower than the 700 credit score the state requires for conventional mortgage applications.

In many cases, applicants that would normally be turned down will get accepted for an FHA loan because the lender knows they’ll make their money back from the government even if the homeowner defaults.

FHA loans also benefit the national economy by stimulating the real estate market, expanding the tax base, and creating jobs.

But for most of us the main benefit of an FHA loan in New Jersey is that it’s cheaper upfront and more accessible than traditional mortgages.

What are the disadvantages for an FHA loan?

FHA loans offer many attractive advantages, but they come with disadvantages as well, which is why it’s important to see if you are the type of person best suited to benefitting from this type of mortgage:

Buyers have to pay an FHA funding fee up front. Though this is still lower than a typical down payment on a home, the Federal Housing Administration charges a fee that’s approximately 1.7 percent of the total mortgage.

This is how the government protects its investment – it’s basically an insurance premium.

FHA loan recipients cannot cancel their insurance until they’ve paid off the whole mortgage.

Conventional home loans usually let recipients cancel private mortgage insurance payments after they’ve accrued a certain amount of equity.

In practice, this means that the FHA loan payments will probably be higher than those of conventional mortgages especially as you get to the end of the loan term.

Interest rates are often slightly higher for an FHA loan in New Jersey. This is how the lender makes up for the small up front payment.

In short, think of an FHA loan as having slightly larger monthly payments in exchange for a much smaller down payment.

What type of properties qualify for FHA Loans in NJ?

In New Jersey, many types of properties qualify for FHA home loans:

In New Jersey, many types of properties qualify for FHA home loans:

Townhomes

Multi-unit properties

Manufactured homes

Single-family homes

Condominium units

These properties must be at least 400 square feet and have been constructed after June 15, 1976.

They also have to meet rigorous safety standards – a government employee will appraise the house beforehand to make sure these standards are met.

The complete 21-page checklist these appraisers go through is detailed in Chapter 3 of the Department of Housing and Urban Development’s Handbook 4150.2, which can be found here.

In brief, they will disqualify a home with:

- Foundation cracks

- Loose handrails

- Structural concerns

- Holes or leaks in the roof

- Low water pressure

- No hot water

- Insufficient space

- Faulty HVAC system

Among other concerns.

The property must also cost less than the maximum lending limit for an FHA loan in New Jersey, as described on a county-by-county basis here.

How important is credit when applying for an FHA loan in New Jersey?

Credit is a major concern whenever you’re applying for a loan, but one of the major benefits of FHA mortgages is that they have much lower credit requirements.

In New Jersey, most FHA Underwriters require a middle credit score of 620, as well as three open trade lines on your credit report that have been there for a minimum of 12 months.

However, this credit limit is not actually set by the federal government. If you “shop around” you may find FHA-partnered moneylenders that will accept credit scores as low as 580. However, these lower credit requirements usually mean a higher down payment.

Also, some FHA lenders in NJ may consider “additional forms of credit” like long-standing accounts with your phone company or utility services in place of a FICO credit score.

What are the requirements for an FHA loan in New Jersey?

As of 2018, these are the typical requirements for an FHA loan in New Jersey:

As of 2018, these are the typical requirements for an FHA loan in New Jersey:

- A middle credit score of 620 or two forms of alternative credit.

- A property that has been appraised and meets the requirements of HUD Handbook 4150.2

- A property that is worth less than the maximum loan limits described here.

- A debt-to-income ratio of 50 percent or less

- Two years of steady employment history

- Ability to make a down payment of at least 3.5 percent

FHA Lenders in NJ

FHA Lenders in NJ can set their own standards for an FHA mortgage in New Jersey, but this is what you’re most likely to see.

It will often be worthwhile to spend time looking around for a lender that can work with your specific needs.

How do you receive an FHA loan in New Jersey?

FHA loans are insured by the American government but are originated by private moneylenders.

Most likely your local bank or mortgage company in New Jersey will have some kind of FHA loan program in place.

It’s often recommended to shop around several different lenders to find the one that has the best rate and the requirements that work best for you – the lowest possible down payment, for example, or maybe the most flexible credit scores.

Once you decide on a FHA lender in NJ, you will apply for the FHA mortgage just as you would for any other loan.

Your representative will then check your credit score, income, debt, and more to make sure you fit the lender’s requirements and the federal requirements for this type of loan.

What are the FHA loan rates for New Jersey?

The real estate market is in a constant state of flux, and as a result, loan rates will change frequently – sometimes even on a daily basis! What’s more, different lenders offer different rates for FHA loans in New Jersey.

As a result, we can’t give you an exact number for what the loan rate will be where you live. This is why it’s best to do some research before applying to a specific moneylender.

Do you have to be a first-time home buyer for an FHA loan in New Jersey?

FHA loans often appeal more to first-time home buyers than to other customers for the reasons we’ve listed above.

However, despite the common misconception, you do not have to be a first time buyer to be eligible for an FHA loan in New Jersey. That is not one of the federal requirements.

What is the maximum income limit for FHA loans NJ?

This is another popular myth with no basis in reality – there is no maximum income limit for FHA loan applicants in New Jersey.

However, FHA loans are usually a better investment for low-income families who are willing to accept greater ongoing payments in exchange for a lower down payment.

Get Pre Qualified for a New Jersey FHA Loan – Click Here.

by Mike Plambeck

Being Self Employed while seeking to borrow through the Fannie Mae lending system is an incredibly complicated process!

This article will help you understand and navigate through the guidelines surrounding being self-employed and applying for Fannie Mae. We will also cover recent important changes.

You’ll learn:

-

- What’s Changed with Fannie Mae and the Self Employed

- How You Can Get Help from Homeloansforall.com With Your Self Employed Fannie Mae Application

- Guidelines for Getting Approval with Fannie Mae while being Self Employed

- What to do if your business distributions are irregular

- What can you do if you don’t have 2 years tax returns

- What if You are employed while also running your own business.

Home loans for self-employed borrowers are becoming more accessible by the day.

‘Why?’, you ask?

Because of recent changes to Fannie Mae self-employment guidelines in regards to income.

In this article, we’ll discuss in detail what’s changed, explain why these changes specifically benefit self-employed homeowners. We will help you through the process of securing a Fannie Mae self-employed loan for yourself.

We Can Get Your Self Employed Fannie Mae Loan Approved

Fill Out The Form Below To Get Help Today!

Fannie Mae Self Employed Guidelines: What’s Changed?

“Fannie Mae” is the colloquial name for the Federal National Mortgage Association, a publicly-traded company sponsored by the US government.

For years, their borrowing process has been quite tedious, especially for Fannie Mae self-employed borrowers. Largely, it has been so due to the burdensome documentation requirements and the Fannie Mae verification of employment guidelines.

For example, on top of the usual requests for credit reports and bank statements, self-employed borrowers have had to show their federal income tax returns. The more other related documentation, the better.

New changes have made these loans much more accessible and have simplified the process for everyone. Self-employed and salaried persons with secondary sources of income from non-salaried businesses find new ways convenient for them.

One of the biggest changes is that only one year of federal income tax is required instead of two. Though, this only applies to certain cases. Also, the body has unveiled a new income calculation that caters to business owners with a little-to-no history of distributions.

-

-

- Fannie Mae Self-employed borrowers whose business distributions are irregular or non-existent will now have show access to their business income. This can be shown easily by producing a letter of incorporation or the K-1 filing. Additionally, your business should show adequate liquidity that can support income withdrawals.

- Self-employed borrowers whose businesses do not have the previously required two years of federal tax returns now only have to show one year of federal tax returns. However, your business’s cash flow needs to appear realistic and credible. It also should cover at least 12 months.

- Borrowers with a self-employment income from a second, non-salaried business will no longer be required to show proof of income from their self-employment sources. If the income from the “salaried” job qualifies them for a mortgage, there is no need for that. If you’re a borrower living off pension payments, retirement income, social security income as well as dividends, this is definitely good news. However, you will have to produce your federal income or corporate tax returns as it relates to your non-salaried source of income.

It is worth noting that these new rules only apply to conventional home loans, and thus guidelines for other mortgage products such as FHA loans and VA loans may differ.

How To Get Approved For A Fannie Mae Self-Employed Mortgage

These changes to the Fannie Mae self-employed guidelines and current mortgage rates under 4% are a sign for you to become a homeowner. There’s never been a better time to shop for a mortgage. Here’s a quick guide to getting approved for a mortgage if you’re self-employed.

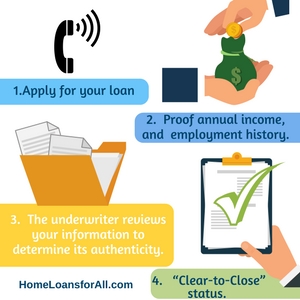

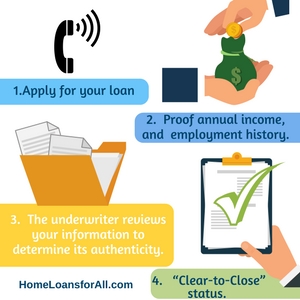

Firstly, you should apply for your loan in-person, by telephone or online. Applying for a loan usually includes showing proof of your annual income, savings, debts, your locality, and your employment history.

The last section laid out some of the more specific Fannie Mae self-employment guidelines. Your lender will tell you exactly what you need to send them.

Once you’ve applied, your application will be forwarded to a bank employee, underwriter. The underwriter reviews your information to determine its authenticity. This includes making requests for supporting documentation and clarifications where needed.

Your underwriter is at liberty to seek as much information from you as they deem right. It’s their job to make sure your loan application is feasible, based on the minimum qualification standards of a respective bank.

For example, you may have to explain and even show proof of the source of an unusually large deposit (60 days or so).

If your loan meets the bank’s qualification guidelines, including the Fannie mae verification of employment guidelines, the underwriter will assign your loan a “Clear-to-Close” status. Then you’re all ready to start financing your house!

Also, the underwriting process doesn’t follow any specified pattern and will vary for different types of loans, lenders, and applicants. So, if the underwriter asks you weird questions, it only seems to you. During the underwriting process, the underwriter is your best friend.

This means all Fannie Mae self-employed borrowers will be required to present specific documentation depending on what the underwriter considers right.

So, What Has Changed With the New Rules?

This borrowing process has for a long time been quite tedious. Self-employed borrowers felt this even harsher than everyone.

For example, on top of the usual requests for credit reports and bank statements, self-employment borrowers have had to show their federal income tax returns. Imagine, someone loves seeing those papers! They would also ask for additional documents that might be proof of business stability. Whatever these docs might be, you’d better provide them or you lose any chance of Fanny Mae loan whatsoever.

However, with the new mortgage guidelines in place, the amount of documentation is smaller now.

This move waives a fair share of the paperwork especially for the self-employed as well as the salaried persons with secondary sources of income from non-salaried businesses.

Fannie Mae Guidelines for Self-Employed Mortgage Borrowers

As mentioned earlier, the Fannie Mae guidelines are keen to make access to home loans easier for the self-employed mortgage borrowers. The policy updates that have been in effect since late-August 2015 covers three main areas;

-

-

- Self-employed borrowers whose business distributions are irregular or non-existent

In this case, you (borrower) will only be required to have access to your business income which you can easily prove by producing a letter of incorporation or the K-1 filing. Additionally, your business should show adequate liquidity that can support income withdrawals.

-

-

- Self-employed borrowers whose businesses do not have two years of federal tax returns.

The new rules offer looser guidelines for this category. All that you need is proof of one year of federal tax returns. However, your business’s cash flow needs to appear realistic and credible and covering 12 months and over. No cheating! You learned this in school, right?

-

-

- Salaried borrowers who also have a second self-employment job

You do not have to provide income from your self-employment job/business as proof to qualify for a mortgage. This will particularly be necessary if you’re a borrower living off pension payments, retirement income, social security income, or dividends.

This means you no longer have to produce your federal income or corporate tax returns as it relates to your non-salaried source of income. However, this only applies if your application for a mortgage indicates adequate household income. It should be less than your salaried job.

It is worth noting that these new rules only apply to conventional home loans, and thus guidelines for other mortgage products such as FHA loans and VA loans may differ.

That’s it! Our comprehensive guide to the new Fannie Mae guidelines for self-employed borrowers has come to its end. So, what does this mean to you? Well, it’s your perfect opportunity to consider taking that mortgage you’ve only dreamed about before. The hitherto stringent mortgage rules are gone. It’s your time to celebrate the newly found opening and own a home.

Related Articles:

How To Successfully Apply For A Mortgage While Self-Employed

Getting Your Mortgage Approved: What Loan Officers Look At

Fannie Mae Homepath Program

by Mike Plambeck

Can you really have a mortgage after bankruptcy? People who have declared bankruptcy often wonder if it is still possible for them to obtain a mortgage in the future. Fortunately, the answer is a resounding yes! Many families are still eligible to receive a new mortgage after declaring bankruptcy if they can follow the proper steps to obtain lender approval.

The first thing you need to do is to have the bankruptcy discharged. While this might sound like a monumental task, it is a normal part of the bankruptcy process. The discharge simply means that you have been released from all of the debts you previously owed. You might need to go about this differently depending on whether you had a Chapter 7 or a Chapter 13 bankruptcy.

We Can Help You Qualify For a Mortgage After Bankruptcy

Fill Out The Form Below To Get Help Today!

Depending on the circumstances and the filing method, you will need to either follow your repayment plan or simply wait for the discharge to occur. Under a Chapter 7 bankruptcy, you will typically receive your discharge four months after filing.

Chapter 13 bankruptcies take longer because they involve repayment plans. This might require three to five years’ worth of these payments before you are released from the debt.

Once the discharge happens, you can finally move forward with the necessary steps to obtain a new mortgage. Homeownership will once again be in your future if you can adhere to some of these key steps.

What Do I Need to Do Before Applying?

Before you can head straight to the bank to talk about buying a house after Chapter 7 and a foreclosure, you will need to take a few proactive steps. These steps can help you to receive a mortgage after Chapter 7 discharge with more favorable terms and in a much timelier manner than might otherwise be possible.

Prove to lenders you can pay the money back

Getting the discharge isn’t going to be enough to demonstrate to your lender that you are ready to take responsibility for a new mortgage.

Getting the discharge isn’t going to be enough to demonstrate to your lender that you are ready to take responsibility for a new mortgage.

If they are going to loan you a substantial amount of money, you will ultimately need to prove that you can be trusted to repay it. This doesn’t require a specified period of time, but there are definitely a few steps you can take to make it more likely that lenders will issue financing for your new home.

The first step is to get a secured credit card. These cards require you to make a deposit amount for the “credit line” that the bank is willing to issue you. Each month, you can use this small limit to purchase groceries, gas, or other inexpensive items that you know can be repaid. Be certain to pay your credit card bill on time each month to demonstrate that you can handle this responsibility.

The other step that many individuals will take to prove their creditworthiness is to take out an installment loan. An installment loan is any type of loan that features set monthly payments over a specified period of time.

Fixed-rate mortgages are a great example of installment loans, but you can also receive them in much smaller quantities. You can use these to pay for car repairs, a new car, or to pay off unforeseen medical bills. Much like the secured credit card, it’s imperative that you make the payments on time each month without fail.

Both of these simple suggestions can prove to lenders that you have learned a great deal of fiscal responsibility following your bankruptcy. You won’t be able to convince them of your creditworthiness overnight, but these small steps can add up to long-term value when done properly.

Build up your credit after bankruptcy

Filing for bankruptcy can seriously disrupt your credit score and wreak havoc on your financial status. Rebuilding your credit to resemble that of a financially healthy individual is a time-consuming process that consists of simple steps over a long period of time.

You won’t see an immediate gain in your credit score but sticking with these solutions is sure to show you a difference over time.

Use only a small percentage of available credit.

Many people automatically assume that they should max out their credit limits on their card or loan amounts. It can be misleading that lenders will issue you a line of credit but expect you not to take advantage of its full value. However, this is exactly what you need to do to demonstrate financial trustworthiness. Experts recommend that you only utilize about thirty percent of your available credit at any given time.

Do you already have credit cards that are reaching their upper limits? Make a conscious effort to repay some of this debt so you can lower your overall credit utilization.

Move slowly – pay back money on time or early.

Paying things off quickly might be too much for your finances to handle if you’ve recently filed for bankruptcy. Instead, it’s a much wiser decision to take baby steps in regards to your monthly debts and payments. Make sure that every bill is paid on time or slightly early to prevent mishaps on the actual due date.

You can set an alarm on your phone to remind you that payments are due on a specific day each month.

You can set an alarm on your phone to remind you that payments are due on a specific day each month.

Make sure you set the alarm on a day and time where you will be available to pay the bill immediately, such as a Saturday morning or a Thursday evening after work.

Set up autopay.

Instead of scheduling a time to pay your bills, you might want to consider enrolling in autopay. If any of your accounts offer an autopay feature, you can fork over your payment information and select your desired payment date. They will automatically handle the transfer of your funds without any additional action required from you.

This is an extremely convenient way to make sure that you pay back your money either on time or a few days early each month.

Put money in savings.

Having a savings account should be considered a necessity for everyone, but it is particularly essential for individuals who need to rebuild their credit. A savings account demonstrates to lenders that you have some financial flexibility to set money aside for disasters and unforeseen financial emergencies. These funds are a great way to prevent yourself from maxing out the credit card or setting the stage for late and missed payments.

Not only can savings accounts be a practical way to manage your finances, but it can also translate into your down payment when you do qualify for a new mortgage after bankruptcy. Many lenders will require a higher down payment from those who have low credit scores, so this savings account could come in handy for your new purchase.

Stay at the same job for a while.

A steady employment history can do wonders for showing lenders that you are trustworthy. They want to see that you have a reliable and steady source of income for a long period of time. This ensures that you will have the means necessary to pay off your mortgage each month, in addition to all of your other bills.

It’s recommended that you show at least a two-year history of staying within the same field of work. Your employer and the circumstances might change, but your job title and responsibilities should stay relatively the same.

Don’t apply for at least two years

There are minimum waiting periods for individuals who want to obtain a mortgage after bankruptcy. A conventional mortgage through Fannie Mae or Freddie Mac could require you to wait up to four years from the time your bankruptcy is discharged. Other lending options might be able to provide financing in as little as two years, including advantageous programs like the FHA mortgage loan.

Because there are a few necessary waiting periods, it is best not to tax yourself with attempting to secure financing until these waiting periods are up. Two years is a safe amount of time to spend rebuilding your credit, saving up for a down payment, and proving your financial trustworthiness before talking with your lender about the possibility of a loan.

Read our article on Bad Credit Home Loans and How To Get Approved here.

What Should I Do When I’m Ready to Apply for a Mortgage After Bankruptcy?

Once you know that you’re ready to start seeking out assistance and financing from a lender, it’s important that you get everything in order. There are a few steps you will still need to take to prove that you’re ready to take on the immense responsibility of a mortgage after bankruptcy. The best thing you can do is start to prepare all of your paperwork and proof now before you ever set foot in the lender’s office.

Show you have a good debt to income ratio

Lenders want to know that you can actually afford the home you are attempting to purchase.

Lenders want to know that you can actually afford the home you are attempting to purchase.

Most of them will want to see a debt to income ratio that is 43 percent or lower. What does this mean practically? Well, it means that your total monthly debts (including your new estimated mortgage, interest, taxes, and insurance payments) will equal 43 percent or less of your gross monthly income.

You can consider this in terms of real-world numbers for a moment. Let’s say that you have $600 in debt that you pay each month that covers your student loan debt, auto loan, and credit card payment. You aren’t quite ready to purchase a home, so we won’t factor that into your debt to income calculation.

You also don’t need to add in monthly bills that are not “debts” where you have borrowed money from someone else such as your groceries or gas bills.

If you make $2,000 each month, that means that your current debt to income ratio is around thirty percent.

Round up all of your loan statements in every area to show your lender just how much you pay each month. If you find that your debt to income ratio is too high to add in a mortgage payment, you might want to start paying down some of your other loans before you apply for a new mortgage.

Show that you have money in the bank

Lenders don’t want to issue financing to people who barely have enough money in the bank to cover their monthly bills. They want to see that you have money in both your checking and savings account to prepare adequately for the future. This should include money for your down payment as well as “rainy day” money.

Lenders don’t want to issue financing to people who barely have enough money in the bank to cover their monthly bills. They want to see that you have money in both your checking and savings account to prepare adequately for the future. This should include money for your down payment as well as “rainy day” money.

Start to take your future into consideration as well before you head to the bank. A lender might want to see your retirement savings account in addition to a regular savings account. This long-term plan can contribute to your overall financial health and demonstrate a high degree of fiscal responsibility. These are all things that a lender is bound to look for when issuing you a mortgage after bankruptcy.

Have a big down payment ready.

When your credit score is low, lenders prefer to see other compensating factors to give them a little peace of mind for taking a risk on you.

When your credit score is low, lenders prefer to see other compensating factors to give them a little peace of mind for taking a risk on you.

One of the easiest and most common compensating factors for lenders to require is a larger down payment.

This ensures that you have more equity built up in the property before you ever move into the house. It allows them to take a much lesser risk on financing your property in the event that you filed for bankruptcy again or the mortgage moved into foreclosure.

A conventional mortgage used to require a twenty percent down payment, but many of the other financing programs are much more advantageous these days. Consider the down payment required for an FHA (Federal Housing Administration) loan.

For individuals with credit scores of 580 or higher, you will only be required to come up with a 3.5 percent down payment. Credit scores between 500 and 579 will require a substantially higher down payment of ten percent.

While this can certainly derail your plans for more immediate homeownership, it does have some benefit to you once you move in. A larger down payment lowers the principal balance on your mortgage and enables you to have lower monthly payments.

Conclusion

Getting a mortgage after bankruptcy is possible, no matter whether it was a Chapter 7 bankruptcy or a Chapter 13. You will have to wait through the acceptable waiting periods required by your lender and the specific financing program you are interested in. However, homeownership can be a realized goal in the years ahead despite your murky financial past.

You need to take the steps today to start moving toward realistic homeownership. Building your credit score, coming up with a large down payment, and getting your finances in order are essential steps toward receiving financing for a new home in the future. Evaluate where you are right now to determine the best course of action moving forward.

Frequently Asked Questions

How soon after declaring bankruptcy can I buy a home?

Most experts recommend waiting at least two years before applying for a new mortgage. Some loan programs will allow you to purchase a new home just one year after a bankruptcy discharge if there were extenuating circumstances leading up to your bankruptcy.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

A Chapter 7 bankruptcy is a liquidation bankruptcy for individuals who have little to no income and who need to pay off large amounts of debt for medical bills, credit card debt, and other varieties of loans. You might not have any assets to sell in order to cover the cost of your debts.

A Chapter 13 bankruptcy is designed for individuals who make too much money and who can afford to repay at least a portion of their debt. It is characterized by a repayment plan that might stretch out up to five years before you receive a discharge from the bankruptcy.

How long does a bankruptcy stay on my credit score?

It depends on what kind of bankruptcy you file. A Chapter 7 bankruptcy can stay on your credit report for up to ten years, while a Chapter 13 bankruptcy can stay on your report for up to seven years.

How long after bankruptcy can I buy a house?

You will likely have to wait at least two years to purchase a home after bankruptcy. However, you might be able to apply in one year if you had extenuating circumstances leading up to your bankruptcy.

Can I have a mortgage after bankruptcy?

Yes, you can have a mortgage after bankruptcy if you actively work to repair your financial status and credit score. This might require years’ worth of work, but it is possible.

Can you get a mortgage after bankruptcy and foreclosure?

Yes, you can get a mortgage after bankruptcy and fore closure if you can restore financial balance and repair your credit score.

Additional Mortgage After Bankruptcy Resources

Pre Qualify for a Mortgage Today, with Our Help – Even if You’ve had a Bankruptcy – Click Here.

by Leslie Rowberry

Many people have heard of the HUD Dollar Homes program and are understandably interested in what it could mean for them. After all, everyone wants to find a bargain on the home of their dreams.

This program is run by the Department of Housing and Urban Development (HUD) and features homes that were once for sale through the HUD Homestore. All of the properties listed on this government website are foreclosed homes that once had an FHA mortgage.

Have a home you like but still need to secure financing? Get pre approved fast – Click Here!

In a Federal Housing Administration (FHA) loan, the federal government agrees to back a portion of the loan for a private lender.

The lender will want to recoup the money they lose if a homeowner decides to stop making their monthly mortgage payments.

Many of these lenders will turn the property back over to the government and HUD now retains ownership of the homes.

They attempt to sell these properties at a substantially reduced price in order to entice home buyers and government agencies who might be interested in purchasing bargain houses.

HUD homes can be purchased by anyone who has the money or the funding required to pay for one of these properties. Unfortunately, there are some common misconceptions relating to these dollar homes. It’s time to take a closer look at just what this program entails.

We Can Help You Qualify For HUD Homes

Fill Out The Form Below To Get Help Today!

What are HUD Dollar Homes?

The HUD Dollar Homes are properties that were listed on the HUD Homestore for six months but were unable to sell for one reason or another.

Eventually, the government simply wants to cut their losses with a property, so they decide to make a very bold move. They reduce the price on all of these homes to just a single dollar plus any closing costs that are necessary.

The properties will only be offered to the local government for a ten-day period. The original list price of the home must have been $25,000 or less in order to qualify for this program.

Now, this is where many homebuyers can become confused about the process.

These HUD Dollar Homes are only available to the local government for purchase. This gives state agencies and nonprofit organizations an opportunity to fix the homes back to a habitable condition and restore some parts of a run-down neighborhood.

The idea is that these extremely inexpensive 1 dollar HUD homes can help these agencies to provide housing for low or moderate-income families.

All of the properties that are reduced into these HUD Dollar Homes listings are going to be single-family residences, but many of them will need major remodeling.

The extensive list of repairs could be the reason why these homes have remained on the market for such an extended period of time.

The local government may have to forge connections with various nonprofit organizations and other local programs in order to get these homes back in shape and available to families in need of assistance.

It is a great way for the government to give back to a community and start to draw in new residents to a particular area.

After all, it’s better for the local economy to have a new family move into one of these homes that were sold for just one dollar than for them to remain a vacant eyesore.

How Do I Find These Homes?

If you are a part of a government agency that would be eligible to purchase these properties (or you’re curious what might be available in your area), you can search the available HUD 1 Dollar homes on the HUD Homestore.

This website is the listing place for every home available through HUD, including the HUD Dollar homes. Right on the home page, you can filter for houses that meet your search criteria including state, city, zip code, and even street name.

Under the “buyer type” heading, you will need to select the drop-down box that reads “Dollar Homes.”

From here, you can see if there are any HUD 1 Dollar homes that meet your current search criteria.

Keep in mind that the availability of these homes is constantly changing. A property you see listed under the HUD Dollar Homes search function today may not be available tomorrow. At such a rock-bottom price, these homes are often sold relatively quickly to the applicable agencies.

Local agencies that offer housing assistance to low-income families may have some of the remodeled properties available for sale or rent. Be sure to check around with your local agencies or government officials to see how you might be able to find some help with providing adequate housing for your family as a result of this financial incentive for the government.

HUD Dollar Homes Conclusion

The HUD Dollar Homes are an excellent option for government agencies and nonprofits to coordinate their work and offer assistance to low or moderate-income families.

While many of these properties may require some serious renovation, the reduced price of the homes allows for more financial flexibility with this process.

While it is disappointing that the HUD homes for a dollar aren’t available to the general public, it does still benefit the communities where these properties are located.

Frequently Asked Questions

Can you really buy a house for a buck?

Yes, local governments can purchase homes that have been listed on the HUD Homestore for longer than six months at the low price of just one dollar.

Who can buy HUD Dollar Homes?

Only local governments can purchase HUD Dollar Homes. Once local governments purchase the homes, they are made available for low to moderate income families which can then revitalize communities.

What are HUD Dollar Homes?

HUD Dollar Homes are properties listed at just $1 that are available for purchase for local governments to help assist low-income and moderate-income families with housing. These properties must have been on the market for six months without a sale and be priced under $25,000.

Are there other programs available?

Yes, HUD does offer other programs to entice buyers to purchase these foreclosed homes. Their Good Neighbor Next Door program offers a 50 percent discount to law enforcement officers, emergency medical technicians, teachers, and firefighters if they agree to live in the home for three years.

Their nonprofit program offers a 30 percent discount to nonprofits who will use the properties to assist low-income families with their housing.

Owning a home gives you a sense of security and stability you just can’t get from renting an apartment or a duplex.

Owning a home gives you a sense of security and stability you just can’t get from renting an apartment or a duplex.  An FHA loan is a housing loan that is insured by the United States Federal Housing Administration, from which it takes its name.

An FHA loan is a housing loan that is insured by the United States Federal Housing Administration, from which it takes its name.  A fixed rate FHA loan in New Jersey. This type of loan has a fixed interest rate that remains steady for the duration of the mortgage – a period of usually either 15 or 30 years.

A fixed rate FHA loan in New Jersey. This type of loan has a fixed interest rate that remains steady for the duration of the mortgage – a period of usually either 15 or 30 years.  In New Jersey, many types of properties qualify for FHA home loans:

In New Jersey, many types of properties qualify for FHA home loans:

As of 2018, these are the typical requirements for an FHA loan in New Jersey:

As of 2018, these are the typical requirements for an FHA loan in New Jersey:

Getting the discharge isn’t going to be enough to demonstrate to your lender that you are ready to take responsibility for a new mortgage.

Getting the discharge isn’t going to be enough to demonstrate to your lender that you are ready to take responsibility for a new mortgage.  You can set an alarm on your phone to remind you that payments are due on a specific day each month.

You can set an alarm on your phone to remind you that payments are due on a specific day each month.  Lenders want to know that you can actually afford the home you are attempting to purchase.

Lenders want to know that you can actually afford the home you are attempting to purchase.  Lenders don’t want to issue financing to people who barely have enough money in the bank to cover their monthly bills. They want to see that you have money in both your checking and savings account to prepare adequately for the future. This should include money for your down payment as well as “rainy day” money.

Lenders don’t want to issue financing to people who barely have enough money in the bank to cover their monthly bills. They want to see that you have money in both your checking and savings account to prepare adequately for the future. This should include money for your down payment as well as “rainy day” money.  When your credit score is low, lenders prefer to see other compensating factors to give them a little peace of mind for taking a risk on you.

When your credit score is low, lenders prefer to see other compensating factors to give them a little peace of mind for taking a risk on you.