by Mike Plambeck

Buying a home can be confusing and scary process with an endless list of items to do. Of all the pieces that go into buying a home, none is quite like the mortgage. With a range of different mortgage options, it can be difficult to decide which option is best. One such option is the FHA loan, specifically the FHA loan in Oregon. While the FHA loan comes with its own list of things to keep in mind, in many cases it is the best choice for home buyers.

Buying a home can be confusing and scary process with an endless list of items to do. Of all the pieces that go into buying a home, none is quite like the mortgage. With a range of different mortgage options, it can be difficult to decide which option is best. One such option is the FHA loan, specifically the FHA loan in Oregon. While the FHA loan comes with its own list of things to keep in mind, in many cases it is the best choice for home buyers.

This article is intended as an overview for anyone considering taking on a FHA loan in Oregon. It will touch on the key points to understand when considering a FHA loan, as well as the pros and cons of taking one out, and the process that is involved in securing one.

Get pre-qualified for a FHA Loan in Oregon Today!

What is an Oregon FHA Loan?

A FHA loan in Oregon is a mortgage that is insured by the Federal Housing Administration (FHA). What separates this type of mortgage from a more traditional one is the lower down payment, along with less strict credit requirements. In many cases, the down payment required is only 3.5%, making it the perfect choice for those who don’t have the more standard 20%.

Different Types of FHA Loans in Oregon

During the course of shopping for loans several recurring terms will likely come up.

During the course of shopping for loans several recurring terms will likely come up.

Fixed-Rate FHA Loan

A fixed rate mortgage is one where the interest rate does not fluctuate. It won’t get any lower, but it won’t go up. This means monthly payments will remain the same throughout the loan term, making it very easy to budget. This makes it an attractive choice for many borrowers.

30 Year FHA Loan

This is the most popular term for mortgages and FHA loans. A 30 year loan simply means that re-payment of this loan will take place over the next 30 years. Compared with another popular loan term of 15 years, a 30 year mortgage gives twice as much time to pay off. Keep in mind though that during those extra years the loan will incur additional interest charges making the total cost of the loan larger.

In addition to the above, there are other options that are available for FHA loans. These include ARM loans, hybrid, or a balloon mortgage.

Advantages of an FHA Loan in Oregon

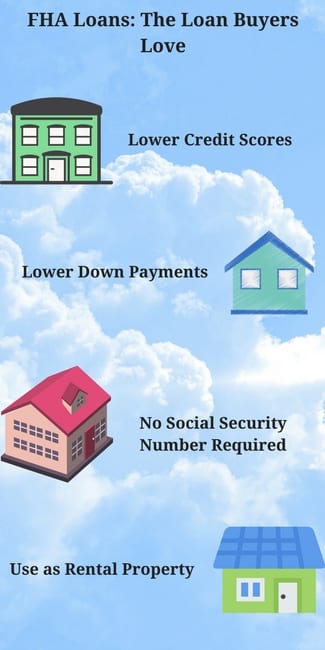

The main benefits of the FHA loans are its low down payment and low, at least in comparison to other mortgages, credit requirements.

The main benefits of the FHA loans are its low down payment and low, at least in comparison to other mortgages, credit requirements.

To start, banks are very motivated to approve these types of loans, which is evident in the fairly loose requirements. For people who may have been denied a mortgage loan in the past, have less than good credit, or lack a large down payment, an FHA loan in Oregon is an attractive choice. Due to the government backing and funding requirements, banks are much more likely to approve these types of loans.

The small down payment also makes them very attractive for first time home buyers. Traditional mortgages typically look for around 20% down payment, which can be difficult for many to come up with. This is especially the case for first time home buyers who lack any sort of home equity to negotiate with. FHA loans however, only need 3.5%! This allows a much wider range of people to apply for and be approved for this type of loan.

Disadvantages of an FHA Loan in Oregon

While there’s definitely some attractive positives to taking one, FHA loans do have some cons to keep in mind when considering getting one. This is mainly in the form of additional fees owed to secure the loan. At the beginning of the loan term there is an upfront funding fee of, at the time of writing, 1.75% of the total value of the loan. This amount can be working into closing costs however.

In addition to the upfront fee, there is also an annual fee broken into 12 monthly payments. This mortgage insurance is required to be carried for the lifetime of the loan. This too is calculated as a percentage of the total loan amount.

What Properties Qualify?

Not all properties are eligible for a FHA loan in Oregon, and there are additionally some requirements all properties need to meet. To start, FHA loans are primarily intended for those who intended to occupy the property in question. Therefore, they typically cannot be used for things like vacation, rental, or investment properties.

There’s also minimum property standards that need to be met before the loan is approved. Some items that a property will look for are:

● Asbestos

● Contaminated Soil

● Roofing expected to last for 2+ more years

● Located in an area of excessive noise

● Working bathroom with sink, toilet, and shower

● Structural soundness

This is just a short list of some of the items an inspector will look for. The housing department has put together a full list that goes into more depth on what disqualifies a property. If any issues are found, they will have to be fixed before the loan will be approved.

FHA Loan Limits Oregon

Another caveat of FHA loans is the limits imposed on how much can be borrowed. Each year, the max borrow amount is adjusted based on media home prices. This amount also varied for different residence types, and how many families are occupying a dwelling. A two family, duplex style home has a higher allowance than a single family home. Most buyers however, fall into the “One-Family” designation.

Currently, the range for “One-Family” dwellings ranges from roughly 275-408k. These values are based on county, so where a house is located can drastically affect the loan amount available. As noted above, this range is subject to change, so potential buyers should check the FHA website to get an updated look at the limits.

Credit Score

As with any type of loan, credit score is a major consideration when looking to get a FHA mortgage. For the standard 3.5% down payment, a credit score of 580+ is required. Those below this are not automatically disqualified, although additional conditions may apply.

The primary way to get one with a lower credit score is to offer a higher down payment. Typically, for those < 580, a down payment of 10% is required to offset the additional risk. They may also be subject to higher interest rates. They can also attempt to use alternative credit such as utility bills to prove credit worthiness. This is at the discretion of the lender however, so plan to call ahead.

FHA loan Requirements in Oregon

While easier to get from a credit perspective, there are a number of additional FHA loan requirements in Oregon for securing a FHA loan. Some of these are unique to this type of loan, and may not be required for a traditional mortgage. Here is the list of requirements for those taking out a FHA loan:

While easier to get from a credit perspective, there are a number of additional FHA loan requirements in Oregon for securing a FHA loan. Some of these are unique to this type of loan, and may not be required for a traditional mortgage. Here is the list of requirements for those taking out a FHA loan:

● 3.5% down payment (potentially more for bad credit borrowers)

● Credit rating of 580+ (may be lower in certain cases)

● Steady employment history, usually at least 2 years

● Must be for a primary residence

● Property must be appraised and assessed by a licensed inspector

In addition, borrowers are also required to have debt to income ratios in an acceptable range. For front-end this is less than 31%, and back-end less than 41%. Finally, any bankruptcies or foreclosures should be 2-3 years in the past. In the time since, the borrower should have attempted re-established their credit.

How Do You Apply?

The first step to applying for any type of loan is to get your numbers in order. Make sure that your credit score is in the expected range and come up with budget estimates that keep your debt to income ratios acceptable.

Once all that is in order the next step is to find a lender that is approved to give out FHA backed loans. The FHA website has a handy tool for finding FHA lenders in Oregon that are approved. It does pay to shop around a bit as not all lenders will offer the same interest rates.

Once you’ve determined a reputable lender, you’ll be required to submit various documents that will verify things like employment, income, and credit. These documents include:

● W-2 from the last two years

● Tax documents

● Bank statements

● Proof of income

● Address of past residences

● Information on past employers

This information is then used to determine if you are eligible for a FHA loan in Oregon. Once you’ve gone through the approval process you’ll need to have the home inspected as mentioned above. This inspection must be ordered by the lender, and the inspection must pass, or issues must be fixed, in order to secure the loan.

What Are The FHA Loan Rates In Oregon?

The interest rates for FHA loans can change daily, so check with a lender to determine the current rate being charged. FHA lenders in Oregon do have the ability to charge their own rates, so it’s very likely that two lenders for the same loan will have different interest rates. In fact, many times the rate is up for negotiation, so don’t be afraid to ask your lender to go lower on the rate or match a competitor.

Rate Lock

Once a lender has committed to writing a loan, they’ll provide the borrower with what is know as a rate lock. This will usually last from 30-45 days, but can last longer at the discretion of the lender. A rate lock simply locks in the interest rate at its current value and prevents it from moving with the market. Many lenders will also allow borrowers to pay to extend the length of the rate lock.

Once a lender has committed to writing a loan, they’ll provide the borrower with what is know as a rate lock. This will usually last from 30-45 days, but can last longer at the discretion of the lender. A rate lock simply locks in the interest rate at its current value and prevents it from moving with the market. Many lenders will also allow borrowers to pay to extend the length of the rate lock.

Keep in mind though, rate lock is a double edged sword. While it will keep your interest rate from getting any higher, it will also keep if from going lower.

Apply for your FHA Loan in Oregon Today!

FHA Loan in Oregon FAQs

1. Do You Have To Be a First Time Home Buyer To Qualify?

No, FHA loans are open to anyone who meets the requirements. Weighting the pros and cons can help you decided whether to go with FHA loan or a traditional mortgage.

2.What Is The Maximum Income Limit for FHA Loans?

There is no maximum income, if you meet the requirements you are eligible to apply for a FHA loan in Oregon. Keep in mind though, for higher income families that a traditional mortgage is likely to be cheaper over the life of the loan if they can supply a larger down payment.

3.Can you Refinance a FHA Loan?

Yes you can refinance into another FHA loan (called a streamline refinance) or into a traditional loan. Both options have their own set of pros and cons, so it’s important to understand each before making a decision.

Mortgages are one of the most confusing parts of buying a home, but hopefully this article has helped you decide whether a FHA loan in Oregon is the right choice. While certainly attractive on the surface, there are pros and cons to consider before diving in. Making sure you understand the full process is the best step to take to get the best deal when buying a new home!

by Mike Plambeck

In order to officially secure financing on your next home purchase with the VA financing, you will need to obtain a VA Appraisal. This tool is used to determine the fair market value of the home you intend to buy. In turn, this helps both the buyer and the lender to protect their interests.

In order to officially secure financing on your next home purchase with the VA financing, you will need to obtain a VA Appraisal. This tool is used to determine the fair market value of the home you intend to buy. In turn, this helps both the buyer and the lender to protect their interests.

The VA home appraisal is a significant hurdle that must be crossed before you can move forward with purchasing your home.

How does this tool help to protect both you and the lender? Some homes are priced above what would be considered fair or reasonable based on their condition and the prices of the comparable surrounding homes.

We Specialize in VA Home Loans

Fill Out The Form Below To Get Help Today!

If you were to default on your loan, the bank would take ownership of your property. They want to ensure that they can resell the home to recoup their initial investment in your financing.

Similarly, not all homeowners intend to stay in one home for the rest of their lives. You may decide to move on or receive orders to be stationed elsewhere across the country.

The home you purchase should be able to be resold for at least the amount you originally paid in order to cancel out the mortgage debt you incurred.

The lender is the preferred party who will initiate the appraisal process and formally submit the request shortly after the home moves under contract. However, any party to the mortgage purchase may submit the request for a VA loans appraisal as long as it is a VA-certified inspector who completes the job.

Is a VA Appraisal the Same as a Home Inspection?

On the surface, you may notice that the VA loans appraisal is meant to financially protect the lender.

The VA appraisal is also designed to help protect veterans from purchasing a home in need of significant repairs. This must be completed prior to the closing of the loan in order to guarantee financing from the lender and the Department of Veterans Affairs.

The timing of the VA appraisal prevents the sale from going too far without the property meeting minimum property requirements or being reasonably priced.

While the primary goal of the VA loans appraisal may first appear to be protecting your financial interests, it also ensures that the house meets the minimum property requirements. These are the basic rules established that make the house safe and sanitary.

Appraisers are looking for major hazards, including those with electrical issues, termites, or running water. It’s a cursory glance over many of the most important components of a home, but it’s not an exhaustive list.

A VA home inspection provides a more thorough examination of the property. This additional step is optional but highly recommended. A home inspection may uncover far more issues with the property than you could expect with an appraisal.

Inspectors are trained differently than appraisers, with an eye more for the finer details of your home. They will thoroughly inspect the roof, electrical, plumbing, and more.

Once you have a detailed look at any issues that present themselves, you may opt not to purchase the home (if you have an inspection contingency). The repairs could be too costly or more extensive than you’re willing to commit to.

However, a VA home inspection is a great idea to make sure that you know what to expect before you take out a thirty-year mortgage.

VA Loan Inspection Requirements

This federal program wants to ensure that every property purchased by veterans and active-duty service members meets a few minimum standards.

This federal program wants to ensure that every property purchased by veterans and active-duty service members meets a few minimum standards.

These are known as the minimum property requirements (MPRs). They help to establish a baseline that determines whether a property is going to be safe, sound, and sanitary for your residence.

It may seem like another hoop to jump through or a delay in obtaining your financing, but these property requirements are designed to protect you as the home buyer. As we mentioned earlier, this is not an exhaustive list of issues that could be wrong with the home.

You would need an inspection for that. However, this is to make sure that it meets the VA loan inspection requirements in regards to basic health and safety.

For example, they will start by making sure that this is designed for residential purposes only and provides adequate living space.

There isn’t necessarily a magic formula to determine the amount of living space necessary, but it should be large enough to allow you to do all of the basic daily activities like eating and sleeping.

Beyond that, here are a few other items that are included in the VA home inspection requirements:

- Electrical and plumbing systems are safe. The property must be able to demonstrate that all of these systems work appropriately and will continue to do so. It should be noted if it becomes apparent that a significant repair is looming on the horizon.

- Heating is adequate. The home must have heat in order to make a safe living environment. This will be tested as part of the minimum property requirements.

- Water is available. Clean drinking water is a must-have feature for any home.A VA loans appraisal will make sure that there is running water available and provide testing of well water to determine whether it is safe to drink. Public or county water can usually forego this additional testing step.

- Roofing is in good shape. Your roof protects the entire home from the elements. It should be in good shape now and for the foreseeable future. Read more about VA Roof requirements here.

- Property is accessible from a street. You should be able to enter and exit your home without illegally trespassing on someone else’s property. This requires a permanent driveway or a permanent easement with a neighboring property.While you may be allowed to share a driveway with someone else, additional documents might need to be drawn up to outline the responsibilities of each party when it comes to maintenance and upkeep.

- No defective construction. This category includes a wide variety of issues relating to the structural integrity of your home. It may start at the foundation, checking for cracks or rotted wood in the crawl space. The foundation should be stable and not in need of current (or future) repair.Water damage is also taken into consideration when looking at the lower levels of the home. From there, you can move all the way into the attic. Here, ventilation is going to be key in order to prevent future issues with mold.

- Termite inspection. Would you really want to purchase a home that was infested with termites and other pests? A basic termite inspection provides answers to some of these extremely pressing issues.The VA appraisal should also take a look at whether there is any damage done by a previous infestation, such as rotted wood or significant repairs needed.

- No safety or health hazards. It seems like this should go without saying, but your VA loans appraisal is concerned with identifying any potential health or safety risks that this property poses. This could include exposed wires, leaking sinks, or a dry rotted roof. Anything that poses a concern for safety is noted and needs to be repaired.

- No lead-based paint. Older homes may have been decorated using lead-based paints prior to the year 1978. The dust created by this paint can lead to lead poisoning. Your inspector should check to make sure that the paint on the walls does not fall into this category.

The basic premise of a VA appraisal is to make sure that your potential home can live up to all of these minimum property requirements.

The basic premise of a VA appraisal is to make sure that your potential home can live up to all of these minimum property requirements.

Sometimes, that turns out not to be the case. Before you despair over potentially losing your dream home, you may still be able to work out a way to secure financing for this specific property.

Depending on the issues and the agreeability of the sellers, the current homeowners may be willing to make the necessary repairs.

You may even be able to cover the cost of the repairs yourself in order to move forward with the financing. Either way, these minimum property standards should be met on any home you will live in.

These standards aren’t set out by the federal government simply because they are guaranteeing a portion of your financing. These are standards that all properties should meet to make your living spaces safe and sound.

If the property doesn’t meet these minimum standards, you may really want to consider whether it’s going to be the best house for you. You should always have the option to walk away from the purchase and continue on with a new search for the perfect home.

VA Appraisal Timeline

How long can you expect this stage of your financing approval to take? Many new home buyers are anxious to get themselves into their new home and resent the idea of waiting for an additional step. Understanding the VA loan appraisal timeline can help you to prepare yourself for the anticipated time required to complete this essential step.

It begins when the lender (or another member of your loan team) sends the official request to the VA.

This notifies them that you are ready to move forward with the VA home inspection for minimum property requirements. An appraiser will be assigned to your file and schedule a time to complete the walkthrough.

The VA will send out an independent inspector to take care of this step. A third-party who works for neither the Department of Veterans Affairs nor your lender ensures that you are getting an objective look at the home.

They do not have to protect anyone else’s interests in financing the property except for yours.

Overall, it should take ten business days or less to compile the full report. Homeowners may experience a delay in some areas where there could be a shortage of available independent inspectors. It’s always best to plan for a few extra days just in case something else arises that you weren’t expecting.

Fortunately, the appraisal process is relatively short. This gives you plenty of time to move forward with a home inspection as well if you choose to do so.

VA Home Appraisal Fees

As you may have already guessed, a VA appraisal isn’t completely free. The prospective home buyer is required to pay for the appraisal upfront whenever the task is completed. Many home buyers choose to have a thorough home inspection completed first in order to spare them from paying the VA appraisal fee on a property they won’t purchase. This is one way to save money on a house that could be a potential money pit.

However, they are both essential aspects of making a wise investment and the appraisal is non-negotiable.

Your VA appraisal should cost anywhere from $300 to $500, depending on the state and the type of home you purchase. For example, a VA appraisal on a single-family home is typically more expensive than a similar appraisal on a manufactured home. You will be responsible for this fee at the time services are rendered.

The initial cost could be reimbursed during your closing costs based on your negotiations with the seller. It isn’t a guarantee that you will be able to recoup these costs though.

Read more about VA Appraisal Fees here.

VA Appraisal Challenges

Sometimes, a property does not appraise for the list price when your appraiser determines the fair market value of the property. Lenders may hesitate to offer financing on a property that isn’t worth as much as you are currently projected to pay. If you were to default on the loan, they would not be able to recoup their costs based on what the property could potentially sell for.

Sometimes, a property does not appraise for the list price when your appraiser determines the fair market value of the property. Lenders may hesitate to offer financing on a property that isn’t worth as much as you are currently projected to pay. If you were to default on the loan, they would not be able to recoup their costs based on what the property could potentially sell for.

When this happens, homebuyers are presented with a few different choices. The simplest option is to walk away from the property and find another house that would suit your needs. Unfortunately, most buyers are very committed to a specific property by the time the appraisal returns. You may not want to start the house hunting all over again.

The second option is to request that the seller lower the price to meet the fair market value determined by the appraiser. You may have some success with this method and still be able to secure full financing for the property. The seller could opt to meet you in the middle of the appraised value and the list price, which still leaves you in a bit of a bind.

You may be required to bring cash to closing if you still want to proceed with a home that costs more than it’s worth.

For many prospective buyers, this isn’t going to be a possibility. One of the largest advantages of opting for a VA loan is that no down payment is required. Buyers may not have thousands of dollars saved up to cover the additional expense of putting down money at closing.

It’s even possible that you don’t believe the appraisal was completed fairly or accurately. Perhaps you found comparable properties in the area that appraised for much higher than what your desired property did. You can always call the appraisal itself into question with a Reconsideration of Value appeal.

Reconsideration of Value

A home buyer, lender, or real estate agent can request that the appraisal be reconsidered by submitting what is known as a Reconsideration of Value (ROV).

You will need to notify your lender of the request and give them an opportunity to review both the appraisal and the reasons why you believe it should be reconsidered.

If you have any substantial claim to request a revised appraisal, the lender will then forward the information over to the appraiser who was initially assigned to your property.

It will require a lot more work on your part than simply signing a letter requesting this ROV. Research other properties in the area of your pending sale to be used as comps, explain why remodeling changes boosted the home’s market value, and any other details you find pertinent that weren’t accurately included in the initial appraisal report.

Furthermore, you should even take the time to thoroughly check and recheck the numbers in the first appraisal.

It’s possible that there were errors in addition or other math sections that led to a lower appraisal value. These are relatively easy to fix, but they can take quite some time to spot.

The Reconsideration of Value is still not a guarantee that the home will appraise for the asking price.

If this doesn’t yield any results, you will have to come to grips with one of the three main options you have left: renegotiate with the seller, bring money to the closing, or walk away from the property altogether.

Conclusion

A VA home appraisal is a necessary part of the home buying process when you make use of this advantageous federal program. It can help to ensure that the home meets some very basic minimum property standards and allows you to make sure you receive a good deal on the property. Be certain not to confuse it with a VA home inspection though.

Take the time to carefully read over any appraisal reports generated on a potential property. You should know everything there is to know about a home you plan to purchase. Allow this stage to help you make an informed decision about the purchase of a particular property.

VA Appraisal FAQs

What is the difference between a VA appraisal and a VA home inspection?

A VA appraisal is designed to assess the fair market value of a property and ensure it meets the minimum property standards. It provides a cursory look at some of the most important features related to safety and health in the property. A VA home inspection is a separate process that takes a much more in-depth look at any potential issues with the property.

Only the VA home appraisal is typically required, but it’s highly recommended that you have both.

What does a VA loans appraisal cost?

The cost for a VA loan appraisal varies based on the type of property you are attempting to purchase and the state in which it is located. For detailed specifications regarding the appraisal price, you can select your state from this list.

Are there new appraisal requirements in 2018?

No, there are no new appraisal requirements for 2018.

Who orders the VA appraisal?

Anyone who has an interest in the sale of the property may order the VA appraisal, but it is preferred that the lender initiate the request.

I got an appraisal. Do I have to get a home inspection too?

Only the VA appraisal is absolutely required for the purchase of the home. However, a VA appraisal takes only a cursory glance at some of the main areas of the house to determine if it meets the minimum property standards. A home inspection, while optional, is highly recommended because it takes a more thorough look at the state of the home.

What are the VA minimum property requirements?

- Residential property with adequate living space

- Safe electrical and plumbing systems

- Adequate heating

- Clean drinking water availability

- Sturdy roofing

- Street-accessible

- No defective construction

- Current termite inspection

- No safety or health hazards

- No lead-based paint

Why did my home fail the VA Home appraisal?

Your potential property could fail the VA Home Appraisal for an inability to meet any of the minimum property requirements. This often means that the home doesn’t have adequate heating or electrical systems, has a roof in disrepair, or is infested with pests (including termites). However, this list is by no means exhaustive of all the possible ways a property could fail the VA appraisal.

Resources

How-to Challenge a VA Loan Appraisal

Appraisers/Staff Appraisal Reviewer

by Mike Plambeck

What is a Missouri VA loan?

Applying for a VA loan in Missouri often has the most favorable terms and conditions. In fact, this program has the potential to save Missouri homeowners thousands of dollars.

Navigating through all of the financing options available for prospective home buyers can be overwhelming.

You should understand all of the benefits associated with a VA loan in Missouri to ensure that you receive the best possible financing.

We Specialize in Helping Veterans find Home Loans – Pre Qualify Today Click Here.

The VA loan program allows veterans and service members to receive better terms from their lenders. A private lender issues the financing with a small guarantee from the Department of Veterans Affairs on the overall loan value.

This makes lenders more likely to give out favorable terms and to approve individuals who may not qualify for traditional mortgage programs.

VA Loan in Missouri Benefits

The benefits of receiving a VA loan in Missouri can save potential home buyers thousands of dollars in unnecessary fees. Find out the most advantageous parts of this loan program below.

The benefits of receiving a VA loan in Missouri can save potential home buyers thousands of dollars in unnecessary fees. Find out the most advantageous parts of this loan program below.

No Down Payment

The largest upfront cost associated with purchasing a new home is your down payment. Traditional financing often requires a twenty percent down payment.

This could mean waiting a few years to purchase a home while you scrape together a large enough savings account.

With a VA loan in Missouri, home buyers are not necessarily required to come up with a down payment. This savings alone is what makes the program so appealing to potential buyers.

No Private Mortgage Insurance

When you purchase a home with little to no down payment, most lenders will require you to carry private mortgage insurance. This monthly fee usually equals 0.3 percent to 1.5 percent of the loan value each year.

It represents a significant cost to homeowners each month and may limit what sort of housing they can afford. A VA loan in Missouri does not require private mortgage insurance, which represents yet another source of savings.

No Penalty for Early Payoff

Some families dream of being debt-free and are willing to work hard to make that dream a reality. Paying off a mortgage early eliminates some of the cost associated with interest rates, but the fine print dictates what sort of penalties you will face for this. With a VA loan in Missouri, you won’t face any penalties or fees for choosing to pay off your loan early.

Loan Assistance Programs

The ultimate goal for VA loans is to make homeownership affordable for all individuals and families. If you are struggling with financial hardship and may be facing foreclosure, there are trained loan experts available to assist you through the Department of Veterans Affairs.

They can help to connect you with resources to prevent you from losing your home.

Eligibility

How can you qualify for a VA loan in Missouri? You must obtain a Certificate of Eligibility for meeting the service requirements set out by the government. The service requirements will vary based on your dates of service, the branch you served in, and your enlistment dates.

Surviving spouses may also qualify for a VA loan in Missouri if they meet the eligibility requirements.

You can find more information regarding the criteria for a Certificate of Eligibility here.

From there, you will need to find a property that qualifies for financing with a military mortgage. Single-family homes, condominiums in a VA-approved project, and manufactured homes with lots will all qualify. New construction homes are also allowed, and you can use a VA loan in Missouri to build your own home.

Some people may be interested in using VA loans to purchase and remodel a new property at the same time. The financing could also be used to install energy efficient upgrades or improvements to an existing property.

VA loans can be used to refinance your current home. This allows you to take advantage of lower VA loan rates in Missouri without selling your current property. Over the duration of your loan, this savvy move could save you thousands of dollars in interest.

Loan Limits by County in Missouri

The amount of financing you receive in a VA loan is subject to approval by your lender. The final decision will be made based on your credit score, income level, debt-to-income ratio, and other factors. However, there are also VA loan limits in Missouri.

These loan limits are the maximum amount that can be borrowed for a home without making a down payment. Technically, there are no maximum loan amounts for this program but you will be required to come up with a down payment for homes in excess of the VA loan limits in Missouri.

The specific loan limit often varies by county with higher limits in areas that see significant increases in the cost of living. However, the VA loan limits in Missouri are all equal at $453,100 in every county.

Regional Loan Centers

There are eight regional loan centers available to offer assistance to veterans who want additional information about the VA loan program. You can connect with trained representatives who can answer questions regarding your eligibility, the application process, and how to get started with receiving a VA loan in Missouri.

This is also an ideal contact for homeowners who feel they may be facing foreclosure. A regional loan center can often connect you with available resources that could prevent this from occurring.

In Missouri, you would need to contact the regional loan center located in St. Paul.

Missouri Home Prices

Making sure you can pay the monthly mortgage payments on your new home is essential before you sign on the dotted line.

Take the time to research the real estate market in your state, as well as the specific prices of homes in your desired area. This can help you to make the decision about whether homeownership is truly affordable for you right now.

The median list price of homes in Missouri is currently at $165,900 with a square foot price of $106.

To compare it with two major cities, you can see the median list price for both Kansas City and St. Louis below:

Kansas City: $184,450 with square foot price of $119

St. Louis: $144,900 with square foot price of $117

Regional Benefit Offices

Contact the regional benefit office in your area if you have any questions about the VA loan program in Missouri. They may also have information regarding additional resources available in your area.

St. Louis Regional Benefit Office

9700 Page Avenue

St. Louis, MO 63132

FAQs

I have bad credit. Can I get a VA loan in Missouri?

Yes, you can still qualify for a VA loan in Missouri with a low credit score. You will need to do additional research to find a lender who is willing to issue loans to individuals with bad credit. There are no minimum credit score requirements for this loan program though. If you can find a lender to issue the loan, the federal government will still guarantee your financing.

You may face higher VA loan rates in Missouri if you have bad credit.

Can a surviving spouse receive a VA loan in Missouri?

Yes, a surviving spouse who meets the eligibility requirements can receive a VA loan in Missouri. You must be either un-remarried or remarried past the age of 57 and after December 6, 2003. You must also meet the following criteria:

Must be the spouse of a veteran who died while in service or from a service-connected disability

Must be the spouse of a service member who is missing in action or a prisoner of war

Must be the spouse of a totally disabled veteran whose disability may not have been the cause of death

What is the VA loan rate in Missouri?

The government does not set a specific VA loan rate in Missouri. Instead, each individual will receive an interest rate based on their personal financial history, economic factors, and the private lender. These rates will fluctuate over time, so be sure to check with your lender to see what today’s VA loan rates in Missouri happen to be.

by Mike Plambeck

Every homeowner who maintains a mortgage is required to keep a valid homeowners insurance policy on their property. Even once the financing portion of homeownership is finished, it’s still highly recommended that you keep a policy open to protect your most valuable asset. Many individuals lack the basic understanding of what this policy covers and how it connects to your overall mortgage. Once you understand this basic connection, you can find a number of savvy ways to lower homeowners insurance costs.

Every homeowner who maintains a mortgage is required to keep a valid homeowners insurance policy on their property. Even once the financing portion of homeownership is finished, it’s still highly recommended that you keep a policy open to protect your most valuable asset. Many individuals lack the basic understanding of what this policy covers and how it connects to your overall mortgage. Once you understand this basic connection, you can find a number of savvy ways to lower homeowners insurance costs.

What is Homeowners Insurance?

A homeowners insurance policy is used to help protect your interest in the home. They typically cover major categories of harm such as interior damage, exterior damage, loss of belongings or assets (including theft), and bodily injury on the property. An insurance company will offer a certain degree of protection across these four categories in exchange for your monthly insurance premium.

When something goes awry, you may have to pay some money upfront to cover your deductible before the claim can be approved by the insurance company. The details of both the coverage and the deductible amount will vary based on the policy you select.

When something goes awry, you may have to pay some money upfront to cover your deductible before the claim can be approved by the insurance company. The details of both the coverage and the deductible amount will vary based on the policy you select.

This simple home insurance policy is very important to help provide you with financial security in the event of a disaster. A storm, a freak accident, or a flooded home can happen in the blink of an eye. Without an insurance policy in place, the majority of people would lack the necessary funds to cover the cost of repair out of pocket.

The danger can be even greater if someone is injured on your property, whether they slip coming down the stairs or trip over a lawn gnome in your front yard. Insurance can help to cover the cost of the medical bills sustained as a result of the injury, preventing you from being sued. This provides some legal and financial protection in the rare event this ever occurs.

You can ultimately lower homeowners insurance costs by altering the degree of coverage for your home. With every change you make to the policy, you have an opportunity to save a few dollars on your monthly costs. Unfortunately, few homeowners realize just how much control they may have over the final price they pay for insurance.

How Does Insurance Relate to Your Mortgage?

It becomes even more unclear to homeowners who are still paying off their current mortgage. Until the home is officially your own, your monthly insurance premiums are usually covered by an escrow account set up by your lender. This means that your mortgage payment bundles in a certain amount to cover your insurance premiums along with your principal and interest payment. Your property taxes may be handled similarly.

If you fail to keep the policy active, the lender has the right to place a new policy over your property at an additional fee. You may end up paying more for one of these policies that offers a different degree of coverage than you would with some of these money-saving tips that can help you to save money on your own home insurance.

What You Can Do to Lower Homeowners Insurance

Back To Top

Fortunately, you aren’t necessarily stuck paying the price that your insurance company quotes to you. There are many different attributes you can change on your plan to increase the value while simultaneously decreasing what you pay each month. It helps to determine just how much you can afford to pay out of pocket in the event of a disaster, as well as what you can afford monthly.

If you’ve been trying to figure out what you can do to lower homeowners insurance costs, take a look at these top suggestions for finding a better rate.

Shop Around Before You Buy

Back To Top

The company you select for your homeowners insurance really does play a part in how much you will pay month to month. Much like car insurance, there are variations in price that are more related to the company than the policy itself. This can be time-consuming to compare quotes that are apples to apples but ultimately has the potential to pay huge dividends when it comes to your savings.

One suggestion for shopping at multiple companies is to enlist the help of an insurance agent. Many of your local agents may provide coverage through multiple companies. With their help, you can compare the prices of policies that offer comparable coverage under the watchful eye of a professional. The bonus is that you also have someone readily available to answer questions about small details you don’t understand.

One suggestion for shopping at multiple companies is to enlist the help of an insurance agent. Many of your local agents may provide coverage through multiple companies. With their help, you can compare the prices of policies that offer comparable coverage under the watchful eye of a professional. The bonus is that you also have someone readily available to answer questions about small details you don’t understand.

Of course, money shouldn’t be the only thing you consider when looking at various homeowners insurance companies. You also need to think about how previous and current customers feel about their coverage.

Some insurance companies will try to find loopholes in your contract with them, transferring some of the financial responsibility back onto the homeowner. You may spend a lot of time filing claims and arguing with representatives in order to get the money you need to cover extensive damage that you believe is included in your comprehensive homeowners insurance plan.

This would be an excellent time to ask friends and family members if they are satisfied with their provider. Look for reviews online about the service they provided and how happy homeowners were regarding their claims resolutions.

Shopping for the perfect homeowners insurance company means looking for a reputable organization that charges fairly and has great success rates and recommendations from their clients. There has to be a balance between these items or you may be unsatisfied with the long-term repercussions of choosing this company.

Raise Your Deductible

Back To Top

One of the fastest ways to lower homeowners insurance is to raise your deductible. Your deductible is the amount of money you will have to pay out of pocket before the insurance company will consider your claim. There is an inverse relationship between your deductible and the price of your insurance premium. Generally speaking, a lower deductible will mean a higher premium amount and vice versa.

One of the fastest ways to lower homeowners insurance is to raise your deductible. Your deductible is the amount of money you will have to pay out of pocket before the insurance company will consider your claim. There is an inverse relationship between your deductible and the price of your insurance premium. Generally speaking, a lower deductible will mean a higher premium amount and vice versa.

Before you immediately raise your deductible to the maximum amount, you should consider whether you can truly afford it in the event of an emergency. Is a $10,000 deductible reasonable and could you cover that cost if you had a disaster strike your property? For many people, they need to select a deductible that is more in the middle and could be considered affordable based on their budget.

You can work up to raising your deductible to the maximum limits by setting aside a savings account with the total amount needed. This gives you some financial protection and security in knowing that you will be protected in these worst-case scenario situations.

Much like finding the perfect insurance company, finding the deductible that works for your family will require striking a balance between monthly savings and what you could afford to pay upfront if you need coverage.

Keep in mind that you may have different deductibles for separate aspects of potential damage to the property. For example, water damage may have a separate deductible than hail damage. It may pay bigger dividends to investigate all of these minor possibilities. Some experts estimate that raising your deductible by just $500 can save you 25 percent on your monthly homeowners insurance costs.

Disaster Proof Your House

Back To Top

With a few simple home modifications, you could lower homeowners insurance and protect your investment all at the same time. Areas that are particularly prone to natural disasters such as hurricanes and tornadoes will want to consider making some key changes to the home in order to “disaster proof” it. This may include installing storm shutters and doors that are professionally placed on the home.

With a few simple home modifications, you could lower homeowners insurance and protect your investment all at the same time. Areas that are particularly prone to natural disasters such as hurricanes and tornadoes will want to consider making some key changes to the home in order to “disaster proof” it. This may include installing storm shutters and doors that are professionally placed on the home.

An insurance company could view this attempt at protecting your investment as a reason to lower your monthly costs. While these may be minor changes, they could mean that your home is less likely to be damaged in the event of a natural disaster. This is beneficial for you and the insurance company who will be less likely to see a claim coming from your property.

Keep in mind that most insurance companies are going to want proof that these were quality investments that were professionally installed before they offer a discount. You may need to provide them with product information, receipts, and photographic evidence that the work has been completed on the home.

If you’re in the process of purchasing a new home that has these features and you want to gather insurance quotes, you will need to mention that these items are available upfront. The insurance company has no way to identify their presence without your direct input. You may also ask them what kind of a discount you could receive on the policy if you were to make these changes. This can help you to evaluate whether you feel it is worth the investment.

Upgrade Home Security

Back To Top

Common home insurance policies cover the property in the event of a theft or burglary as well as a physical disaster. Depending on the details of your plan, you may have a certain deductible to meet before they will cover the remaining assets that have gone missing. You may even choose to place coverage on specific items such as expensive electronics or equipment used for work.

Common home insurance policies cover the property in the event of a theft or burglary as well as a physical disaster. Depending on the details of your plan, you may have a certain deductible to meet before they will cover the remaining assets that have gone missing. You may even choose to place coverage on specific items such as expensive electronics or equipment used for work.

If you’re taking steps to minimize the likelihood that a burglar would get away with your goods, an insurance company is likely to shave a few dollars off your monthly bill. This keeps your house safe and lessens their overall risk when it comes to insuring your property.

Similar to disaster-proofing your home, you will also want professional installation from a home security company. The insurance company might ask to see your contract or receipt from the installation. Keep in mind that they are looking for a system that does more than simply scare off the bad guys. They also want the system to automatically dial out to first responders whenever the alarm sounds.

Predicting how much money you can save by installing a professional home security system is difficult because each company has a unique policy. However, some insurance companies are willing to issue discounts of twenty percent simply for adding this feature.

Be sure to keep in mind that you will be offsetting the savings on your homeowners insurance policy with the additional cost of maintenance on the security system. This could be a great tradeoff that allows you to receive more peace of mind in your home for a reduced fee that can help to balance it out.

Seek Discounts

Back To Top

Most homeowners insurance companies are willing to offer discounts to their clients, but you have to be willing to ask about them. Too many people are hesitant to discuss the intimate details of their finances. Money is such an uncomfortable topic that they simply accept the bottom line number that the company gives them.

They may not even realize that there is some room to negotiate inside of this figure.

Browse through the insurance company’s website to see if they offer an extensive list of potential discounts that they’re willing to give out to their customers. This can give you a great starting point for contacting a customer service representative to see how to go about making use of them. For example, many companies will issue discounts based on common things like these:

- Long-standing customer with the company

- Bundled policies

- Home remodels

- Auto-pay enrollment

- Discounts for time without claims

- Retiree discounts

Companies are willing to give out these discounts, but only customers who are bold enough to ask will receive them. They are very rarely applied to your insurance policy automatically, so don’t forget to speak up and ask if any of these common discounts are offered. After all, some of them could save you up to thirty percent on your monthly homeowners insurance premium.

Make a list of the potential discounts that you believe you could be eligible for. It’s also helpful to get a few quotes from other insurance companies to see if your company can offer a discount or match their rates on a comparable policy.

Get a Better Credit Score

Back To Top

If you live in a state that allows insurance companies to use your credit score, you may face higher premiums for bad credit. The logic behind this concept makes sense, but few homeowners take the time to truly consider what a low credit score is costing them. Insurance companies have their own scoring system that uses your credit score, A lower insurance credit score generally results in lower homeowner’s insurance rates.

Insurance companies are more apt to raise the rates for a person who may not be consistently reliable at paying their monthly premium. Poor credit tends to be an indicator that you don’t have a favorable long-term history of making timely payments, so the insurance company attempts to minimize their risk by insuring your property at a much higher rate.

Insurance companies are more apt to raise the rates for a person who may not be consistently reliable at paying their monthly premium. Poor credit tends to be an indicator that you don’t have a favorable long-term history of making timely payments, so the insurance company attempts to minimize their risk by insuring your property at a much higher rate.

The best thing you can do to lower your homeowners insurance rates would be to raise your credit score.

This money-saving technique does require a long-term commitment to working on your financial health, but it pays big dividends in every area of your life. You will almost definitely qualify for better interest rates, better terms on credit cards, and more favorable loan programs when you have a better credit score. All it takes is a commitment to managing your money well on a monthly basis.

For most individuals, the biggest struggle they face with their credit score is making their monthly payments on time. Set up an autopay function on your accounts whenever possible and set an alarm on your phone to remind you to pay the others. This prevents the due date from passing you by, creating yet another blemish on your credit report.

Credit utilization also plays a role in determining your final credit score. Most experts recommend using only thirty percent of your available credit at any given time. If you have excessive debt, you can actually improve your credit score and your finances by paying off some of those high-interest credit cards, student loans, and auto loans.

If you know that you’ve had a major overhaul of your credit score over the past couple of years, you may want to consider reaching out to your insurance company to see if they will think about lowering your rates. They may just reward you for your hard work and put you in an even better spot financially.

Bundle Insurance

Back To Top

Most companies offer more than one type of insurance. They probably also provide car insurance, RV insurance, motorcycle insurance, and other types of coverage that you may need. One of the easiest ways to receive a discount on your homeowners insurance is to bundle all of your insurance policies in one place.

Most companies offer more than one type of insurance. They probably also provide car insurance, RV insurance, motorcycle insurance, and other types of coverage that you may need. One of the easiest ways to receive a discount on your homeowners insurance is to bundle all of your insurance policies in one place.

Insurance companies make more money when they receive more of your business and keep it out of the hands of their competitors. In exchange for your business, they are often willing to pass along significant discounts that can save you in every area. This also makes it more convenient for you to pay your bills if they are all due in one easy location.

Be aware that there could be a major pitfall to bundling your policies under one carrier, particularly if you’re considering switching your car coverage. If you have a long driving record full of tickets and accidents, your carrier may drop both your auto insurance and homeowners insurance all at the same time.

Research the companies and ask to receive price quotes separately to see the breakdown of what each policy will cost you. It may still be less expensive for you to keep your policies under two separate companies that offer fantastic rates instead of bundling them. In the end, it’s possible that you may pay more for the bundle so make sure to do your homework.

As with most discounts, the specific amount that you will save is based on your location and the details of your coverage. However, it’s estimated that you could save between ten and twenty percent when bundling policies together.

Eliminate Unnecessary Coverage

Back To Top

As time passes, you may not necessarily need the same amount of coverage you signed up for when you first purchased your home. Eliminate coverage that is no longer pertinent to your property, including any major changes regarding valuables within the home. This may be particularly true for families who downsized in recent years or parted ways with many of their more expensive gadgets.

However, it could also mean that you change the type of coverage on your house. For example, that tree in the front yard that loomed ominously when you first moved in may have been cut down last year. This would reduce the amount of coverage you feel is truly necessary in order to replace or rebuild your home.

However, it could also mean that you change the type of coverage on your house. For example, that tree in the front yard that loomed ominously when you first moved in may have been cut down last year. This would reduce the amount of coverage you feel is truly necessary in order to replace or rebuild your home.

The key to eliminating unnecessary coverage is to be thorough in what it would cost to rebuild and re-furnish your home. No matter what, your coverage should always cover the complete cost to rebuild the entire structure and replace everything that was inside. This saves you from massive out of pocket costs in the event that a disaster does occur on your property.

It also helps to make a home inventory during this stage. This document outlines all of the major items that are within the home, as well as their value. Be sure to include photos of each item as proof that it was in the home. This is key to ensuring that you have enough money to replace all of the items you care about most if disaster strikes.

It’s a good idea to reevaluate your degree of coverage at least once each year. You want to be careful not to over-insure the property because you will ultimately pay for this amount, even though it will yield few results. Stolen goods will be replaced at their actual value, even if they happened to be “valued” in your eyes much higher.

The same goes for damages done to the property. You may have your home covered for up to $200,000 in rebuilding costs, but it could cost just $150,000 to actually rebuild. Unfortunately, the insurance company is only going to cover the real cost to rebuild. The excess funds are simply a reason to charge customers more for their premiums on a monthly basis. You could be paying twenty percent more each month for no additional benefit or protection if you have overvalued the property.

Talk with your insurance agent to see what degree of coverage you currently have. This may answer any questions you have regarding what level of coverage you could drop to in order to save a substantial amount on your monthly premium.

Remove Old Structures

Back To Top

Do you have an abandoned detached garage in the backyard or a barn that’s seen better days? Even if you’ve never used these structures, you may still be paying to cover them under the umbrella of your homeowners insurance policy. Removing them from the property could save you a significant amount on your insurance premiums.

Do you have an abandoned detached garage in the backyard or a barn that’s seen better days? Even if you’ve never used these structures, you may still be paying to cover them under the umbrella of your homeowners insurance policy. Removing them from the property could save you a significant amount on your insurance premiums.

Because these structures are located on the property, there is still a risk that someone may be injured in or around the buildings. This philosophy could be particularly true if the buildings are dilapidated and run-down. They could collapse suddenly or have bits and pieces falling off that harm passersby. Taking them down lowers the overall safety risk to your property and can lower homeowners insurance costs as well.

If you aren’t using these buildings and have no intention of doing so, removing them should be relatively simple. Be sure to take before and after pictures to demonstrate just what work was done to the property in order to justify your request for a reduced homeowners insurance rate.

Be careful to ensure that you follow all of the local rules, codes, and regulations when it comes to dismantling a building on your property. You want to ensure that you do everything properly if you hope to receive a price break on your insurance costs.

Exclude Land Value

Back To Top

Some homes come with a large plot of land in addition to your actual house. Depending on the circumstances or the layout of the property, the land value may also be covered by your homeowners insurance. You might not even be aware that this trivial detail has slipped into your coverage unless you specifically ask.

Some homes come with a large plot of land in addition to your actual house. Depending on the circumstances or the layout of the property, the land value may also be covered by your homeowners insurance. You might not even be aware that this trivial detail has slipped into your coverage unless you specifically ask.

You could consider removing the value of your land from the insurance policy. After all, you’re more likely to use the insurance policy to cover the cost of rebuilding or replacing your home in the event of a disaster than you are to use it for repairing the land itself. Some companies may allow you to keep bodily injury protection on the land without covering it for damages.

Talk with your insurance agent or customer service representative to see just what is covered under your policy in regards to land values. This may be an easy way for you lower your coverage and save money quickly on your monthly expenditures. Just be certain that you can afford to take care of the land if you would need to in the event of a disaster.

Clean Up the Land

Back To Top

You might have noticed that there were a few trees that needed to be cleaned up on the property when you first purchased it. That mighty oak in the front yard was attractive when you first moved into the home, but now its limbs are stretching dangerously over the roof. An insurance inspector who views the property may look at all of the limbs and debris as a hazard, forcing them to raise your homeowners insurance rates as a result.

You might have noticed that there were a few trees that needed to be cleaned up on the property when you first purchased it. That mighty oak in the front yard was attractive when you first moved into the home, but now its limbs are stretching dangerously over the roof. An insurance inspector who views the property may look at all of the limbs and debris as a hazard, forcing them to raise your homeowners insurance rates as a result.

Try combating these price increases by cleaning up the land around the house. This not only improves the curb appeal of your home, but it also makes the home safer and could boost the market value if you ever look to sell the property.

Removing major risks to the structural integrity of your property is important, but it could be essential in locations prone to fire. Dry areas that see many wildfires throughout the year should view cleaning up the land as completely necessary, apart from any potential discounts on homeowners insurance they could receive. You will have many benefits from this simple task and it can pay dividends in the years to come.

Take some before and after pictures to demonstrate the level of work that went into improving the quality of the land around the property. This can also help you to prove that the modifications will help your home to remain intact for longer periods of time into the future. Be sure to write down your justification for why these changes should warrant a reduction in your premium amount for home insurance.

Ensure that you are following local codes and ordinances to have any trees, structures, or limbs removed from the property. This could be essential, particularly if you are removing certain types of trees. Fines may be forthcoming if it isn’t done according to the local standards.

Dog Breeds Can Matter

Back To Top

Unfortunately, the type of dog you own can definitely influence the overall amount of your monthly insurance premium. Some companies maintain a long list of breeds that have been commonly and historically known for their aggressive tendencies. Homeowners who consider their furry friends a part of the family may face higher premiums as a result.

Depending on the company and the specific breed of dog, you might even have a difficult time finding an insurance company that will allow it. Animals are often viewed as unpredictable because they can run off or bite someone at any given time. Dog breeds that seem more susceptible to act on an impulsive desire to bite a stranger will cost you more on your insurance because it covers bodily injury on your property.

Muscular dog breeds tend to be more likely to fall under the list of “aggressive breeds” because their attacks could potentially inflict more damage. There isn’t an official list that all companies will refer to, but many of these common breeds will hike up your premiums:

- Pit bulls

- Dobermans

- German Shepherds

- Chow Chows

- Boxers

While most people know that not all of these breeds are harmful or aggressive, the stigma is still there and it can cost you. A more “docile” breed is less likely to cause a price increase. Cats are less susceptible to face the same stigma as larger dogs known for their size and aggression.

Not all pets will raise your insurance premiums, but it is worth checking with your company before you purchase a new pet for your family.

You will want to ensure that your pet is covered by the policy in case something unpredictable happens on your property. This means being forthcoming with veterinary records and documentation about what type of dog is living in your home. This should be a real and serious consideration before you make a purchase, as some companies will refuse to provide service to homeowners with certain breeds.

When it comes to more exotic pets, check with your agent to see if they are covered. Snakes, monkeys, and some other types of animals may be considered dangerous to visitors and won’t be covered under the policy. This also means that any injuries they inflict on guests or visitors won’t be covered under the policy.

Conclusion

Back To Top

Saving money on your homeowners insurance can be simple when you know what to expect and how to ask for the right discounts. Maintaining coverage of your most valuable assets is absolutely essential to giving yourself peace of mind and protecting your financial future, even beyond the point where your mortgage company will require this coverage.

Consider what steps you can take today to start asking for a reduction in your homeowners insurance policy. You may decide to do a little remodeling, install the security system you’ve been wanting for years, or hold off on purchasing that new pit bull puppy. Sometimes, the small things that you do around the home can yield the largest payoff when it comes to your overall savings.

Make a list of the steps that you can take before you talk with your homeowners insurance company about any possible discounts you may eligible for.

FAQs

Back To Top

What are typical homeowners insurance rates?

The typical homeowners insurance rates will vary based on your state and the type of coverage you have on your property. The average across the nation usually measures at approximately $1,000 per year, but it typically ranges anywhere from $300 to $1,500 annually. You may be able to more accurately calculate the total by dividing your home value by 1,000 and multiplying the result by $3.50.

What is a homeowners insurance premium?

Your homeowners insurance premium is the amount of money you pay monthly or annually in exchange for the insurance company providing coverage in the event of a disaster to your property. The specific details of the coverage will vary, as will your insurance premiums.

What should my deductible be for my home insurance?

Your deductible should be set at the amount you are able to and willing to pay upfront out of pocket in the event of a disaster. This will vary for each homeowner. Some may be comfortable paying a common deductible amount, such as $500 or $1,000. However, you may save up to 25 percent on your homeowner insurance by opting for higher deductibles between $2,500 and $10,000.

Do home insurance rates go up after a claim?

Yes, insurance rates will typically go up after a claim is made. It is estimated that they rise approximately ten percent after the first claim and twenty percent following the second claim. This is why some homeowners will choose to pay the total cost of a small repair out of pocket instead of filing it with their homeowners insurance company.

What does homeowner insurance cost?

Homeowner insurance costs will vary across the nation, but many premiums range from $300 tp $1,500 depending on your coverage, location, and insurance company.

Is homeowner insurance negotiable?

There is some flexibility in the rates provided by insurance companies for homeowner coverage. You may be able to negotiate a lower rate by making improvements to your home and property, changing the coverage, or bundling your insurance policies together under one company.

What home insurance discounts should I ask for?

Many companies will offer common discounts including:

h2

- Claim-free discounts

- Senior citizen or retiree discounts

- Long history of being a customer with the company

- Bundled policies

h

- Home remodels

- Auto-pay enrollment

Why is my homeowners insurance so high?

The cost of homeowners insurance will vary based on the specific details of your policy and the location of your home. Your policy may be high because you have had many claims over the years, have a low deductible plan, or are insuring your property for more than it’s worth. The value of your home will also play a role in raising your homeowners insurance rates.

How much does a security system save on homeowners insurance?

The specific discount afforded to homeowners for a security system will vary based on your policy, state, and the insurance company. You may save up to twenty percent with this change. Keep in mind that you will have the additional cost of paying to maintain the security system on a monthly basis as well.

How much is homeowners insurance?

Homeowners insurance varies based on your coverage, the policy details, your insurance company, and the state in which your property is located. The average homeowners insurance premium in the country is around $1,000 but rates typically fall between $300 and $1,500.

A rule of thumb for estimating costs is to divide the value of the home by 1,000 and then multiply by $3.50. This should give you a rough idea of what you can reasonably expect to pay for insurance.

Resources

Homeowners Insurance and Such: What You Forgot to Think About

U.S. Homeowners: Tax Benefits and Deductions for You!

12 Ways to Lower Your Homeowners Insurance

How To Lower Your Homeowners Insurance Premium

18 Ways to Lower Your Homeowners Insurance Premiums

10 Ways You Can Lower Your Homeowners Insurance Premium (U.S. News & World Report, 8/31/2016)

Homeowners Insurance Buying Guide – Consumer Reports

10 Hidden Home Insurance Credits

Your Government Helps You Find Lower Auto & Home Insurance Rate

by Mike Plambeck

FHA Loans

Federal Housing Administration insures FHA Home Loans mortgages. It has lower underwriting standards, low rates as compared to the conventional ones and low down payment rates of 3.5%. In addition, FHA borrowers are saved by mortgage insurance, which is a must to be paid, in case they default.

FHA Loans: Flexible and within reach

First-time as well as repeat buyers like to get a home with low or no down payment at all. In this scenario FHA loan remains the best choice. Out of every five US buyers, one chooses FHA loan.

In part, FHA loan is popular because it requires just 3.5 % down payment. Moreover, FHA mortgage rates are lower as compared with others, and a subsequent buyer can also have this loan. It also has flexible underwriting standards. And this is really attractive especially when you have high mortgage rates in the competitive market.

We Will Help You Qualify for An FHA Loan – Click Here To Pre Qualify Today.

An overview of FHA mortgage

During The Great Depression when the US was going through a period of ‘heavy renting’, Federal Housing Administration was established in 1934. At that time 4 out of 10 owned a house. Moreover, mortgage terms were nearly impossible to meet up with. 50% down payment, agreement on a loan term of 5 years or less and also a hefty sum to be paid to the bank after a first few years spent with the mortgage. Not everyone was able to meet up with such mortgage conditions in 1930s.

During the same era, the US government devised a plan to ensure that maximum people have their own homes. Government officials argued that it will stabilize neighborhood and help US economy thrive. So FHA and its mortgage program were established.

A prominent feature with the FHA mortgage was Mortgage Insurance Premium (MIP) program. Under this program, FHA insured lenders if they faced default situation.

To get FHA’s insurance on their loans, banks needed to verify whether the loans met FHA’s minimum qualification standards also known as FHA mortgage guidelines.

FHA MIP program boosted up confidence of banks and in turn they provided US home buyers better loans. As a result, first down payment requirements plummeted then the 5 year loan term was abandoned and replaced by more flexible terms of 15 to 30 years. Mortgage rates also dropped.

At present, FHA remains the biggest mortgage insurer in the world.

FHA Loans – The choice of US home buyers

US home buyers now have a diverse range of loans available. Fannie Mae and Freddie Mac provide conventional loans, USDA provides Rural Housing Loans and Department of Veterans Affairs provides 100% loans.

Still the top choice with US home buyers remains the FHA loan. Its low mortgage rates, lesser down payment and easy lending guidelines make it the top choice of home buyers.

Let’s look at some of the benefits of an FHA loan.

Mortgage Insurance Premium (MIP) Program

FHA MIP is an important part of FHA mortgage. That’s the reason most people choose to seek FHA-insured loans.

Now news to be cheered about is that FHA MIP rates are 50 basis points per annum that is 0.50% lower as compared to the rates in 2014.

There are other benefits. You can reduce what you will annually owe in FHA Mortgage Insurance Premium Program wither using a 15 year mortgage plan against your FHA loan or increasing down payment to 5 percent. There is a more common option: refinance yourself out of MIP program.

Down payment as low as 3.5 % with FHA loan

Home buyers now-a-days have limited mortgage options to choose that offer down payment of 5 % or less. FHA offers the same.

Home-buyers can make just 3.5 % down payment with FHA loans. This is a huge encouragement for those people who don’t have enough savings to make heavy down payments or they have set aside some amount to pay for moving costs or emergency funds.

100% gift funds for down payments

This is an offer not usually given by most mortgages. But FHA provides you an opportunity to make full down payment for your house from a gift. It is quite flexible with gift funds.

It means if you need to make 3.5 % down payment from a gift by your employer, parents, a government home-buyer or some charitable group, FHA mortgage allows that. Of course, there is some due process to follow.

No social security number required