by Leslie Rowberry

Why you need a mortgage broker

You have been searching for a house and finally found your dream home. The next thing you want is to find the right mortgage and get those keys. One of the easiest ways to do this is working with a mortgage broker to guide you through the complex process from the beginning to the end. This negotiator is neither a loan officer nor a banker. This is what they do for you.

You have been searching for a house and finally found your dream home. The next thing you want is to find the right mortgage and get those keys. One of the easiest ways to do this is working with a mortgage broker to guide you through the complex process from the beginning to the end. This negotiator is neither a loan officer nor a banker. This is what they do for you.

- Evaluating your financial needs: They need to see the big picture why you need a mortgage.

- Calculating the borrowing power: Your middleman helps you to determine your borrowing capacity. After calculating your debt to income ratio, they will tell you the type and size of home loan you can afford.

- Comparing the options: you might not know the right tools to compare the available mortgage products in the market but your broker knows them so well. Thanks to online comparison rates, brokers can compare hundreds of mortgages in matters of minutes including those from bigger financial institutions.

- Offering expert advice: lenders fight hard to get mortgage clients and they might confuse you with ads that seem too good to be true. This is where you need an expert’s counsel to avoid falling into a trap. A negotiator knows what product is over hyped and one that suits your needs.

- Doing the legwork on your behalf: the paperwork involved in mortgage application can be very confusing. A broker who has been doing it for a long time knows how to go about it in the shortest time possible, giving you a stress-free time.

- Getting you a pre-approval: a broker can even help you to get pre-approved. A pre-approval gives you the confidence to make a realistic bid on a home at an auction.

A mortgage broker does as all these things for you at no additional cost. The lender pays them a commission after the settlement, so it doesn’t affect the mortgage deal in any way.

What to expect in a meeting with your mortgage broker

As explained earlier, brokers simplify things for you when you are looking for a new home. They compare different loans and explain financial jargons you don’t understand. You can leave the negotiation on the interest rates to them. That is why they are called negotiators. You will know you are dealing with a good broker if they don’t ask for consultation fees. You can meet them anywhere- in their office, your office, or home.

Things that your broker will ask for

During the submission of a mortgage application, you must your financial details like tax returns, employment history, income, bank assets, etc. Do not be afraid to disclose these personal details because they are important. Lenders take big risks by offering thousands of dollars to help people buy homes. So, it makes sense that they give a financial colonoscopy to see whether you can actually pay their loan. How else can they determine your competence anyway? The following are the 7 most important details you should submit to your mortgage broker

1. Income

How much money do you earn per month? This is a very important question you must not lie about if you don’t want to end up in a debt cycle you cannot get out of. You must have had a stable job at least for the last 2 years. You must produce documents that show your employment history as well as each position you have taken in a particular time frame. A good advice is t never hide any income source because your lender might decline your application if they find out that you are lying.

2. Bankruptcy, child support, and divorce

These details seem too personal but the lenders need to know too. It is important the bank knows whether part of your income comes from child support to determine potential liabilities in the future. Moreover, if you have filed for bankruptcy recently, you must wait for another 2 years to get discharged before you are considered qualified for a mortgage.

These details seem too personal but the lenders need to know too. It is important the bank knows whether part of your income comes from child support to determine potential liabilities in the future. Moreover, if you have filed for bankruptcy recently, you must wait for another 2 years to get discharged before you are considered qualified for a mortgage.

3. New loans

It is not advisable to take a big loan if you are planning to get a mortgage. No lender wants an applicant with a high debt to income ratio because that means a risky business. Consider reducing your DTI if you want to get a good mortgage.

4. Bank deposits

Lenders require at least bank statements worth of 2 months. Large bank deposits are considered red flags by underwriters. You need to get ready with proper documents to explain huge bank deposits. It is important for them to know that those deposits are not from other forms of loans. The other reason is that the lenders want to make sure that you have sufficient funds for closing the deal.

5. Previous addresses for tax returns

You qualify for a mortgage depending on your income level as well as the IRS tax return of the last few years. Your broker must submit your tax transcripts to compare the information against your income. If the addresses don’t match, issues will arise in the verification process. Ensure that you have a list of previous tax return addresses in case they are requested by the lender. That way, your loan application process goes on without delay.

6. A plan for financial assets

A mortgage down payment plus closing costs require a huge sum of money. You must prove to them that you will make enough money to continue with mortgage payments. Some home buyers don’t have an idea of where the money will come from, something that needs to be planned for in advance. When you are uncertain, ask the mortgage broker for guidance. They will suggest assets for down payment such as a savings account, financial gifts, retirement benefits, and so on.

A mortgage down payment plus closing costs require a huge sum of money. You must prove to them that you will make enough money to continue with mortgage payments. Some home buyers don’t have an idea of where the money will come from, something that needs to be planned for in advance. When you are uncertain, ask the mortgage broker for guidance. They will suggest assets for down payment such as a savings account, financial gifts, retirement benefits, and so on.

7. Employment changes

A lender needs to know both the income and employment history. So, if you plan to change your job, it is important that you give the details. Failure to do so can affect your credibility and cause issues before closing the deal.

A seasoned broker takes time to know your financial situation and knows what is best for you. Be sure to ask for clarifications especially on costs, fees, and the conditions of the home loan. After the meeting, you should be able to get a personalized report of the viable options for you. Once you decide which option to take, the negotiator will start the application process and sort out the paperwork. Check out how much mortgage you can afford.

by Leslie Rowberry

House remortgaging

This is the process of switching the prevailing mortgage to another deal with the existing provider or another lender. It doesn’t mean that you are moving house. Rather, the new mortgage deal will still be secured by the same home. If you want a new deal from your mortgage lender, remortgaging is a good option. Your home loan can last for many years so you must analyze your finances critically before you change the terms and conditions of the loan. This decision is as important as the one you made the first time you applied for a mortgage.

This is the process of switching the prevailing mortgage to another deal with the existing provider or another lender. It doesn’t mean that you are moving house. Rather, the new mortgage deal will still be secured by the same home. If you want a new deal from your mortgage lender, remortgaging is a good option. Your home loan can last for many years so you must analyze your finances critically before you change the terms and conditions of the loan. This decision is as important as the one you made the first time you applied for a mortgage.

Why should you remortgage the house

Unlike in the olden days, today you can switch your mortgage lender after a particular term. If you discover another provider who can help you save, feel free to switch to their service. As long as you are a reliable borrower and have good credit, you can get a good deal out there. Ask help from mortgage broker when shopping around to ensure that you are making a good choice. Perhaps you are incurring too much on the existing home loan. Why not look out for better deals that can boost your savings in the long run? Check the summarized reasons for remortgaging.

- To minimize monthly installments with a cheaper mortgage

- To release the accumulated value of your home for other uses like renovation

- To extend the term and reduce monthly payments

- To reduce the interest rate by switching to adjustable-rate

- To protect yourself against possible financial crises

- To consolidate debts

If you are remortgaging to consolidate debts, make sure to seek expert advice lest the debts end up costing you more in the long term. And when you need to release equity, make sure that you will afford the new monthly payments.

What are considerations for remortgaging a house?

Refinancing your home enables you to change the prevailing terms like the length of the repayment period and the interest rate. But there are certain factors you should put into the account. Note that you will be closing on your home again. The closure comes with extra charges like inspection, valuation, appraisal, loan origination, and closing charges. You have to provide these fees out of your pocket.

Alternatively, you can opt for zero refinancing whereby your lender will include the fees in your loan in addition to a higher interest rate. If you choose to extend the life of your mortgage, you will have to pay more interest in the long run.

The process of remortgaging a house

If you took the original mortgage with no deposit or a very small amount, you may not be able to remortgage as the equity might be insufficient. So, you will continue with the same lender’s terms and conditions. But if the equity allows, your lender should give you a remortgage application. The process is almost the same as the original one so it shouldn’t overwhelm you. Here are the steps you should take.

1. Gather your paperwork

Start your remortgaging plans at least 6 months before the current mortgage term ends. Have your bank statements ready to give a proof of how much debt you are in. if you have a variable mortgage deal, you might want to determine how much interest you were paying before the rates began to fluctuate.

Start your remortgaging plans at least 6 months before the current mortgage term ends. Have your bank statements ready to give a proof of how much debt you are in. if you have a variable mortgage deal, you might want to determine how much interest you were paying before the rates began to fluctuate.

2. Calculate the cost of refinancing

Some of the charges that make remortgaging expensive include early redemption fees particularly on capped, discounted, and fixed-rate mortgages. Check the exit fee as well which is charged during closing. It covers for releasing your title deed and land registry. Ask the lender to provide a quote for clearing what you owe in addition to other charges. The exit fee should match those on the mortgage contract.

3. Consider the restrictions

Certain mortgages come with overhung tie-ins. Your lender might also ask for SVR for a certain period of time once the first deal comes to an end. If the interest rates reduce, variable mortgages become cheaper than fixed-rate mortgages. So, it would be expensive to stick to the same rate in the long run.

4. Get a suitable mortgage

Compare different fact sheets to determine what kind of loan is suitable for you. Track the deal down and speak directly to the lender. You can also use comparison rate websites like homeloansforall.com. If the legwork is too much for you, find a mortgage broker to assist you.

Compare different fact sheets to determine what kind of loan is suitable for you. Track the deal down and speak directly to the lender. You can also use comparison rate websites like homeloansforall.com. If the legwork is too much for you, find a mortgage broker to assist you.

5. Calculate the overall cost

A good deal doesn’t always come cheap. You might pay for legal fees, application fees, and valuation fees. They may be included in the loan and you will still pay interest on them. It might be better off to use the legal service of the lender.

6. Match or better the deal of your choice

Even if the new deal doesn’t isn’t that appealing, you should ask the lender to match it to give something similar to save your time and money.

7. Apply for a new deal

If your current lender doesn’t offer a deal worth staying for, feel free to apply for another deal. Do it months before the existing offer expires. It pays to start early but you can always look elsewhere if you are turned down. In the event that house values are declining, you can leverage on the equity and set it as a deposit.

8. Wait for a response

If the lender accepts the application, and after you have paid all the fees, they will send you an offer stipulating the deal. Once the deal is closed, you will be given a completion statement. This process takes about 4 weeks.

Mortgage agreements encompass a plethora of terms and financial clauses which are not always pleasant for young couples. The private mortgage insurance plus the variable interest rate may not be favorable and you can always create a new contract with your lender. Most people refinance their adjustable-rate mortgage to change the monthly payments and save a little money gradually. By changing the terms and clauses, you might realize benefits which you would have otherwise missed. You can qualify for better rates if you have a low loan-to-value ratio and more equity. Check out how much mortgage you can afford.

by Leslie Rowberry

If you are trying to make a decision on whether to take a mortgage or not, one of the key decisions that you will need to make is on whether to take the mortgage on an interest-only basis or a repayment basis. If you are getting a mortgage that has higher interest, you will be required to repay on a monthly basis the interest to the lender as well as part of the capital debt. During the course of the mortgage term, you will chip away the debt of the mortgage before finally repaying it.

If you are trying to make a decision on whether to take a mortgage or not, one of the key decisions that you will need to make is on whether to take the mortgage on an interest-only basis or a repayment basis. If you are getting a mortgage that has higher interest, you will be required to repay on a monthly basis the interest to the lender as well as part of the capital debt. During the course of the mortgage term, you will chip away the debt of the mortgage before finally repaying it.

What is an interest only mortgage?

In an interest-only mortgage, the borrower only pays the mortgage’s interest through some monthly repayment for a term fixed on the interest-only of the mortgage loan. This term can be for a period of 5 to 7 years. After the term has elapsed, many choose to refinance their homes, making a lump sum payment. Alternatively, they choose to start making payment on the principal amount. However, during the payment of the principal, there is a significant increase in the payments.

Therefore, when a borrower chooses to go with the interest-only mortgage, he will only pay the mortgage interest and for a fixed period of time. This could be for a period of 5 to 7 years. Once that term has passed, many choose to refinance their homes, make a payment in its lump sum or start to pay off the principal amount. However, when you are paying off the principal, the payment will start to decrease in a significant way.

In case you choose a home loan on the basis of interest only, you will be paying the full interest to the lender during the full term and in the end, you will only owe the money you borrowed. If you are a prudent borrower, you can choose to open an investment vehicle where you can be adding money every month with the hope that this will grow to the point where it will be possible for you to repay your debt. There isn’t a guarantee that this method may work as it might leave you with a shortfall that you may need to make up for. You might even be left with a surplus.

In the past, many mortgage customers were relying on taking a mortgage on the interest-only basis. Their goal was to rely on the increase in house prices to make it possible for them to sell the property and even pay off the mortgage at the term’s end. However, in the recent past, we have seen prices of houses going down and this is a proof that there is no guarantee that the prices of houses will keep on rising.

Who should choose an interest-only mortgage?

There are certain situations when you may opt for an interest-only mortgage. These include:

- If you have a desire to afford a bigger home

- You understand that there is a need to sell the home within a short period of time

- If you would like the initial payment to be lower and you got the confidence to deal with the huge increase in payment in future.

- You are quite certain that you can get a rate of interest that is significantly higher if you invest the amount elsewhere

Pros of interest-only mortgage

Every type of mortgage comes with its pros and cons. Some of the benefits of an interest-only mortgage include:

Every type of mortgage comes with its pros and cons. Some of the benefits of an interest-only mortgage include:

- You will pay monthly installments that are significantly lower during the term

- You can manage to buy a bigger home later as you can qualify for a loan amount that is bigger

- You place some extra money into investments and these can go a long way in building your net worth

- The amount that you pay during the interest-only duration will be a tax deductible.

Cons of the interest-only loans to the interest

There are certain drawbacks for choosing the interest-only mortgage. These cons include:

- Rising rate of mortgage increases the risk particularly if its an adjustable rate mortgage(ARM)

- Most people spend the extra money rather than investing it

- Most borrowers are unable to afford the principal amount once the interest-only period elapses. Most do not even have the discipline to pay some extra amounts towards the mortgage

- Unlike what many people think, the home may fail to appreciate as fast as you had envisaged

Other interest-only risks

Other interest-only risks

- It can be risky trying to focus on the ability to make the interest only repayment. This is because you will eventually be required to pay the interest on top of the principal each month. After this has happened, you may be left with what is commonly referred to as a payment-shock. Unless you put your money into an additional vehicle or you sell the property, it may be difficult for you to repay the debt at the end of your term.

- You may be in a position to prevent the payment shock that results at the end of the interest-only mortgage. Unfortunately, it is not possible to predict the interest rates that will be applicable after 10 years. This means that if the loan amount is able to grow into a figure that is higher than the value of the home, it may not be possible to refinance.

- There are mortgages that come with the interest-only plans and can carry a penalty if the borrower chooses to prepay. In case the loan gets refinanced during the period of refinancing, the borrower can end up having additional fees. You will need to check with the lender to determine if there is such a fee that applies.

- The value of the home may be lower than the amount due on the mortgage or it may even depreciate faster if there is a decrease in the housing prices.

Consider these pros and cons before choosing an interest-only mortgage. In order to make the right choice, you can contact mortgage advisers.

by Leslie Rowberry

Defining debt to income ratio for mortgage

The debt to income ratio refers to the total monthly debt payments relative to the gross monthly pay. It is one of the most crucial factors that mortgage lenders use to analyze your creditworthiness when applying for a home loan. They need to know if you can actually manage the payments every month and repay the loan in good time.

The debt to income ratio refers to the total monthly debt payments relative to the gross monthly pay. It is one of the most crucial factors that mortgage lenders use to analyze your creditworthiness when applying for a home loan. They need to know if you can actually manage the payments every month and repay the loan in good time.

How is a debt to income ratio (DTI) determined?

Are you worried that your financial position cannot allow you to purchase a house? Take a close look at what mortgage lenders think is the ideal the ideal income to debt ratio.

To calculate the DTI ratio, divide your recurring monthly debt payments by your gross monthly income. The resulting quotient is your potential mortgage burden. It gives a clear picture of how you will manage the loan and allows the lender to predict if you can complete the mortgage bill payments. Note that the gross income means the amount of money earned before taxation or other deductions. The DTI ratio doesn’t put into account the money you pay for daily expenses e.g. car insurance premiums or grocery expenses. Other monthly bills that count include credit payments, child support, rent, and student loan. If you think you are ready for a mortgage, you must figure out how it is going to affect your budget.

Suppose you have an auto loan that requires $900 per month, a $500 per month for a personal loan, and $1,100 for a mortgage. Your overall monthly debt burden is $2,500. If your monthly gross income is $5,000, your DTI ratio is (2500/5000)*100 = 50%.

What is the acceptable DTI in Canada?

Statistics indicate that home buyers with a high DTI are more likely to default their mortgage payments. The acceptable ratio by most lender falls between 30% and 45%. If your DTI is 50%, you should consider consulting a debt expert because it is not a healthy financial position. But there are certain exceptions when you approach a small mortgage lender who might give you a loan with a DTI above 45%. Big lenders might provide a mortgage if your DTI is more than 45% but you must demonstrate the ability to repay the loan. You need, for instance, excellent credit score or make a bigger down payment.

How to improve your DTI

The key to determining how much mortgage you can afford is knowing your debt to income ratio. This is a vital aspect which underwriters take into consideration to see how well you can handle a loan. Bearing in mind its significance in the lending industry, it is imperative to understand how you can improve it.

The key to determining how much mortgage you can afford is knowing your debt to income ratio. This is a vital aspect which underwriters take into consideration to see how well you can handle a loan. Bearing in mind its significance in the lending industry, it is imperative to understand how you can improve it.

The good news is that DTI can be improved, unlike other areas of financial life. If you pay off some of your excess debt like students loan, you can lower it to a healthier level. Before you start making mortgage payments, check with your lenders as requirements can differ significantly.

By paying down your debts, you can reduce the DTI. Pay off any credit card dues so your gross income can improve. Your lender may not be aware of your side hassle so you can use the extra income to reduce your debts. Moreover, you can use your bonus pays and cash windfall to minimize your debt burden. Note that your student loan is included in the calculation of DTI. The type of loan plus whether it has been deferred will determine whether the student loan counts against you.

Other expenses

Mortgage lenders have to review your recurrent monthly expenses like condo dues and homeowners association charges; insurance and mortgage premiums, and other financial obligations. Even if you have a great credit score, your debt to income ratio is equally important. Mortgage lenders have to look at the greater picture to see if you are capable of managing a plethora of monthly bills.

Types of debt income ratios

Lenders use two types of DTI ratios to determine your eligibility for a mortgage.

Lenders use two types of DTI ratios to determine your eligibility for a mortgage.

- Front-end DTI: this is the first ratio that mortgage lenders use. It is the proposed overall monthly payments of your housing (which include insurance premium, property taxes, and new mortgage installments) relative to the gross monthly salary.

- Total debt ratio: it is another important ratio in addition to the housing payments. It takes into account all the other monthly financial obligations like credit card loans, student loans, and auto loans.

Once you know your DTI, you can finally know what type of home loan you qualify for and how much you can save per month. Talk to an expert to help you with the grunt work of canceling mortgages that are too much out of your league. Then, focus on home loans which match your financial position.

Conclusion

Banks prefer mortgage clients with low DTI. Ratios above 45% are considered risky. Borrowers with DTIs as low as 36% have higher chances of qualifying for low-interest mortgages. If you are trying to acquire mortgage with better terms, your best bet is to keep your DTI as low as possible (below 36%). If you are stuck on how to calculate the ideal DTI and how it will affect your ability to get a home loan, talking to a financial advisor would be a good option. Don’t forget to use other smart tools to find a mortgage that meets your needs. Such tools help you to compare the mortgage rates thereby allowing you to find a good fit. A DTI ration is a good heads-up for considering a home that suits well your budget. In the end, you want a happy ending by making a major financial purchase. Check out how much mortgage you can afford.

by Leslie Rowberry

Having bad credit can seem like a death sentence for the goal of home ownership. Fortunately, that doesn’t have to be the case as there are many programs that help people secure bad credit home loans in Colorado.

These programs range from federal loans, to local grants, but all can help you achieve the dream of homeownership even with a bad credit score.

What’s a Credit Score?

Your credit score is simply a measure of your financial history, and how responsible you have been with credit.

If you have a long history of responsible managing debt and make all your payments on time then it’s likely your credit score is high, and likely to be low if you have little history or have lots of missed payments.

Get Help Pre Qualifying for a Colorado Bad Credit Home Loan – Click Here!

In terms of actual numbers, most lenders are looking for borrowers to have a score of at least 620. For those under this score it doesn’t automatically prevent you from securing a mortgage.

The government and state of Colorado both have multiple programs that can help people in this situation get approved for a mortgage.

In addition to that, credit is not the only criteria for acquiring a home loan, and improving these can help offset less than perfect credit.

Additional Factors

As mentioned, credit isn’t the only thing lenders look at when deciding whether to approve a mortgage application or not.

There are a host of other factors that also come into play, and exceeding in these might sway the lender despite a poor credit score.

The reverse is also true, even a great credit score would be hard pressed to win an approval if the following items are in bad order.

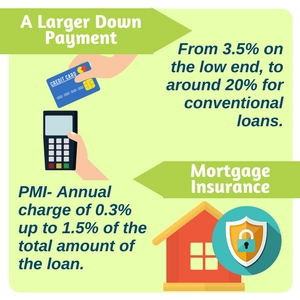

Down Payment

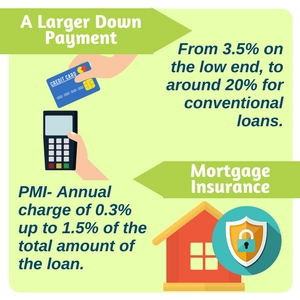

Probably the next most important requirement for a mortgage is the down payment. This is the money you put down at the beginning of the loan, and is typically expressed as a percentage of the total homes price.

Coming to the lender with a larger down payment is a good way to offset a poor credit score.

For a conventional loan, usually 20% is the required down payment amount. Other types of loans of loans may have less; for example the FHA loan only requires 3.5%.

Keep the percentages in mind to figure out how much more you should bring to the table.

Mortgage Insurance

Mortgage insurance is also another common aspect of bad credit and low down payment loans. Private mortgage insurance, or PMI, is an extra fee paid to help offset some of the risk for the lender.

The fee is generally a percentage of the total cost of the loan due annually. This is generally 0.3% to 1.5% depending on the exact terms of the loan and how risky the borrower is.

PMI is generally going to be a requirement for many bad credit loans, and it’s important to keep in mind as it is an extra free due as part of the home buying process.

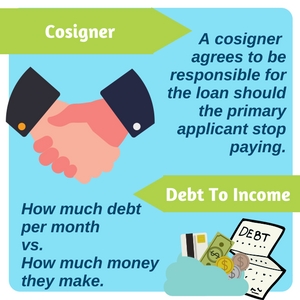

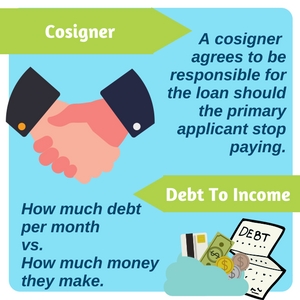

Cosigner

Another great option for securing a bad credit home loan in Colorado is to use a cosigner.

A cosigner is someone who agrees to also be responsible for the loan, and agrees to take over any payments should the main borrower not keep up with payments.

What’s great about a cosigner, is that the lender will also take into account their credit rating. Since they agree to be responsible for the loan, their credit score is also factored into the loan approval process.

Having a high credit score cosigner can really help get an application approved.

Debt To Income

Another important aspect to consider is your debt to income ratio. This is a measurement of how much debt you have versus your income, usually expressed as a monthly percentage.

The lower the number the better, as it means you have more free income to take on other debt, or pay for emergencies.

In general, lenders look for borrowers to have a debt to income ratio of 43% or less. While that’s generally the maximum, having a lower ratio is always better.

If your ration is significantly low, then it can help to offset a bad credit score.

The key here is just to make sure that you have as little debt as possible. Not only does this make you a more attractive borrower in the short term, but it also will help build credit in the long term as well!

Bad Credit Home Loans Colorado

If you’re living in Colorado with bad credit and are looking to buy a home then there are several great options open to you.

These programs come in a variety of different forms, and include everything from easy to acquire loans to grants that can help up your down payment.

It’s important to understand the ins and outs of each of these, as each one as their own set of requirements as well as benefits.

FHA Loans

One of the most popular types of loans for bad credit borrowers is the FHA loan. This is a government backed loan, that in general has lower requirements for both credit and down payments.

This makes it easier to acquire than a conventional loan.

The FHA loan is also very popular due to the fact that the down payment required is only 3.5%. Compare to a conventional loan which requires 20%, and this makes it much easier to get.

In order to qualify for this low down payment you’ll need a minimum credit score of 580.

For those lower than this, the FHA is actually available for scores as low as 500. In cases under 580 however, the borrower will need to come with at least a 10% down payment to make up for the increased risk.

VA Loan

For veterans with bad or even no credit the VA backed home loans are an excellent option. These are available nationwide, so are an option for Colorado residents as well.

The VA loan, the the FHA loan, is government backed and due to this provides a lot less risk for the lenders.

What’s great for bad credit borrowers about this particular loan is that it doesn’t have a set credit score requirement.

It also can be acquired for no down payment in some cases as well. This gives a lot of room for a bad credit borrower to come to the table with a large down payment to offset their credit score.

USDA Loans

Another great option for those looking to move to rural locations is the USDA loans. These are federally backed loans that are given to individuals who are looking to move to qualified rural locations in the country.

Their website has a map of what locations qualified, and it does take up a significant portion of the country.

While loan loan typically requires a credit score of 640+, those with lower can still apply. They will have to go through a process known as manual underwriting, which means a real person will take a look and make a decision on the application.

This takes a bit more time, but can work in the borrowers favor as the person looking at the application can take into account all the circumstances.

If you have worked on other areas to offset your credit, then this is a great opportunity to highlight those!

State and Local Programs

Colorado Home Buyer Tax Credit

The Colorado tax credit is a Colorado specific program that helps reduce the overall cost of your mortgage.

Qualified first time home buyers are able to reduce tax liability based on interest paid on their home loan.

This overall reduces the amount spent per year on the mortgage itself, which naturally reduces your debt liability. This is always a good thing, and can help swing a mortgage decision in your favor.

Colorado Housing and Finance Authority

Another Colorado program is the Colorado Housing and Finance Authority, or the CHFA. They help low income families secure housing both through renting and home ownership.

They have a variety of programs, including financial courses, special low down payment loans, and grants for down payment assistance.

This wide range of services makes them an excellent resource for anyone looking to buy a home in Colorado.

Their programs do have some credit requirements as well as maximum income requirements, so it’s definitely worth checking out their website to see if you qualify.

Teacher Next Door

Another example of a local program available in Colorado is the teacher next door. Specifically this program is available in Denver and Aurora, but may also be available in other Colorado cities as well.

This program provides teachers grants, down payment assistance, and good rates on home loans.

The program is also available to first responders such firefighters, police, and EMT. The also provide advice and knowledge in addition to their financial services.

The Teacher Next Door Program is a good example of a local program that has some specific requirements.

There are many programs all over Colorado that cater to specific groups of people like this, so make sure to do some research to see what’s out there in your area.

What’s a Good Credit Score For Buying a Home In Colorado?

Overall, your credit score is simple a number representing how much of a risk you are to bank. The higher the score the more dependable you have proven to be, and in turn the less of a risk you are.

Credit scores range from 350, all the way up 850, and are reported by three main agencies. These scores can differ from agency, so find out which one your lender uses so you can arm yourself with the best knowledge.

Most conventional loans are looking for credit scores of 620+. Individuals above this number have demonstrated they can handle credit and debt, and present less of a risk of defaulting on their loan.

If your score is below this, then this is a good number to shoot for, at least initially. Higher is always better, as the lenders will give better rates to those above 700 or 750.

Bad Credit Home Loans Colorado

Having bad credit doesn’t mean you can’t buy a home. There are a lot of programs that can help bad credit buyers in Colorado achieve the dream of home ownership.

Bad credit isn’t a life sentence either, you can always rebuilt it. Even if you have a bankruptcy or foreclosure in your past, working hard paying off debt is a sure fire way to get that score back up. Don’t let bad credit stop you from becoming a homeowner!

FAQ

Can I still buy a home with a bad credit score in Colorado?

Yes! There are many programs that can help low credit buyers acquire a mortgage. These programs are often either government backed, or help provide more money to the lender; both of which lower the lender’s risk.

What Options Do I have For Bad Credit Home Loans In Colorado?

There are a wide range of programs, both federal and local. This includes things like the FHA loan which can be acquired with as low as a 500 credit score, or local programs like the Teacher Next Door which can provide down payment assistance and other financial services.

Can I rebuild a bad Credit Score? How Long Does it take?

Yes you can! The best way is to be responsible with your credit and debt. Make sure to always pay your payments on time, and reduce the overall debt you have.

How long it takes is very variable. It depends on how long you’ve had credit for, and what sort of history it has.

For example, someone with a bankruptcy in their past is going to have a more difficult time rebuilding than someone who doesn’t.

You have been searching for a house and finally found your dream home. The next thing you want is to find the right mortgage and get those keys. One of the easiest ways to do this is working with a mortgage broker to guide you through the complex process from the beginning to the end. This negotiator is neither a loan officer nor a banker. This is what they do for you.

You have been searching for a house and finally found your dream home. The next thing you want is to find the right mortgage and get those keys. One of the easiest ways to do this is working with a mortgage broker to guide you through the complex process from the beginning to the end. This negotiator is neither a loan officer nor a banker. This is what they do for you. These details seem too personal but the lenders need to know too. It is important the bank knows whether part of your income comes from child support to determine potential liabilities in the future. Moreover, if you have filed for bankruptcy recently, you must wait for another 2 years to get discharged before you are considered qualified for a mortgage.

These details seem too personal but the lenders need to know too. It is important the bank knows whether part of your income comes from child support to determine potential liabilities in the future. Moreover, if you have filed for bankruptcy recently, you must wait for another 2 years to get discharged before you are considered qualified for a mortgage. A mortgage down payment plus closing costs require a huge sum of money. You must prove to them that you will make enough money to continue with mortgage payments. Some home buyers don’t have an idea of where the money will come from, something that needs to be planned for in advance. When you are uncertain, ask the mortgage broker for guidance. They will suggest assets for down payment such as a savings account, financial gifts, retirement benefits, and so on.

A mortgage down payment plus closing costs require a huge sum of money. You must prove to them that you will make enough money to continue with mortgage payments. Some home buyers don’t have an idea of where the money will come from, something that needs to be planned for in advance. When you are uncertain, ask the mortgage broker for guidance. They will suggest assets for down payment such as a savings account, financial gifts, retirement benefits, and so on.

This is the process of switching the

This is the process of switching the  Start your remortgaging plans at least 6 months before the current mortgage term ends. Have your bank statements ready to give a proof of how much debt you are in. if you have a variable mortgage deal, you might want to determine how much interest you were paying before the rates began to fluctuate.

Start your remortgaging plans at least 6 months before the current mortgage term ends. Have your bank statements ready to give a proof of how much debt you are in. if you have a variable mortgage deal, you might want to determine how much interest you were paying before the rates began to fluctuate. Compare different fact sheets to determine what kind of loan is suitable for you. Track the deal down and speak directly to the lender. You can also use comparison rate websites like

Compare different fact sheets to determine what kind of loan is suitable for you. Track the deal down and speak directly to the lender. You can also use comparison rate websites like  If you are trying to make a decision on whether to take a mortgage or not, one of the key decisions that you will need to make is on whether to take the mortgage on an interest-only basis or a repayment basis. If you are

If you are trying to make a decision on whether to take a mortgage or not, one of the key decisions that you will need to make is on whether to take the mortgage on an interest-only basis or a repayment basis. If you are  Every type of mortgage comes with its pros and cons. Some of the benefits of an interest-only mortgage include:

Every type of mortgage comes with its pros and cons. Some of the benefits of an interest-only mortgage include: Other interest-only risks

Other interest-only risks The debt to income ratio refers to the total monthly debt payments relative to the gross monthly pay. It is one of the most crucial factors that mortgage lenders use to analyze your creditworthiness when applying for a home loan. They need to know if you can actually manage the payments every month and repay the loan in good time.

The debt to income ratio refers to the total monthly debt payments relative to the gross monthly pay. It is one of the most crucial factors that mortgage lenders use to analyze your creditworthiness when applying for a home loan. They need to know if you can actually manage the payments every month and repay the loan in good time. The key to determining how much mortgage you can afford is knowing your debt to income ratio. This is a vital aspect which underwriters take into consideration to see how well you can handle a loan. Bearing in mind its significance in the lending industry, it is imperative to understand how you can improve it.

The key to determining how much mortgage you can afford is knowing your debt to income ratio. This is a vital aspect which underwriters take into consideration to see how well you can handle a loan. Bearing in mind its significance in the lending industry, it is imperative to understand how you can improve it. Lenders use two types of DTI ratios to determine your eligibility for a mortgage.

Lenders use two types of DTI ratios to determine your eligibility for a mortgage.