by Leslie Rowberry

Reasons your mortgage application was rejected

Nobody likes rejection because it hurts. A home loan application that has been denied is especially debilitating because it shutters one of the biggest dreams in life- home ownership. However, it shouldn’t be the end of the world when a lender rejects your application. There is always a second chance. Mortgage lenders are supposed to explain to unsuccessful loan applicants why their applications were declined. They normally give a free credit report that was used to make the decision. If you get such a copy, you should use it to address your weak areas and start working on them so you can be approved in your next application. The loan can be denied for reasons such as:

Nobody likes rejection because it hurts. A home loan application that has been denied is especially debilitating because it shutters one of the biggest dreams in life- home ownership. However, it shouldn’t be the end of the world when a lender rejects your application. There is always a second chance. Mortgage lenders are supposed to explain to unsuccessful loan applicants why their applications were declined. They normally give a free credit report that was used to make the decision. If you get such a copy, you should use it to address your weak areas and start working on them so you can be approved in your next application. The loan can be denied for reasons such as:

- Missed debt payments

- Too small a down payment

- Poor credit history

- Too low DTI

- Lack of a savings account

- Lack of proper income statements

- Recent application of credit cards and other loans

- Monetary gifts

- Moving a huge sum of money

- Over-drafting the checking account

- Job inconsistency

Here are the right steps to take when you are denied a mortgage.

Make an appointment with the loan officer

If your lender doesn’t give reasons for your disapproval, you have the right to ask them what went wrong. It could be your income, small down payment, or credit issue. Ask the loan officer to point out the specific areas of concern. Perhaps you need to add a few thousand dollars to your down payment in which case you can save up and re-apply.

If your credit report had issues, your lender should provide the name of the agency used and a copy of your credit report. From there you should take the right steps to improve the credit score. If the application was brushed-off due to income inadequacy, consider other home financing options for borrowers in low-income classes. Different lenders provide different approval benchmarks and you should know your options before you try something. Don’t forget that you can always negotiate the terms and rates with your lender to reduce the loan amount.

Bottom line is being aware of the reason for your disapproval helps you to apply smartly next time. However, you shouldn’t apply for more than 5 home loans in a period of six months.

Consider a different type of mortgage

There are several types of mortgages which come with different sets of guidelines. The key is working with a mortgage consultant to find what mortgage fits your financial situation. If you are strapped for cash, a conventional mortgage is an ideal option for you because it requires only about 3% of security deposit. But you need a credit score above 620. If your credit score doesn’t allow, consider other options like FHA home loans which are not stringent on credit scores. You might even be approved with as low as 580 credit score and at least 10% down payment. Certain lenders are committed to assisting homebuyers to qualify for home loans regardless of their financial situations. So, when you don’t qualify for one type of home loan, ask the loan officer for an alternative option. If you don’t speak up, you might not be assisted.

There are several types of mortgages which come with different sets of guidelines. The key is working with a mortgage consultant to find what mortgage fits your financial situation. If you are strapped for cash, a conventional mortgage is an ideal option for you because it requires only about 3% of security deposit. But you need a credit score above 620. If your credit score doesn’t allow, consider other options like FHA home loans which are not stringent on credit scores. You might even be approved with as low as 580 credit score and at least 10% down payment. Certain lenders are committed to assisting homebuyers to qualify for home loans regardless of their financial situations. So, when you don’t qualify for one type of home loan, ask the loan officer for an alternative option. If you don’t speak up, you might not be assisted.

Find another lender

Just because one lender denied you a loan is not to mean that the entire industry has turned you down. The mortgage lending sector is quite flexible. Banks normally check your prevailing debts and income to calculate the DTI and determine if you are an eligible borrower. In general terms, your DTI must not exceed 36%. There are banks that are very strict to DTI. If your debt burden exceeds 36% of your gross income, they cannot approve your loan application unless you pay off some debts. Nonetheless, other lenders are a bit lenient and can allow a DTI up to 45%. Therefore, when a big bank rejects your home loan due to a high DTI, don’t lose hope yet. Go to another lender like a credit union or the local community bank.

Work on your credit report

If you are a first-time home loan applicant, you should know that checking your credit report before applying for a loan is mandatory. You can get it free of charge from one of the three credit reporting bureaus every year. Perhaps you did not bother to check your credit history before applying for the home loan and that is why you were turned down. It’s high time you review it and clean up the mess. It takes minor errors to pull down the credit rating thereby hampering your chances mortgage approval. Thus, you must dispute erroneous information on your credit report that is tarnishing your credit status. Even if the information was reported by mistake, your lender won’t care and will see you as a risky borrower until the issues are resolved. Removing those errors might take a few weeks. You might also want to pay off some debts to boost the credit score but it takes one to two months for that change to be reflected on the credit report. Because mortgage processes are time-conscious, enquire about rapid scoring to get the credit report updated quickly. With rapid scoring, your creditor can acknowledge the error. The good thing about rapid scoring is that the credit is updated within 3 days. The lender will verify the updated information forts and sent the right documents to a credit reporting bureau. The charges for such a service differ from one mortgage lender to the next.

If you are a first-time home loan applicant, you should know that checking your credit report before applying for a loan is mandatory. You can get it free of charge from one of the three credit reporting bureaus every year. Perhaps you did not bother to check your credit history before applying for the home loan and that is why you were turned down. It’s high time you review it and clean up the mess. It takes minor errors to pull down the credit rating thereby hampering your chances mortgage approval. Thus, you must dispute erroneous information on your credit report that is tarnishing your credit status. Even if the information was reported by mistake, your lender won’t care and will see you as a risky borrower until the issues are resolved. Removing those errors might take a few weeks. You might also want to pay off some debts to boost the credit score but it takes one to two months for that change to be reflected on the credit report. Because mortgage processes are time-conscious, enquire about rapid scoring to get the credit report updated quickly. With rapid scoring, your creditor can acknowledge the error. The good thing about rapid scoring is that the credit is updated within 3 days. The lender will verify the updated information forts and sent the right documents to a credit reporting bureau. The charges for such a service differ from one mortgage lender to the next.

Final word

Mortgage rejection can be a big shock but you shouldn’t take it lying down. One denial should not discourage you from becoming a homeowner. It only means that you are not a suitable candidate for a particular lender at that point in time. Just make sure you have gotten to the bottom of disapproval. Luckily, most lenders dint leave you guessing as they provide an explanation for the denial. Don’t fret because there are many ways to get approved as explained above and move on with home-buying. Check out how much mortgage you can afford.

by Mike Plambeck

Buying a home can be confusing and scary process with an endless list of items to do. Of all the pieces that go into buying a home, none is quite like the mortgage. With a range of different mortgage options, it can be difficult to decide which option is best. One such option is the FHA loan, specifically the FHA loan in Oregon. While the FHA loan comes with its own list of things to keep in mind, in many cases it is the best choice for home buyers.

Buying a home can be confusing and scary process with an endless list of items to do. Of all the pieces that go into buying a home, none is quite like the mortgage. With a range of different mortgage options, it can be difficult to decide which option is best. One such option is the FHA loan, specifically the FHA loan in Oregon. While the FHA loan comes with its own list of things to keep in mind, in many cases it is the best choice for home buyers.

This article is intended as an overview for anyone considering taking on a FHA loan in Oregon. It will touch on the key points to understand when considering a FHA loan, as well as the pros and cons of taking one out, and the process that is involved in securing one.

Get pre-qualified for a FHA Loan in Oregon Today!

What is an Oregon FHA Loan?

A FHA loan in Oregon is a mortgage that is insured by the Federal Housing Administration (FHA). What separates this type of mortgage from a more traditional one is the lower down payment, along with less strict credit requirements. In many cases, the down payment required is only 3.5%, making it the perfect choice for those who don’t have the more standard 20%.

Different Types of FHA Loans in Oregon

During the course of shopping for loans several recurring terms will likely come up.

During the course of shopping for loans several recurring terms will likely come up.

Fixed-Rate FHA Loan

A fixed rate mortgage is one where the interest rate does not fluctuate. It won’t get any lower, but it won’t go up. This means monthly payments will remain the same throughout the loan term, making it very easy to budget. This makes it an attractive choice for many borrowers.

30 Year FHA Loan

This is the most popular term for mortgages and FHA loans. A 30 year loan simply means that re-payment of this loan will take place over the next 30 years. Compared with another popular loan term of 15 years, a 30 year mortgage gives twice as much time to pay off. Keep in mind though that during those extra years the loan will incur additional interest charges making the total cost of the loan larger.

In addition to the above, there are other options that are available for FHA loans. These include ARM loans, hybrid, or a balloon mortgage.

Advantages of an FHA Loan in Oregon

The main benefits of the FHA loans are its low down payment and low, at least in comparison to other mortgages, credit requirements.

The main benefits of the FHA loans are its low down payment and low, at least in comparison to other mortgages, credit requirements.

To start, banks are very motivated to approve these types of loans, which is evident in the fairly loose requirements. For people who may have been denied a mortgage loan in the past, have less than good credit, or lack a large down payment, an FHA loan in Oregon is an attractive choice. Due to the government backing and funding requirements, banks are much more likely to approve these types of loans.

The small down payment also makes them very attractive for first time home buyers. Traditional mortgages typically look for around 20% down payment, which can be difficult for many to come up with. This is especially the case for first time home buyers who lack any sort of home equity to negotiate with. FHA loans however, only need 3.5%! This allows a much wider range of people to apply for and be approved for this type of loan.

Disadvantages of an FHA Loan in Oregon

While there’s definitely some attractive positives to taking one, FHA loans do have some cons to keep in mind when considering getting one. This is mainly in the form of additional fees owed to secure the loan. At the beginning of the loan term there is an upfront funding fee of, at the time of writing, 1.75% of the total value of the loan. This amount can be working into closing costs however.

In addition to the upfront fee, there is also an annual fee broken into 12 monthly payments. This mortgage insurance is required to be carried for the lifetime of the loan. This too is calculated as a percentage of the total loan amount.

What Properties Qualify?

Not all properties are eligible for a FHA loan in Oregon, and there are additionally some requirements all properties need to meet. To start, FHA loans are primarily intended for those who intended to occupy the property in question. Therefore, they typically cannot be used for things like vacation, rental, or investment properties.

There’s also minimum property standards that need to be met before the loan is approved. Some items that a property will look for are:

● Asbestos

● Contaminated Soil

● Roofing expected to last for 2+ more years

● Located in an area of excessive noise

● Working bathroom with sink, toilet, and shower

● Structural soundness

This is just a short list of some of the items an inspector will look for. The housing department has put together a full list that goes into more depth on what disqualifies a property. If any issues are found, they will have to be fixed before the loan will be approved.

FHA Loan Limits Oregon

Another caveat of FHA loans is the limits imposed on how much can be borrowed. Each year, the max borrow amount is adjusted based on media home prices. This amount also varied for different residence types, and how many families are occupying a dwelling. A two family, duplex style home has a higher allowance than a single family home. Most buyers however, fall into the “One-Family” designation.

Currently, the range for “One-Family” dwellings ranges from roughly 275-408k. These values are based on county, so where a house is located can drastically affect the loan amount available. As noted above, this range is subject to change, so potential buyers should check the FHA website to get an updated look at the limits.

Credit Score

As with any type of loan, credit score is a major consideration when looking to get a FHA mortgage. For the standard 3.5% down payment, a credit score of 580+ is required. Those below this are not automatically disqualified, although additional conditions may apply.

The primary way to get one with a lower credit score is to offer a higher down payment. Typically, for those < 580, a down payment of 10% is required to offset the additional risk. They may also be subject to higher interest rates. They can also attempt to use alternative credit such as utility bills to prove credit worthiness. This is at the discretion of the lender however, so plan to call ahead.

FHA loan Requirements in Oregon

While easier to get from a credit perspective, there are a number of additional FHA loan requirements in Oregon for securing a FHA loan. Some of these are unique to this type of loan, and may not be required for a traditional mortgage. Here is the list of requirements for those taking out a FHA loan:

While easier to get from a credit perspective, there are a number of additional FHA loan requirements in Oregon for securing a FHA loan. Some of these are unique to this type of loan, and may not be required for a traditional mortgage. Here is the list of requirements for those taking out a FHA loan:

● 3.5% down payment (potentially more for bad credit borrowers)

● Credit rating of 580+ (may be lower in certain cases)

● Steady employment history, usually at least 2 years

● Must be for a primary residence

● Property must be appraised and assessed by a licensed inspector

In addition, borrowers are also required to have debt to income ratios in an acceptable range. For front-end this is less than 31%, and back-end less than 41%. Finally, any bankruptcies or foreclosures should be 2-3 years in the past. In the time since, the borrower should have attempted re-established their credit.

How Do You Apply?

The first step to applying for any type of loan is to get your numbers in order. Make sure that your credit score is in the expected range and come up with budget estimates that keep your debt to income ratios acceptable.

Once all that is in order the next step is to find a lender that is approved to give out FHA backed loans. The FHA website has a handy tool for finding FHA lenders in Oregon that are approved. It does pay to shop around a bit as not all lenders will offer the same interest rates.

Once you’ve determined a reputable lender, you’ll be required to submit various documents that will verify things like employment, income, and credit. These documents include:

● W-2 from the last two years

● Tax documents

● Bank statements

● Proof of income

● Address of past residences

● Information on past employers

This information is then used to determine if you are eligible for a FHA loan in Oregon. Once you’ve gone through the approval process you’ll need to have the home inspected as mentioned above. This inspection must be ordered by the lender, and the inspection must pass, or issues must be fixed, in order to secure the loan.

What Are The FHA Loan Rates In Oregon?

The interest rates for FHA loans can change daily, so check with a lender to determine the current rate being charged. FHA lenders in Oregon do have the ability to charge their own rates, so it’s very likely that two lenders for the same loan will have different interest rates. In fact, many times the rate is up for negotiation, so don’t be afraid to ask your lender to go lower on the rate or match a competitor.

Rate Lock

Once a lender has committed to writing a loan, they’ll provide the borrower with what is know as a rate lock. This will usually last from 30-45 days, but can last longer at the discretion of the lender. A rate lock simply locks in the interest rate at its current value and prevents it from moving with the market. Many lenders will also allow borrowers to pay to extend the length of the rate lock.

Once a lender has committed to writing a loan, they’ll provide the borrower with what is know as a rate lock. This will usually last from 30-45 days, but can last longer at the discretion of the lender. A rate lock simply locks in the interest rate at its current value and prevents it from moving with the market. Many lenders will also allow borrowers to pay to extend the length of the rate lock.

Keep in mind though, rate lock is a double edged sword. While it will keep your interest rate from getting any higher, it will also keep if from going lower.

Apply for your FHA Loan in Oregon Today!

FHA Loan in Oregon FAQs

1. Do You Have To Be a First Time Home Buyer To Qualify?

No, FHA loans are open to anyone who meets the requirements. Weighting the pros and cons can help you decided whether to go with FHA loan or a traditional mortgage.

2.What Is The Maximum Income Limit for FHA Loans?

There is no maximum income, if you meet the requirements you are eligible to apply for a FHA loan in Oregon. Keep in mind though, for higher income families that a traditional mortgage is likely to be cheaper over the life of the loan if they can supply a larger down payment.

3.Can you Refinance a FHA Loan?

Yes you can refinance into another FHA loan (called a streamline refinance) or into a traditional loan. Both options have their own set of pros and cons, so it’s important to understand each before making a decision.

Mortgages are one of the most confusing parts of buying a home, but hopefully this article has helped you decide whether a FHA loan in Oregon is the right choice. While certainly attractive on the surface, there are pros and cons to consider before diving in. Making sure you understand the full process is the best step to take to get the best deal when buying a new home!

by Leslie Rowberry

The FHA Title 1 loan provides an easy way for homeowners to finance home improvements without having to have large amounts of equity built up in their home.

When looking to make repairs on a home, many homeowners are forced to take out loans in order to cover the costs of the repairs.

While many use the equity in their home to secure the loan, many homeowners lack the ability to do so. For homeowners in this position the FHA title 1 loan is an excellent option.

We Can Help You Qualify For FHA Title 1 Loans

Fill Out The Form Below To Get Help Today!

FHA Title 1 Loans For Home Renovations

A title 1 FHA loan is a loan that is offered by the FHA for the purpose of home renovations.

What makes the Title 1 Loan different from other home improvement type loans is the ability to secure one without any equity.

This makes it available for a wide range of homeowners to use to improve their home.

No Equity? A FHA Title 1 Loan May Be the Answer!

Title 1 loans are for those looking to make necessary home improvements, who can’t secure a traditional home equity loan due to lack of equity in their home.

Title 1 loans are for those looking to make necessary home improvements, who can’t secure a traditional home equity loan due to lack of equity in their home.

One key here to remember is that the title 1 FHA home improvement loan can only be used for improvements that directly impact the livability or functionality of a home.

That includes things like a new roof or replacing a furnace, but not something like installing a swimming pool.

Items deemed as “luxury” improvements can not use the Title 1 loan to finance their construction.

For those that are looking to many an approved improvement the Title 1 loan is a fantastic option. Due to needing no equity in the home, even recent home purchases can qualify for the loan.

FHA Title 1 Loans Provide Lenders With Security

Lenders are happy to work with Title 1 loans as they provide additional security for the lender.

The big reason is that they are covered by mandatory mortgage insurance of $1 per $100 of the loan or 1%.

This gives them additional security in the case of a default. In addition to that, larger amounts are also secured by collateral in the home.

Applying for a Title 1 Home Loan

Much like the standard FHA home loan, the title 1 loan is not directly provided by the FHA but by approved 3rd party lenders.

Much like the standard FHA home loan, the title 1 loan is not directly provided by the FHA but by approved 3rd party lenders.

In order to secure a FHA, a prospective borrower needs to approach one of these lenders, which the FHA has a list of on their website.

It’s important to note that because it is provided by a 3rd party lender, each one may have their own terms and conditions.

This includes things like credit and income requirements, as well as interest rates and repayment terms. It pays to shop around a bit, and see which lender can provide the best deal.

It also means that time to get approved can vary by lender. Depending on the requirements and process, it may take a lender more time to review and make a decision on an application.

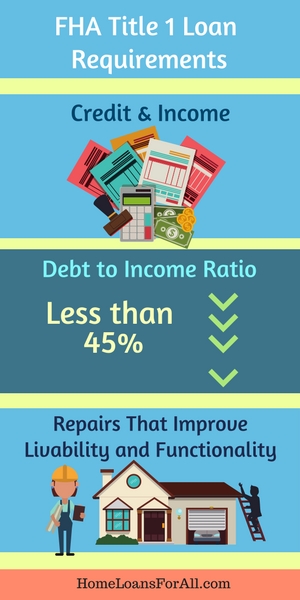

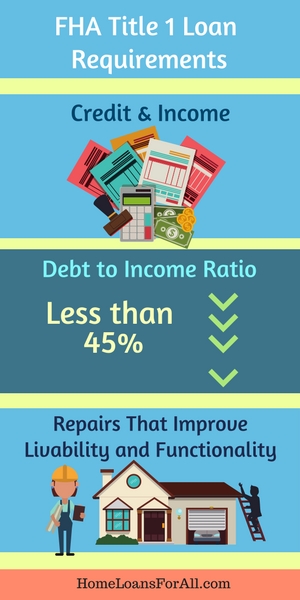

FHA Title I Loan Requirements

Much like the typical FHA loan, title ones loans have a variety of requirements governing their usage.

Much like the typical FHA loan, title ones loans have a variety of requirements governing their usage.

Understanding these requirements is essential to determining whether a title one loan is the right choice.

As with any loan, the first thing a lender will check is your credit and income.

To start, FHA Title 1 loan credit requirements can vary by lender, but a higher score is always better.

There are no set minimums for credit score for a title one loan, so even low credit borrowers can be approved.

Lenders however are likely to offer better rates to those who have higher rates, but having a low credit score won’t automatically exclude a borrower from the program.

After that the lender will check income to make sure that a borrower can afford to make payments.

Many lenders will require proof of income in the form of pay-stubs, bank statements, or W-2’s. These all help to prove income, and show the lender that they are likely to get their money back.

They are also looking for a debt to income ratio of less than 45%.

Lastly, there are also requirements for what the loan can be used for.

In general, only repairs that improve the livability and functionality of the home can financed through this type of lien.

This means improvements such as a new roof or other ones that fall into a similar vein of improvement are acceptable.

It can’t be used for any sort of luxury improvements like adding a hot tub.

The loan must also be used on a property that has been occupied for at least the last 90 days.

FHA Title 1 Loan Limits

As with most loans, there are limits to what can be borrowed. Any amounts over these limits need to separately financed, or made up for by the borrower.

For single family dwellings, the limit is $25,000. Multi family dwellings are bit different, and come with a limit of $12,000 per unit, up to a maximum of $60,000.

In terms of repayment, single and multi family homes offer loans of up to 20 years. There is no repayment for early repayment either!

It’s also important to know that loans under $7,500 also don’t require any sort of collateral. This means that if a borrower defaults on the loan, the lender won’t be able to go after the home. However, for loans above the $7,500 mark, the loan is secured by the collateral of the house. In cases like this, the bank can foreclose on a house where the payments are not being made.

Alternative Home Improvement Programs

The title 1 Loan program is not the only option homeowners have when looking to make improvements on their home.

What’s fantastic for homeowners is some of these programs can be used in conjunction in order to increase the amount a borrower can potentially use for their home improvement project.

FHA Title 1 Vs. FHA Title 2 Loans

Title 2 loans are a group of home loans that allow borrowers to roll the costs of improvement and labor in the mortgage for a home.

Title 2 loans are a group of home loans that allow borrowers to roll the costs of improvement and labor in the mortgage for a home.

Unlike a Title 1 which focuses on the improvement of an existing property, Title 2 loans can also be used for new purchases and fixer-upper type properties. Certain ones can also be used on an existing property to improve or fix issues.

This gives them a much larger range options and a higher amount that can be borrowed.

To offset this, they generally have stricter requirements for who can be approved for one, as well as other requirements such as minimum down payments and property inspections that must be met.

FHA Title 1 Vs. FHA 203K Loans

Another option for homebuyers and owners is the 203(k) loan. This type of loan is meant to aid in major property renovations, and can be taken pre-purchase for a fixer-upper or for improvements on an existing property.

Another option for homebuyers and owners is the 203(k) loan. This type of loan is meant to aid in major property renovations, and can be taken pre-purchase for a fixer-upper or for improvements on an existing property.

The big difference on this loan when compared to the title one is the much larger amount that can be borrowed as it can be used to buy and fix up an entirely new home.

In addition to that, it can also be used with a Title 1 loan in order to further increase borrowing power.

The downsides of a 203K loan come with stricter requirements in terms of credit, as well as long approval process.

A 203K loan actually requires a contractor to submit a bid for larger projects before it can be approved, which can greatly slow down the process. It also requires a down payment of 3.5% for good credit borrowers.

Conclusion

For those looking to make improvements to their home the FHA Title 1 Loan is a great option. It provides an excellent way for those without much equity to secure funding for their project, and without a lot of the red tape of other home improvement loans.

FHA Title 1 Loan FAQs

Can I use a Title 1 loan to put in a swimming pool?

No, the title 1 loan cannot be used for luxury items such as a swimming pool. It can be only used to improvement of functional and structural components of a home such as fixing damaged siding or repairing/replacing a roof.

Can I use a Title 1 loan to install solar panels?

Some energy saving improvements such as solar panels can qualify for a title 1 loan. For those that don’t, the FHA offers a separate PowerSaver program specifically for this purpose. Keep in mind though, this program has different requirements from the title 1, such as minimum credit score of 660, so not all borrowers will qualify.

Does a Title 1 Loan require mortgage insurance?

Yes, title 1 loans require mortgage insurance that is an annual premium of $1 per $100 of loan. This helps to offset the risk for lender and helps ensure they are able to recoup their money in case of a default or non-paying borrower.

What Is The Maximum I can Borrow For a Title 1 Loan?

The maximum amount that can be borrowed depends on the type of house the improvements are going to be performed on. For single family dwellings the maximum is $25,000. For multi-family dwellings, this maximum is increased to $12,000 per unit with a cap at $60,000.

Additional Resources

by Leslie Rowberry

Many homeowners love the idea of having a maintenance-free property with all of the amenities found in an apartment complex.

Many homeowners love the idea of having a maintenance-free property with all of the amenities found in an apartment complex.

Condominiums are an excellent way to combine the best of both worlds, but can you buy a condo with an FHA loan? You can definitely take advantage of all the benefits of this loan and purchase an approved condo all at the same time.

The trick is knowing exactly how to find these properties and learning which ones are FHA approved condos.

Get Pre Qualified for FHA Condos Today – Click Here.

The FHA loan program is sponsored by the Federal Housing Administration in conjunction with private lenders.

The federal government offers to back a certain portion of every mortgage to grant more peace of mind to lenders who might issue financing to first-time home buyers, people with poor credit, or those with no credit at all.

This opens the door for many people to purchase a property even if they aren’t ideal candidates for a conventional loan.

This program comes with lots of benefits for prospective buyers. Most notably, you have a much lower down payment compared to the typical twenty percent requested with a conventional loan.

If you have a credit score of 580 or higher, you could qualify for a down payment of just 3.5 percent.

All of this makes it more likely than ever that you could purchase one of the many FHA approved condos for sale. You only have to know where to look to find a property that meets the requirements.

What are FHA Approved Condos?

Not all condominiums and complexes will qualify for the FHA loan. This is sometimes where home buyers become caught up with the financing because they fall in love with an area that isn’t already approved.

Not all condominiums and complexes will qualify for the FHA loan. This is sometimes where home buyers become caught up with the financing because they fall in love with an area that isn’t already approved.

Familiarize yourself with the eligibility requirements and where you can go to find FHA approved condos for sale before you get started.

Eligibility Requirements

There are some very specific criteria for a complex to qualify as FHA approved condos. Many of these standards are put in place to protect the buyer from purchasing a home in a complex that might not bode well for the resale value of the property.

Home buyers should desire to stay within the boundaries of these eligibility requirements in order to protect their own financial interests in the years ahead.

Here are a few of the eligibility requirements you can expect to face when searching for FHA approved condos for sale:

- Must contain at least two units

- Detached or semi-detached units

- Can be row houses or manufactured homes

- May be walk-ups, mid-rises, or high-rises

- May or may not have an elevator

Project Eligibility Requirements

Beyond these basic requirements, you might also find eligibility criteria that are a little stricter and apply to the project or complex itself. Some of the additional criteria here include:

- Property must be primarily residential with more than 50 percent being used as homes

- Owner-occupants must own at least 50 percent of the properties

- No more than 15 percent of the units can be behind on their payments for more than sixty days

- No more than 50 percent of the units can have FHA loans in one complex

In addition to the rules about ownership and residency for each unit, the complex must also abide by certain rules.

For example, they must have at least ten percent of their budgeted income in a reserve account in order to cover insurance deductibles and repairs or replacements for the coming two years.

All complexes must also have the appropriate type of insurance, including blanket, general liability, and a fidelity bond. Flood insurance might also be required depending on the location.

Leasing is another issue that will come up when searching for FHA approved condos. The HOA at the complex must allow you to lease the unit if you choose to, and you must be allowed to select any tenant you would like.

You should be able to lease the property whenever you choose to without any residency requirements on the property first. They may not allow leases for less than thirty-day periods.

The Board of Directors at the HOA also cannot force you to run background checks, credit checks, or a screening process on a new tenant even though you may choose to do so on your own.

How Can I Find FHA Approved Condos?

In order to find one of these FHA approved condos, you will need to either work with a real estate agent or search on the HUD website. A real estate agent should be familiar with the local condos in your area that qualify for FHA financing.

In order to find one of these FHA approved condos, you will need to either work with a real estate agent or search on the HUD website. A real estate agent should be familiar with the local condos in your area that qualify for FHA financing.

If you don’t want to do much of the work and research on your own, this is definitely a great way to find what you need.

Alternatively, you can use the HUD website to search for condos that bear the HUD FHA approved condos label. This site allows you to search for a specific project or simply to view all of the eligible properties in your area. You can filter by city, zip code, county, and more.

All you need to do is change the status to approved to fund the HUD FHA approved condos.

From here, you can click on the links to find more information on each complex and condo. All of the relevant communities will be directly at your fingertips.

FHA Approved Condo Advantages

Why would you want to opt for a condo instead of a typical single-family detached home? There are a lot of reasons why homeowners are more likely to choose this type of property for their long-term home. Here are a few of the most popular reasons you might consider purchasing an FHA approved condo:

No maintenance or repairs on the condo

No yard work

Predictable fees work easily into your budget

More affordable than many single-family homes

Amenities like a pool and a gym right on-site

Entertainment options

FHA Approved Condo Disadvantages

You will have to weigh whether the advantages outweigh the disadvantages before you make the move. As in any type of home, you are bound to have a few things that you might not care for about the property.

Condos tend to have more disadvantages than a single-family home because they do have a stricter HOA, but you aren’t responsible for the maintenance or repairs on your home. Because of this, some of the restrictions make complete sense.

The primary disadvantage of choosing a condo is the additional fee you might experience. The cost of the amenities might add up, even if you don’t really use them.

The association fees can even be high, contributing a much higher out of pocket cost each month even though your condo purchase was cheaper.

Other disadvantages to choosing a condo include:

Less privacy

Repairs may not be made in a timely manner

Smaller square footages

Limited parking options

Pet restrictions

Are FHA Approved Condos for First Time Buyers?

FHA approved condos are ideal for first-time buyers. The FHA mortgage program is ideal because it features low interest rates, looser credit requirements, and a much lower down payment than traditional options.

FHA approved condos are ideal for first-time buyers. The FHA mortgage program is ideal because it features low interest rates, looser credit requirements, and a much lower down payment than traditional options.

When you combine those features with the low maintenance required for a condo and its low overall market value, you get a great combination that could be the perfect choice for a first-time home buyer.

What are the Credit Guidelines for FHA Approved Condos?

The FHA mortgage program does have some requirements that prospective borrowers will need to meet prior to receiving this loan. Your credit score is one of the most significant hurdles that many homeowners will have to deal with prior to getting financing for one of these FHA approved projects.

There are two different minimum credit scores depending on how you hope to use this mortgage.

Most individuals want to take advantage of the lowest possible down payment. With an FHA mortgage, you might face only a 3.5 percent down payment if you have a credit score of 580 or higher.

Do you need bad credit home loans? You can still purchase a condo with the FHA mortgage program even if your credit score is lower than 580. Be prepared to put down a much larger down payment of ten percent if you have a credit score between 500 and 579.

What is MIP?

All FHA loans come standard with your mortgage insurance premium, often abbreviated as MIP. This monthly fee is very similar to PMI and it helps to protect the lender in the event that you default on the loan.

All FHA loans come standard with your mortgage insurance premium, often abbreviated as MIP. This monthly fee is very similar to PMI and it helps to protect the lender in the event that you default on the loan.

Most conventional mortgages allow you to waive the mortgage insurance once you build up 20 percent equity in your property. However, this isn’t the case with the FHA loan.

If you take advantage of the 3.5 percent down payment, you will have MIP for the entire duration of your loan. This is one of the major drawbacks to this type of loan because it can add up to thousands of dollars over the course of your loan term.

Homeowners who put down at least ten percent of the value of the home have the option to remove their mortgage insurance premium after eleven years.

This could be a major plus for families who have poor credit and need to place a higher down payment on the property.

Keep in mind that you could put down a larger down payment to avoid some of the unnecessary cost of the MIP even if you don’t have poor credit right now.

The cost of your MIP will vary from 0.80 percent of the loan value to 0.85 percent of the loan value.

Frequently Asked Questions

What are the FHA mortgage rates for condos?

What are the FHA mortgage rates for condos?

There are no set FHA mortgage rates for condos or any other type of property. The interest rates on this loan program will be set by the lender based on economic indicators, your credit score, the loan amount, and more. Be sure to check with your lender to view today’s FHA interest rates.

Do condos qualify for FHA loans?

Yes, some condo complexes do qualify for FHA loans. Be sure to check with your real estate agent or the HUD approved listings to determine whether a complex is considered to have FHA approved condos.

How can I find FHA approved condos?

You can find FHA approved condos by working with a real estate professional or searching on the HUD website here.

Conclusion

You can save a lot of money by purchasing one of these eligible FHA approved condos. It can cut back on the amount of maintenance you need to do and put far more amenities right at your fingertips.

Don’t overlook all of the benefits and cost savings you could have from opting for an FHA loan on one of these easy-to-maintain properties instead of a single-family residence.

FHA Approved Condos Additional Resources

by Mike Plambeck

Owning a home is often seen as the ultimate goal of the American dream. And it’s more than just a symbolic gesture – purchasing a home is a long-term investment, an asset whose value can appreciate over time.  Plus, you have the security of owning your own property and the comfort of a large living space.

Plus, you have the security of owning your own property and the comfort of a large living space.

But as we all know, owning a home is also not something to be done on a whim.

It’s important to select the mortgage program that best fits your needs. Many North Carolinans are looking at Federal Housing Administration Loans, also known as FHA loans.

Get Pre Qualified for An FHA Loan in North Carolina Today – Click Here.

The FHA is the largest mortgage insurer in the world and roughly 30 percent of all home loans in Carolina are FHA mortgages.

We’ve compiled a list of some of the most common questions about FHA loans and answered them – and if you’re from North Carolina yourself, maybe you’ll find that this type of mortgage is right for you.

FHA Loans in North Carolina: What are the benefits?

An FHA loan is a type of housing loan that is issued by a private bank or lender and insured by the United States Federal Housing Administration.

In short, the FHA is promising that it will reimburse the moneylender if you can’t pay back your loan, a promise that is backed by the taxing power of the US treasury.

Because they are guaranteed to make their money back, lenders who are partnered with the FHA are willing to make more substantial loans than they would otherwise – even occasionally granting mortgages in cases when they’d normally reject the application outright.

For this reason, FHA loans mostly appeal to first-time home buyers, applicants with credit scores between 580 and 620, and buyers who want to make a low down-payment.

What are the different types of FHA loans in North Carolina?

Homeowners in North Carolina – as in other parts of the world – should educate themselves on the different types of available loans before choosing one that’s right for them.

Homeowners in North Carolina – as in other parts of the world – should educate themselves on the different types of available loans before choosing one that’s right for them.

When most people talk about FHA mortgages, they’re talking about fixed-rate FHA loans.

However, there are actually alternatives to this option, including:

A 5-year adjustable rate FHA loan in North Carolina. This is an option that is specifically designed for low or moderate income families who want to buy their first home.

The 5-year adjustable rate mortgage starts at an interest rate that is 1 percent lower than a fixed rate FHA loan (in most cases), and that rate does not change for five years.

This option gives the homeowners a chance to settle in before beginning to make larger payments.

A fixed rate FHA loan in North Carolina. This is the type of loan most home buyers will be familiar with.

As the name implies, this option has a fixed interest rate that will not change for the duration of the mortgage – apart from slight deviations in insurance or property taxes, naturally.

Your payment will be the same for every month of the payback period, which is most commonly 30 years.

This loan is best for buyers who want a home but haven’t been able to save up money for the purchase, like college graduates or newlyweds.

An FHA condominium loan in North Carolina. This type of loan is specifically targeted towards buyers who are purchasing a condominium unit instead of a traditional house.

This is often a popular choice with low and moderate income applicants.

What advantages do homeowners have with an FHA loan in North Carolina?

As mentioned in the introduction, FHA loans are among the most popular in the country and certainly in North Carolina. They come with a number of obvious advantages:

As mentioned in the introduction, FHA loans are among the most popular in the country and certainly in North Carolina. They come with a number of obvious advantages:

Firstly, FHA loans have a much smaller down payment. Conventional mortgages usually require a down payment of twenty percent on a home. An FHA mortgage only requires a downpayment of 3.5 percent for most families.

In North Carolina, they may even require no down payment at all!

This is why these types of loans are often preferred by first-time homeowners, low income families, and younger prospective buyers – groups that have steady work, but which may not be able to afford a single large payment up front.

Secondly, moneylenders and banks are much more flexible on the requirements for loan approval because the FHA loan protects them from risk and is backed by the United States government.

An FHA loan in North Carolina requires no minimum income, a credit score of only 600 or more, and a much higher debt-to-income ratio than traditional mortgages (usually your payment needs to be no more than 31% of your income, but in some cases an applicant can get approved with a D-I ratio as high as 50%.)

In many cases, applicants that would normally be turned down outright will get accepted for an FHA loan.

In short, an FHA loan in North Carolina is much less expensive upfront and much more accessible than most other forms of mortgages. That said, be sure to pay attention to this next section:

What are the disadvantages for an FHA loan?

This section is why we’ve emphasized throughout this article how important it is to find the mortgage that works best for you.

FHA loans offer many attractive advantages, but they come with disadvantages as well.

Firstly, buyers are required to pay an upfront FHA funding fee which usually costs about 1.7 percent of the total mortgage.

This fee is how the Federal Housing Administration protects its investment – it’s a premium for the insurance the government provides the moneylender.

Secondly, there’s the issue of Private Mortgage Insurance, or PMI.

Conventional mortgages usually let homeowners cancel their PMI after they have accrued a certain amount of equity (usually around 20 percent of the total value of the property.)

With an FHA loan, you can’t cancel your insurance until you’ve paid off the home in its entirety.

Thirdly, interest rates are often slightly higher for an FHA loan in North Carolina than they are on a traditional loan. This is how the banks make back their money from the small down payment up front.

Finally, FHA loans may not provide enough funding if you need a larger loan. In North Carolina, the FHA maximum limit for 2018 is $300,150.

How important is credit when applying for an FHA loan in North Carolina?

One of the major benefits of an FHA mortgage is the lower credit requirements, but let’s face it – credit matters any time you apply for any kind of loan.

One of the major benefits of an FHA mortgage is the lower credit requirements, but let’s face it – credit matters any time you apply for any kind of loan.

In North Carolina, most FHA Underwriters require a middle credit score of 620, and they will want to see three open trade lines on your credit report that have been there for a minimum of 12 months.

However, this is not a hard and fast rule. It can be beneficial to “shop around” for lenders with lower credit requirements – in North Carolina, sometimes you can find as low as 580.

Be aware: lower credit scores usually mean a higher down payment. Still lower than a conventional loan, but sometimes as high as 10 percent.

In addition, some lenders in the state of North Carolina will now consider “additional forms of credit” in place of the typical FICO credit score. These can include long-standing accounts with vendors like your utility companies or phone service.

What type of properties qualify for an FHA home loan?

Not every property is available under FHA loan limits in North Carolina. Chapter 3 of the Department of Housing and Urban Development’s Handbook 4150.2 describes in 21 pages the exact requirements appraisers use to determine if a property is eligible.

Mostly, these are safety standards – the government wants to make sure that the home is safe and secure (which is something you want to be sure of, too.)

They will be looking for foundation issues, cracks, loose handrails, or other structural concerns.

Homes are often disqualified if they have holes or leaks in the roof, low water pressure or temperature, insufficient space, or a faulty HVAC system.

There are additional guidelines for condominium units which can be found at HUD.gov.

Beyond these guidelines, the major qualifier for an FHA loan is the listing price, as laid out in the previous section.

What are the requirements for an FHA loan in North Carolina?

Typical requirements for an FHA loan in North Carolina in 2018 are as follows:

A minimum credit score of 500 or two forms of alternative credit.

A property that has been appraised and meets the requirements of HUD Handbook 4150.2

A property that is worth less than $300,150

A debt-to-income ratio of 50 percent or less

Lenders can set their own standards for an FHA mortgage in North Carolina, but these are the minimum requirements set by the state and federal government.

Most lenders will require a credit score closer to 600 and a debt-to-income ratio around 30-40 percent. However, it’s always worthwhile to “shop around” for a lender that can meet your needs.

How do you receive an FHA loan in North Carolina?

FHA loans are only insured by the government – they don’t originate any of the mortgages.

Instead, the Federal Housing Administration will refer you to a list of lenders that they work with on these types or loans.

Ask your local banks and mortgage companies – they will most likely have some kind of FHA loan program in place.

Once you find a partnered lender with terms that you like, you will have to apply just as you do for any other loan.

A representative will check your credit score, income, debt, and more to make sure you fit their requirements and the federal requirements listed above.

What are the FHA loan rates for North Carolina?

Not every lender will offer the same rates for an FHA loan in North Carolina. What’s more, the real estate market is in a constant state of flux and loan rates often change on a daily basis based on economic indicators.

Shop around and do some research before applying to a specific lender to make sure they offer the lowest rates in your area – you don’t want your payments to become more than you can handle a few years down the road.

Do you have to be a first-time home buyer for an FHA loan in North Carolina?

This is a popular myth, but there’s no truth to it. Though FHA loans often appeal more to first-time home buyers than to other customers, anyone can apply as long as they meet the minimum requirements established by the federal government.

What is the maximum income limit for FHA loans?

There is no maximum income limit for FHA loan applicants in the state of North Carolina.

Again, however, FHA loans are usually a better investment for those with a lower income because the main benefit of these loans is the lower down payment.

If you can afford a larger payment up front a conventional mortgage will give you lower interest rates and you might pay less overall.

Additional Resources

Nobody likes rejection because it hurts. A home loan application that has been denied is especially debilitating because it shutters one of the biggest dreams in life- home ownership. However, it shouldn’t be the end of the world when a lender rejects your application. There is always a second chance. Mortgage lenders are supposed to explain to unsuccessful loan applicants why their applications were declined. They normally give a free credit report that was used to make the decision. If you get such a copy, you should use it to address your weak areas and start working on them so you can be approved in your next application. The loan can be denied for reasons such as:

Nobody likes rejection because it hurts. A home loan application that has been denied is especially debilitating because it shutters one of the biggest dreams in life- home ownership. However, it shouldn’t be the end of the world when a lender rejects your application. There is always a second chance. Mortgage lenders are supposed to explain to unsuccessful loan applicants why their applications were declined. They normally give a free credit report that was used to make the decision. If you get such a copy, you should use it to address your weak areas and start working on them so you can be approved in your next application. The loan can be denied for reasons such as: There are several types of mortgages which come with different sets of guidelines. The key is working with a mortgage consultant to find what mortgage fits your financial situation. If you are strapped for cash, a conventional mortgage is an ideal option for you because it requires only about 3% of security deposit. But you need a credit score above 620. If your credit score doesn’t allow, consider other options like FHA home loans which are not stringent on credit scores. You might even be approved with as low as 580 credit score and at least 10% down payment. Certain lenders are committed to assisting homebuyers to qualify for home loans regardless of their financial situations. So, when you don’t qualify for one type of home loan, ask the loan officer for an alternative option. If you don’t speak up, you might not be assisted.

There are several types of mortgages which come with different sets of guidelines. The key is working with a mortgage consultant to find what mortgage fits your financial situation. If you are strapped for cash, a conventional mortgage is an ideal option for you because it requires only about 3% of security deposit. But you need a credit score above 620. If your credit score doesn’t allow, consider other options like FHA home loans which are not stringent on credit scores. You might even be approved with as low as 580 credit score and at least 10% down payment. Certain lenders are committed to assisting homebuyers to qualify for home loans regardless of their financial situations. So, when you don’t qualify for one type of home loan, ask the loan officer for an alternative option. If you don’t speak up, you might not be assisted. If you are a first-time home loan applicant, you should know that checking your credit report before applying for a loan is mandatory. You can get it free of charge from one of the three credit reporting bureaus every year. Perhaps you did not bother to check your credit history before applying for the home loan and that is why you were turned down. It’s high time you review it and clean up the mess. It takes minor errors to pull down the credit rating thereby hampering your chances mortgage approval. Thus, you must dispute erroneous information on your credit report that is tarnishing your credit status. Even if the information was reported by mistake, your lender won’t care and will see you as a risky borrower until the issues are resolved. Removing those errors might take a few weeks. You might also want to pay off some debts to boost the credit score but it takes one to two months for that change to be reflected on the credit report. Because mortgage processes are time-conscious, enquire about rapid scoring to get the credit report updated quickly. With rapid scoring, your creditor can acknowledge the error. The good thing about rapid scoring is that the credit is updated within 3 days. The lender will verify the updated information forts and sent the right documents to a credit reporting bureau. The charges for such a service differ from one mortgage lender to the next.

If you are a first-time home loan applicant, you should know that checking your credit report before applying for a loan is mandatory. You can get it free of charge from one of the three credit reporting bureaus every year. Perhaps you did not bother to check your credit history before applying for the home loan and that is why you were turned down. It’s high time you review it and clean up the mess. It takes minor errors to pull down the credit rating thereby hampering your chances mortgage approval. Thus, you must dispute erroneous information on your credit report that is tarnishing your credit status. Even if the information was reported by mistake, your lender won’t care and will see you as a risky borrower until the issues are resolved. Removing those errors might take a few weeks. You might also want to pay off some debts to boost the credit score but it takes one to two months for that change to be reflected on the credit report. Because mortgage processes are time-conscious, enquire about rapid scoring to get the credit report updated quickly. With rapid scoring, your creditor can acknowledge the error. The good thing about rapid scoring is that the credit is updated within 3 days. The lender will verify the updated information forts and sent the right documents to a credit reporting bureau. The charges for such a service differ from one mortgage lender to the next.

Buying a home can be confusing and scary process with an endless list of items to do. Of all the pieces that go into buying a home, none is quite like the mortgage. With a range of different mortgage options, it can be difficult to decide which option is best. One such option is the FHA loan, specifically the FHA loan in Oregon. While the FHA loan comes with its own list of things to keep in mind, in many cases it is the best choice for home buyers.

Buying a home can be confusing and scary process with an endless list of items to do. Of all the pieces that go into buying a home, none is quite like the mortgage. With a range of different mortgage options, it can be difficult to decide which option is best. One such option is the FHA loan, specifically the FHA loan in Oregon. While the FHA loan comes with its own list of things to keep in mind, in many cases it is the best choice for home buyers. During the course of shopping for loans several recurring terms will likely come up.

During the course of shopping for loans several recurring terms will likely come up. The main benefits of the FHA loans are its low down payment and low, at least in comparison to other mortgages, credit requirements.

The main benefits of the FHA loans are its low down payment and low, at least in comparison to other mortgages, credit requirements.

While easier to get from a credit perspective, there are a number of additional FHA loan requirements in Oregon for securing a FHA loan. Some of these are unique to this type of loan, and may not be required for a traditional mortgage. Here is the list of requirements for those taking out a FHA loan:

While easier to get from a credit perspective, there are a number of additional FHA loan requirements in Oregon for securing a FHA loan. Some of these are unique to this type of loan, and may not be required for a traditional mortgage. Here is the list of requirements for those taking out a FHA loan: Once a lender has committed to writing a loan, they’ll provide the borrower with what is know as a rate lock. This will usually last from 30-45 days, but can last longer at the discretion of the lender. A rate lock simply locks in the interest rate at its current value and prevents it from moving with the market. Many lenders will also allow borrowers to pay to extend the length of the rate lock.

Once a lender has committed to writing a loan, they’ll provide the borrower with what is know as a rate lock. This will usually last from 30-45 days, but can last longer at the discretion of the lender. A rate lock simply locks in the interest rate at its current value and prevents it from moving with the market. Many lenders will also allow borrowers to pay to extend the length of the rate lock.

Title 1 loans are for those looking to make necessary home improvements, who can’t secure a traditional home equity loan due to lack of equity in their home.

Title 1 loans are for those looking to make necessary home improvements, who can’t secure a traditional home equity loan due to lack of equity in their home.  Much like the standard FHA home loan, the title 1 loan is not directly provided by the FHA but by approved 3rd party lenders.

Much like the standard FHA home loan, the title 1 loan is not directly provided by the FHA but by approved 3rd party lenders.  Much like the typical FHA loan, title ones loans have a variety of requirements governing their usage.

Much like the typical FHA loan, title ones loans have a variety of requirements governing their usage.

Title 2 loans are a group of home loans that allow borrowers to roll the costs of improvement and labor in the mortgage for a home.

Title 2 loans are a group of home loans that allow borrowers to roll the costs of improvement and labor in the mortgage for a home.  Another option for homebuyers and owners is the 203(k) loan. This type of loan is meant to aid in major property renovations, and can be taken pre-purchase for a fixer-upper or for improvements on an existing property.

Another option for homebuyers and owners is the 203(k) loan. This type of loan is meant to aid in major property renovations, and can be taken pre-purchase for a fixer-upper or for improvements on an existing property.  Many homeowners love the idea of having a maintenance-free property with all of the amenities found in an apartment complex.

Many homeowners love the idea of having a maintenance-free property with all of the amenities found in an apartment complex.  Not all condominiums and complexes will qualify for the FHA loan. This is sometimes where home buyers become caught up with the financing because they fall in love with an area that isn’t already approved.

Not all condominiums and complexes will qualify for the FHA loan. This is sometimes where home buyers become caught up with the financing because they fall in love with an area that isn’t already approved.  In order to find one of these FHA approved condos, you will need to either work with a real estate agent or search on the HUD website. A real estate agent should be familiar with the local condos in your area that qualify for FHA financing.

In order to find one of these FHA approved condos, you will need to either work with a real estate agent or search on the HUD website. A real estate agent should be familiar with the local condos in your area that qualify for FHA financing.  FHA approved condos are ideal for first-time buyers. The FHA mortgage program is ideal because it features low interest rates, looser credit requirements, and a much lower down payment than traditional options.

FHA approved condos are ideal for first-time buyers. The FHA mortgage program is ideal because it features low interest rates, looser credit requirements, and a much lower down payment than traditional options. All FHA loans come standard with your mortgage insurance premium, often abbreviated as MIP. This monthly fee is very similar to PMI and it helps to protect the lender in the event that you default on the loan.

All FHA loans come standard with your mortgage insurance premium, often abbreviated as MIP. This monthly fee is very similar to PMI and it helps to protect the lender in the event that you default on the loan.  What are the FHA mortgage rates for condos?

What are the FHA mortgage rates for condos?  Plus, you have the security of owning your own property and the comfort of a large living space.

Plus, you have the security of owning your own property and the comfort of a large living space. Homeowners in North Carolina – as in other parts of the world – should educate themselves on the different types of available loans before choosing one that’s right for them.

Homeowners in North Carolina – as in other parts of the world – should educate themselves on the different types of available loans before choosing one that’s right for them.  As mentioned in the introduction, FHA loans are among the most popular in the country and certainly in North Carolina. They come with a number of obvious advantages:

As mentioned in the introduction, FHA loans are among the most popular in the country and certainly in North Carolina. They come with a number of obvious advantages: One of the major benefits of an FHA mortgage is the lower credit requirements, but let’s face it – credit matters any time you apply for any kind of loan.

One of the major benefits of an FHA mortgage is the lower credit requirements, but let’s face it – credit matters any time you apply for any kind of loan.