by Leslie Rowberry

You have recently graduated from college and are ready to actualize the American dream. As you make the all-important transition from college life to adult life, you are facing a dilemma: Is it time to become a first time home buyer and buy your first home or should you keep on renting as you did in college? If you don’t answer this question correctly, you might live to regret your decision for the next 5 to 10 years. There’s a lot to consider before deciding to buy or rent your first home. Here we lay out the options when it comes to comparing renting vs buying.

Benefits of buying a home

The thing about renting is you are still paying off a mortgage in most cases. The only difference is that it belongs to someone else. In other words, you are creating equity for someone else rather than doing it for yourself. Since you must pay to live somewhere, wouldn’t it be better if you were creating a valuable asset for yourself at the same time? If you are a homeowner, you will build equity every time you pay your mortgage rates.

As a homeowner, you don’t have to answer to a landlord. All the home improvement and decoration choices will be up to you. Unlike renting, you don’t have to seek permission to knock down that wall, upgrade your kitchen or change the bathroom tiles as long as you operate within Homeowners’ association rules. Remember that any home improvement you make will increase the value of your property.

Because you will stay longer in your home as an owner than as a renter, you are more likely to put down roots in your neighborhood. You are likely to take an active interest in the community like volunteering in the community center or joining the local neighborhood association. You may not be able to do such things as a renter since you know you may be moving away in a year or two.

The tax benefits associated with being a homeowner might be enough to make someone buy their own home. You will enjoy many tax benefits from the time you buy your house up until the time you decide to sell it. Apart from deducting property taxes and mortgage interest, which will significantly reduce your annual tax liability, you can also reduce your taxable capital gain when you finally decide to sell your house.

Downsides to buying a home

- Limits your freedom of movement

Your lease while renting might not exceed a year. You have the freedom to move whenever the lease expires. If you’re a homeowner, you can’t afford such luxury. What will you do with your house if you decide to take off for a year for example? Furthermore, you will need to stay in your house for at least three years to recover your initial cost of purchase.

- Managing a home is time-consuming

You will spend more time maintaining and improving your new home than you ever did while renting. You can no longer call the landlord when the toilet leaks. Get ready to handle such issues on your own or hire someone to do it for you. Also, learn how to keep track of things such as when to change the heating filter.

You will incur high upfront costs when buying a home. Your costs will depend on the size of the down payment you put up and the value of the house. Expect to pay no less than 5.5% of the total value of the home for an FHA home loan. But the cost could be as high as 20%. On the other hand, you will pay relatively low upfront costs as a renter.

You should not just compare mortgage rates and rental prices when weighing the cost of buying against renting. Buying usually involves other hidden costs including property tax, insurance and maintenance and repair costs.

Factors to consider when choosing to buy or rent

Renting vs buying is not an easy decision to make. There are many factors to consider. You should answer the following list of questions first.

Do you qualify for a mortgage?

Getting a mortgage can be difficult. It can be especially difficult getting approved with bad credit or if you don’t have much of a credit history. Did you own a credit card while in college? Did you pay your debt on time always? If you answered in the affirmative to both questions, then your credit should be okay.

Can you live in the particular community for years?

You need to research on a neighborhood before you decide to settle. You shouldn’t just buy a house because you can afford it. Is your neighborhood safe in the first place? Will it favor your lifestyle?

Should you rent first before buying?

If you’re buying a house in a particular neighborhood, you need to be sure you like the place. Sometimes research may not be enough. Rent for one year first to get a feel of the area. If you still love the place after that, then you can go ahead with the purchase.

Are you comfortable putting so much money into a single thing?

Buying a house can be costly. You must have saved money during college to afford the down payment. If you are investing all your savings in one asset, then you should take time to consider whether it is worth it. Is buying a house a priority at the moment or should you invest your money in another worthy cause?

What can you afford to buy?

Buy only what you can afford. Remember you have other expenses to consider. You could still be paying your college loan for example. Don’t go for the highest mortgage value just because the bank is willing to give it to you. You don’t have to strain to pay your mortgage rates every month.

What is your plan for the future should you continue renting?

You are probably not planning to rent for the rest of your life. Therefore, you need to figure out a way save money or to invest in the meantime. Remember you’re not building any equity by paying your monthly rent. So you need to have a plan to chart the course for your future.

There are many decisions to make when you’re moving into the next phase of your life after college. You will need to own a house at some point down the road. Whether this is the right time for that is a personal decision you will need to make. But before you commit to something, weigh all the pros and cons in renting vs buying since you might have to live with the decision for a very long time.

by Leslie Rowberry

The credit score you have will tell you whether you are a successful applicant for a mortgage loan or not. It’s a number that determines your riskiness of paying back what you owe to the lenders plus your credit score determines your mortgage interest rate. If you are reading this you have probably calculated your scoring already and if it isn’t as high as you need it to be, no worries. This article is here to help when you’re trying to buy a house with bad credit.

First of all, you need to fix all financial issues in your report if you want the process of buying your dream house to be smooth and pleasant. These days almost every U.S. family has credit card debt of approximately $15,000 so it’s nothing new to buy a home with a bad credit. It’s just a matter of knowing this experts’ information on how to raise your score and be approved for a loan. Here’s how to buy a house with bad credit in 8 easy steps:

Find resources for bad credit home loans by state and by city!

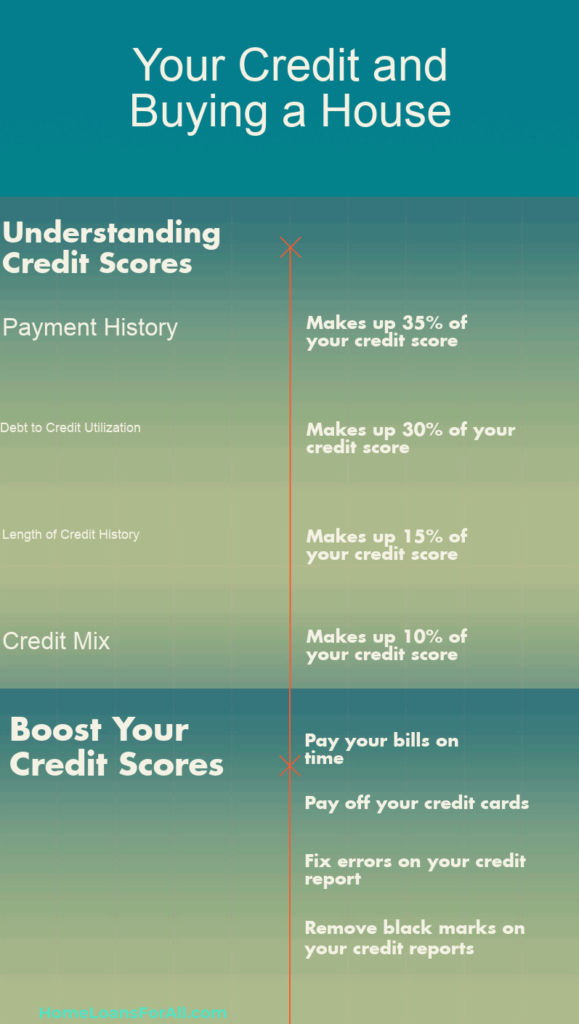

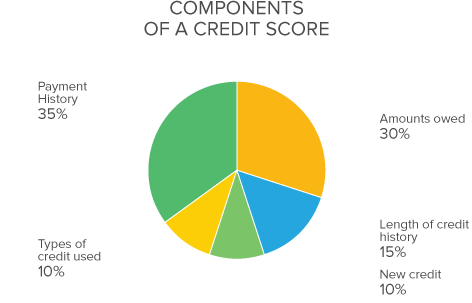

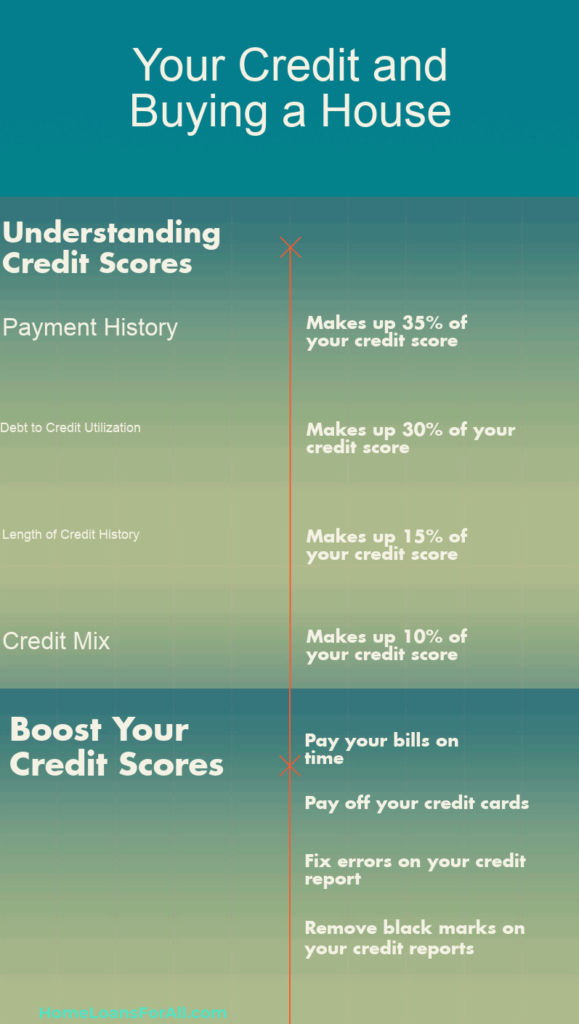

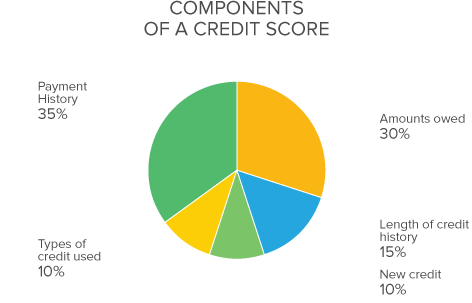

Step 1: Understand Credit Scores

In order to improve it, you first must know what it is. Your credit score is calculated based on the values and numbers you have on the credit report. Here are the five most important and their percentage of impact on your score:

Making payments on time is extremely important when trying to get your scores up. If you are 30 days late with your payment, for example, you might experience anywhere from a 90- to a 110-point drop in your score. Even if you haven’t missed a payment before in your life, a single occurrence like this will result in this significant drop and might disrupt your plans badly.

- Debt-to-credit utilization (30%)

This represents the amount of debt you have accumulated on all your credit cards so far divided by the limit of those cards. This means that your habit of taking all there is to the limit is hurting your score badly, which is why by the experts’ advice, you should keep this ratio no more than 30%.

- Length of credit history (15%)

The longer your credit history is, the higher your scoring will be. This is why it’s advised to keep all your credit accounts open, even if you have zero balance on them.

People who have a combination of credit cards along with car loans, mortgage loans, retail accounts, and/ or installment loans in their portfolio usually have greater credit scores.

At times when planning to have your financial status checked, you should avoid opening multiple new credit applications because it lowers your score by five points.

Step 2: Knowing the Perfect Credit Score:

Having the ideal credit score should be around 850. If this sent shivers down your back because you are far below it, no worries, in truth, only 0.5% of the applicants have this number. If you are somewhere around 750 you are in the great range and your chances of getting approved are high. If your score is below this but still in the 700s you are still able to qualify for a loan with a solid interest rate. Most lenders prefer 660 in order to give you a good interest rate and to keep the process of approval run smoothly. That being said, there are still many lenders out there that will work with individuals looking to buy a house with bad credit.

Step 3: Get Approved Without Credit History

Since the length of your credit history plays at least a 15% importance in your credit scoring, you should start building it as soon as possible, ideally in your 20s. However, if you don’t have it, there are other things lenders look at, and they aren’t necessarily a part of your credit report. If you keep your monthly rent payments, or car loan payments (and you have paid on time), lenders will be satisfied with it as well since it shows that you are responsible for your own debts.

Step 4: Having Bad Credit or No Credit, What’s Better?

Remember that poor credit can be managed and raised, having no credit is a completely different story. If you have it lower than you want your score to be, you can always consult with a mortgage lender to help you discover what you did wrong and if there is room to improve things. Also it’s good to know that there are loan programs like the FHA that require a low credit score, as low as 580 actually with the chance of getting a 3.5% down payment. Another helpful thing if you are a military veteran or a member of your family is, you can get a VA home mortgage approved with 0% down payment – program designed by the Department of Veterans Affairs. With all the many mortgage options out there, it’s not impossible to buy a house with bad credit. Take a look at our comprehensive guide on getting a bad credit home loan here.

Step 5: Boost Your Credit Scores

In order to get your numbers up, you should consult with a financial adviser who can look back to your habits that damaged your score in the first place. Here are some tips on how to start:

- Paying bills on time: The easiest way to be trusted among lenders is to show that you are able to pay your debts on time, each month. If it sounds tough you might need to adjust your spending habits and meet with an expert who can advise you on how to design your monthly budget.

- Paying credit card debts: It’s helpful if the charges to your credit cards aren’t exceeding 1/3 of your limit. If this isn’t something you can lower than raising your limit might do the trick. Try contacting your bank and see if you can raise your credit card limit.

Step 6: Fix Errors On Your Credit Report

Fixing errors on your credit report should be done as soon as you spot one. You have the right to get a copy of your report, so use that to review it carefully because statistics show that 1 in 4 Americans noticed errors in their reports. It’s vital to spot them early in the process of buying your home because it takes time to get the right information updated.

Step 7: Remove Black Marks on Your Credit

If you happen to be a one-time offender and your report shows a missed payment, you can probably ask your creditor for a deletion. If he or she approves, then letters with request for deletion will be sent to the credit bureaus, requesting this process. After that, it’s up to you to gather all the updated documents and have them for a recalculation of your credit score – which should be higher this time.

This process is called “rapid rescore”, and will make all the difference when trying to buy a home in a highly competitive market.

Step 8: Get Help with Your Financial Situation

There are two sides to this depending on whether you have fallen behind on paying your debts of you just need a financial counseling. So, a credit counselor is there to create a plan (with your assistance, of course) to pay back your creditors and will teach you how to manage your money in the future. A debt-management company, on the other hand, will try to reduce the amount you owe to the creditors by negotiating with them. Note that the first one costs relatively less than the second type of service, so if your debt situation isn’t so serious, a debt-management company isn’t what you need at this point. However, a credit counselor will be needed if you have several credit accounts and you are unsure of which one to pay off first. They will set you on the right path and help you understand it better for the future. Except for companies, you might even find a nonprofit organization that deals with these things and will help you manage your financial accounts successfully free of charge. These 8 easy steps should help when you’re ready to buy a house with bad credit.

by Leslie Rowberry

Not everyone can afford to buy a house paying cash upfront which is why people need to know their credit score. The reason why that’s important is that credit score makes you qualify (or not) for a loan and it shapes the interest rate you’ll end up paying. Here we’ll go into depth and give you tips on what credit score is needed to buy a house.

Do You Know What Credit Score Is Needed To Buy A House?

The Process of Buying a House

If you are in the market, looking for your next home you must be well acquainted with the requirements by now, such as lenders looking at your income, savings, and debts when deciding if they should grant you a loan or not. Knowing the credit requirements and what credit score is needed to buy a house is also crucial. However, what has the biggest detrimental power here is your credit score. At the end being approved or declined comes down to whether you have a high or low score. Experts advise that you start checking your score in advance in order to get a better understanding of your financial state at all times, and you are better prepared when the time of buying comes.

Understanding House Mortgages

Before you can know what credit score is needed to buy a house, you need to have an understanding of just what mortgage is. Namely, a mortgage is a loan that can only be used to finance the buying of a house and nothing else.

Mortgages come in multiple parts and last anywhere from 15 to 30 years because they are very large in sum and cannot be paid all at once. The parts a mortgage includes are collateral, a down payment, taxes, and insurance. Keeping all these in mind, you need to make the right preparations and decide well if you are prepared for what’s going to take for you to get the home you want.

The Minimum Amount of Credit Score You Need

Now that you have a better understanding of what kind of loan a mortgage is, let’s talk about what credit score is needed to buy a house. Thing is, credit scores aren’t something fixed but rather something that changes according to the economy and individually for each lender. For instance, in times of recession and bad economy going downhill, it’s predictable for lenders to set high limitations and reject people who have credit scores of 720 or even above. Luckily, the economy has improved a great deal since 2008 thus these limitations aren’t as strict as they used to be.

Now the categories and ranges of credit scores go something like this:

- Credit score of 750 and above is considered Excellent

- Credit score of 700 – 749 is considered Good

- Credit score of 650 – 699 is considered Fair

- Credit score of 550 – 649 is considered Poor

- Credit score of 550 and below is considered Bad

If you are applying for an FHA loan the lowest credit score to buy a house is really 580, while the Fannie Mae or Freddie Mac loans both require a minimum of 620. While this is in general, you should have in mind that individual lenders might raise their limit higher and check your income and what’s the amount of your down payment you are paying upfront. Having all the lenders’ offers and limitations calculated, we are safe to say that the average is 600.

As an example of the foregoing, imagine that your credit score is 640. The house you would like to buy is $200,000 for which you have $20,000 as a down payment and you qualify for a 5% interest rate with which you end up paying approximately $170,000 in interest. On the other hand, if you are able to raise your down payment and pay $40,000 instead, you will get a rate of 4.5% which will save you nearly $35,000 off the interest costs.

Scoring Models and Credit Scores

Scoring Models and Credit Scores

There are many scoring models in the industry and they all shape your credit scores differently. The most commonly used one is the FICO score, developed by Fair Isaac, used by 85% of the lenders when they need to determine whether they should approve or reject your loan application. Another scoring model that is gaining popularity lately is the VantageScore developed by Experian, Equifax, and the TransUnion. This scoring model takes into consideration your payment history, the amount you owe and how old your accounts are.

Even though FICO and VantageScore have ranges between 300 and 850, they use different algorithms that will give you different scores that might even be in large variations.

Putting your credit scores aside, employment and income are of vital significance to the lenders as well. After all, they determine if you are going to make payments on time or not, each coming month. The area where your dream house is, is something lenders look at as well. This is because oftentimes external factors affect your risk of paying. The decision of becoming a homeowner should be something you consider well and beforehand because as you can see, there are many requirements and processes to be completed in the long run.

Buying a House with Bad Credit

It’s true, bad credit scores can at times make you put a large down payment or make you rejected for a loan completely, but having one should not stop you from starting your process altogether. It might only be a matter of time, a little bit of work and a bit more money. Getting a home loan with bad credit is not impossible.

Namely, even people who recently underwent a bankruptcy or foreclosure do have a shot at getting approved for a house loan without skyrocketing rates and large down payments. These mitigating circumstances come thanks to mortgage programs created by the government in order to get the housing market back on track.

House Buying Tips to Get Better Credit Scores

Here we offer certain options that are supposed to help you overcome a low credit score and the challenges it brings with it.

- Organization is the key: Planning ahead for your loan application is very important. This means that you should start collecting tax returns for the last year, W2s, pay stubs, statements for investment or retirement accounts, bank statements, and a list of your debts with the amount owed and your monthly payment. This is because the lender will want to see all this, especially when you have a low credit scoring.

- Having a co-signer: If you have someone who has a good credit score as your co-signer will significantly improve your situation. The reason for this is that the co-signer agrees to take responsibility if you fail to make regular payments.

- FHA loans: The reason why we are suggesting that you try for an FHA loan first is that it is insured by the federal government and doesn’t have as high credit requirements as the rest of them. Additionally, FHA loans do not require 20% as down payment but only 3.5% down.

Buying a House with No Credit

Some people, out of numerous reasons, do not have enough payment history to have their credit score calculated. This, however, doesn’t mean that they are at risk of not being able to pay the loan, so there are ways to turn their situation in their favor as well. If you fall into this category, this is when you should consider an FHA loan. However, the 3.5% mentioned earlier will not be available for you at this time, but 10% – still better than other loan programs.

Another thing to help you with your scoring is owning your own personal credit card with your name on it. In case you do not have any credit, see if you can get a secured card with which you are able to put a deposit serving as a credit line. As long as you are paying off your expenses in full each month, you will be able to get a positive credit score. In case credit cards are something you’d like to stay away from, there is the alternative of getting a recommendation from your landlord, evidence of paying insurance rates on time and/ or utility bills from the previous year. These three are enough evidence that you are responsible for your bills.

Putting a larger down payment down increases your chances greatly as well. Have in mind that local banks and lenders are more likely to accept your application because at that point larger banks aren’t your best bet.

People also rent to own, before buying which increases their chances of getting positive credit scores. If you are able to make this kind of arrangement, you will be able to pay your rent while putting extra money in the escrow – money to be used later on as a down payment or to get deducted from the home’s purchase price. There is another option of getting an owner financing instead of lending from a bank. At this point, your bad or lack of credit score won’t be of any significance. However, before moving forward with this kind of contract, you should have a lawyer inspect it because you can never be too cautious.

Getting Ready To Buy a House

As we said, buying a house and becoming a homeowner isn’t something to be taken lightly. This is why if your credit score isn’t at its best, you should start planning months beforehand and work on bringing it up before filling loan applications.

Step one to consider is resolving any credit report issues you might have gotten in the past. Fixing errors and clearing up inaccurate information will stop dragging your scores down. Federal Trade Commission’s stats show that 1 out of every 5 Americans who apply for a house loan has some error in their credit report which causes them to get lower scores. When you go for a score checkup get copies of the reports from all 3 credit reporting bureaus. The reason for this is that not all creditors report to all of the 3 bureaus, so it’s likely that information showing up on one might not appear on the other.

Paying your existing debts will help greatly in increasing your scores. Lenders need to see that your debt to income ratio is below 30%. While all this will have a positive impact on your score, you need to note that raising it doesn’t happen overnight. However, if you are constantly making positive changes in your financial things, paying debts, removing errors and keeping new credit applications to a minimum will all have their positive impact in the long run towards getting ready for a high credit score. If you know what credit score is needed to buy a house when going into this journey, you’ll be way ahead of the game.

Related Articles:

Mortgage Payment Calculator

First Time Home Buying Guide

FHA Loans vs Conventional Loans

by Trusted House Finance

Trying to decide if you should refinance your home? Are you looking for the best mortgage refinance rate? Hoping to get a lower mortgage refinance rate? These words can be scary for some people who haven’t refinanced before. It can also be a tricky process to find the best rates.

That’s why it’s important to do your research and find the lowest rates before getting locked in. The best place to start is online, where you can shop around, find expert advice, and get the know-how.

Luckily, if you’re looking to find the lowest refinance rate, you’ve come the right place. This blog will cover the top 10 tips to help you lower your rate and better understand how refinancing works.

Top 10 Tips to Lower Your Mortgage Refinance Rate

Step 1: Get Your Credit Score Up

The number one way to get a lower mortgage refinance rate is to get your credit score up. Generally, lenders require a credit score of 620 to 640, on the low end. A score that low will lead to higher mortgage rates. You want to shoot for a score of 740 or higher in order to really make a dent in your refinance rate and really qualify for the best rates available.

The best way to raise your credit score is by making all of your payments on time, paying down existing balances, and even looking for errors in your credit score report. Credit score errors occur more often than people would think, and if caught, they can make a significant impact to your score.

Step 2: Know the Rates, Play the Field

Rates change often and abruptly. It’s important to stay informed and know what fellow borrowers are being offered. Once you know the rate offered to another borrower, you can use it as a negotiation factor to lower your mortgage refinance rate. It’s also okay to talk to multiple lenders and get multiple interest rates to make sure you’re getting the best rate.

Plus you should always do your research. Look up what the average interest rate should look like. Keep in mind that rates are dependent on your personal situation and credit history, but it doesn’t hurt to get a feel for the market and what the typical refinance rate should be.

Step 3: Use Your Credit Card and Pay It Off

It’s important to use your credit card for small purchases and pay it off. If you use a smaller percent of the credit you have available, it will lower your credit utilization ratio, which has the ability to lower your interest rate.

Then be sure to pay off all your balances every month, showing how you can responsibly and dependably manage your debt. This will also help you enhance your credit score and get a better rate.

Step 4: Get All Documents In Quickly

If you respond quickly to questions and requests for documentation then you can avoid paying for extended rate lock period. This occurs if the paperwork takes a while to submit.

It’s recommended to stay on top of all documentation and requests. Some even say you shouldn’t leave the city while going through this process so you’re readily available to submit everything you need.

Step 5: Go For A Shorter Term

A shorter loan term means a lower interest rate. However, the amount you pay will be higher since you will be paying off the loan quicker. If you’re able to quickly make your payments then a shorter term will definitely be beneficial for you.

Don’t choose a shorter term if you don’t think you’ll be able to make the payments on time though. Go with the term length that makes the most sense. Also choose which payment plan you would like to go with before seeing a lender because you may qualify for much more.

Step 6: Speak to a Loan Officer

Loan officers are specialists in all kinds of loans including consumer, mortgage, and commercial. They act as the liaison between you and the institution to help you find the best plan that will meet your budgetary goals.

Plus they have a pretty good idea of when rates will go up or down depending on economic news, announcements, and even government reports. They can help you pick the best rate and lock in that rate before they fluctuate.

Step 7: Raise Your Home Equity

Those that have equity within the 10-15% range will have an easier time when it comes to refinancing. So make sure to look into your mortgage documents and if needed, speak with a realtor about your neighborhoods comps.

Also the loan-to-value (LTV) ratio for your property has the ability to make a significant impact on your refinance rate. A LTV ratio is the ratio of your loan versus the value of an asset purchased. If you have a high loan-to-value ratio then it will cause your interest rate to go up. So check your ratio and see if it’s worth increasing your home equity.

Step 8: Plan Ahead

It’s important to know how you will pay for your refinance and how much you’re willing to pay. During closing, there could be lender fees or other chargers that you need to pay. These are generally included with the rest of your balance.

At this time, you have the option to choose “no-cost” refinance, which is when your lender pays the fees and you pay a little more for your interest rate. It always helps to plan these things out before you get to that point to find the best option for you.

Step 9: Buy Down the Rate

Look into mortgage discount points. These points are generally offered by mortgage lenders to help you lower your mortgage refinance rate. The points are fees that are paid to the lender directly during closing in order to reduce the interest rate.

This strategy is also known as “buying down the rate” and it helps to reduce the cost of your monthly mortgage payments. Every point will cost 1 percent of the cost of your mortgage, meaning it will cost $1,000 for every $100,000.

Step 10: Use a Refinance Mortgage Calculator

In order to help you determine the amount you could save, a refinance mortgage calculator can come in handy. This calculator will go through a series of questions to find out where you are financially. Then it will determine the how much money you can save by refinancing.

This is the perfect tool to use before meeting with your loan officer or lender, so you know what you can expect walking into things.

by Vic Lance

As one of the major steps in life, buying a home is a dream for many. If you’re in the process of arranging a mortgage to purchase a house, you can typically follow two paths. You can either work directly with a lending institution such as a bank, or explore working with a mortgage broker.

Mortgage brokers function as an intermediary between you as the borrower, and the lender. Their services can be very useful, as they take care of all the research needed and find good options that match your conditions. Although brokers charge you for their work, they can even save you money.

However, working with a mortgage broker does not automatically mean you will pay less on your mortgage. It’s still key that you get informed about the mortgage process and verify important details about the broker you have chosen. That’s how you can ensure that you will benefit from working with an intermediary.

Here are the differences between borrowing directly from a financial institution and working with a mortgage broker. You can also get useful tips on how to get the best mortgage rate and see what your lender looks for when approving your loan.

Working With a Mortgage Broker vs. a Lending Institution

You can obtain a mortgage by directly negotiating with a lending institution of your choice.

To choose the best price and conditions, you need to do detailed preliminary research and compare numerous lenders. Instead of going through hard credit inquiries with each, it’s best to provide the lending institution with a copy of your credit report. That’s how they would be able to assess which loans you can go for. You will also need to undergo the pre-licensing approval process with the lender.

As the borrower, you need to verify that the conditions you’re offered are satisfying before you sign the papers. Make sure you understand the terms of the mortgage you are opting for in-depth.

If you decide to use the services of a mortgage broker, you will be spared many of the tedious tasks of shopping for a mortgage yourself. The broker will research the best matching rates and assess your finances. They will also be in charge of going through the pre-licensing approvals, which saves you time.

It is often easier to get your questions answered by your broker rather than by a lender. The broker works for you and gets paid only when you sign the contract, so they are more accessible. They may also be able to get you a lower price. they have access to wholesale rates from lenders and may get some fee waived due to the volume of their work. However, you have to make sure you select the right mortgage broker, so that you can use the benefits that such a partnership can offer.

How to Choose the Right Mortgage Lender

Not all mortgage brokers can provide you with the same quality of services. Before you start a partnership with an intermediary, it’s a good idea to check their credentials and history.

You need to work with a mortgage broker who is duly licensed with your state authorities. You can check the status of their license via the National Multistate Licensing System (NMLS). To get licensed, most brokers need to obtain a surety bond. This is an extra layer of security for you, since it can provide a compensation if you are harmed by any unlawful actions of the broker.

Besides checking their licensing and bonding, make sure you review their portfolio to see the lenders they’re working with. See what previous customers share in their reviews as well. Last but not least, verify the fees you will be charged for using the brokering services. In most cases, the commission is 1-2 percent of your mortgage amount.

Related Articles:

First Time Home Buying Guide

FHA Loan Requirements

Scoring Models and Credit Scores

Scoring Models and Credit Scores